Bank borrowing may hamper recovery

When thinking outside the box was needed, the government opted for the tried-and-tested method.

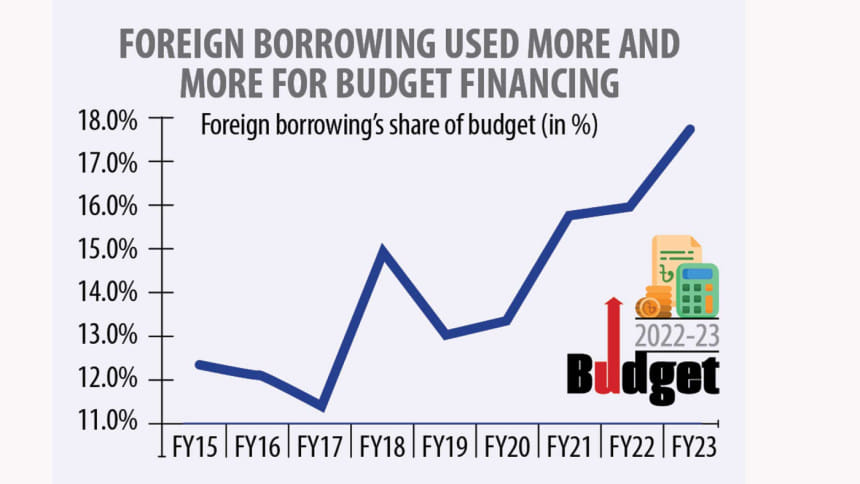

At a time when foreign currency reserves are under strain and the economy is staging a recovery from the pandemic trough, a spot of creative thinking would have pointed the government in the direction of foreign borrowing in financing fiscal 2022-23's budget deficit of Tk 244,864 crore.

The interest rate on foreign loans is never more than 3 percent and the repayment period is as lengthy as 30 years. Then there is the bonus of a much-needed gush of foreign currency to the Bangladesh Bank's vault, which is now at an 18-month low.

But the government is being conservative with foreign borrowing, choosing instead to bump up its domestic borrowing, which comes at a higher interest rate of at least 8 percent and a shorter repayment period.

The government's bank borrowing target for the next fiscal year has been set at Tk 101,818 crore, up 33.2 percent from this year's original budget.

This will create a hurdle for recovery, according to Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

The reason being it will simply crowd out private investment when it is looking up.

In March, private sector credit growth stood at 11.29 percent, the highest in three years.

Besides, there appears to be a liquidity shortage in the economy as demonstrated by the high call money and treasury bill rates, Hussain said.

And one of the reasons for the liquidity shortage is the Bangladesh Bank's sales of dollars to prop up the exchange rate of taka, which is at Tk 87.50 a dollar is its lowest in a decade.

For every dollar injected by the central bank into the open market, an equivalent amount of taka was withdrawn from the economy.

Besides, the demand for trade credit is on the rise for the surge in imports, according to Hussain.

On this path that the government has taken, it also does not have the option of borrowing from the central bank, which entails creating new money and fuelling inflation.

"Inflation is another worry," Hussain said.

In April, inflation hit an 18-month high of 6.29 percent.

The only option it has is to increase borrowing through national savings certificates.

"But that would mean private savings would be diverted from banks. Given the cap on the bank interest rate, the law of demand and supply cannot take the course here," Hussain added.

And the interest rate spread, which is the difference between the interest rate a bank pays to depositors and the interest rate it receives from loans to consumers, is not favourable for the banks either to be able to compete with the government for deposits.

In simple terms, net interest rate spreads are like profit margins. The greater the spread, the more profitable the financial institution is likely to be. In March, the interest rate spread stood at 3.02 percent.

On the other hand, there is ample room to scale up foreign borrowing.

Of the budget deficit, foreign borrowing would cover Tk 120,046 crore (about $13.95 billion), which is an increase of 3.8 percent from this fiscal year's original budget.

There is $48 billion in the pipeline and that could be used, Hussain said.

"Why don't the government accelerate the implementation of foreign-aid projects?"

In that way, the much-needed projects would get momentum and the pressure on the foreign currency would ease.

Besides, the International Monetary Fund has offered $3 billion in budget support to Bangladesh provided the country undergoes some reforms in tax administration and tax policy.

"The reforms would have been good for us," Hussain said.

Instead, the government has chosen a method that would hamper recovery to some extent to finance the budget deficit, which has been brought down to 5.5 percent in the upcoming fiscal year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments