$6b more to come from dev partners

Bangladesh is expected to get about $6 billion over the next four years from development partners other than the International Monetary Fund to meet the development financing needs, particularly to address climate change challenges.

The IMF's staff mission projected a financing gap of $9.1 billion for the period.

While the lender would be providing $4.7 billion, there would still be a deficit.

Subsequently, during its nine-day tour of Dhaka last year, the staff mission met with the representatives of the other development partners to learn about their financing plans for Bangladesh and also to harmonise their conditions with the IMF's 42-month loan programme.

The staff mission learnt that another $6 billion would be arriving from the other multilateral and bilateral lenders.

Of the $6 billion, $1.75 billion is expected from the World Bank, $2 billion from the Asian Development Bank and $2.12 billion from other development partners including Japan International Cooperation Agency and the Asian Infrastructure Investment Bank, according to the IMF's staff report.

The IMF, the WB and the ADB would be collaborating extensively to help Bangladesh build its climate resilience, a key objective of the programme.

Being one of the world's most vulnerable nations to climate change, Bangladesh has set its course toward achieving climate-resilient development by envisioning various strategies and policies, including a Delta Plan and a series of five-year plans, said Bangladesh Bank Governor Abdur Rouf Talukder and Finance Minister AHM Mustafa Kamal in their letter of intent to the IMF.

"These plans as well as our National Adaptation Plan, recently approved by the cabinet, have identified our country's adaptation and mitigation priorities in the transportation, power, industry, infrastructure, and agriculture sectors, estimating the additional annual climate financing needs at 2–3 percent of GDP," they added.

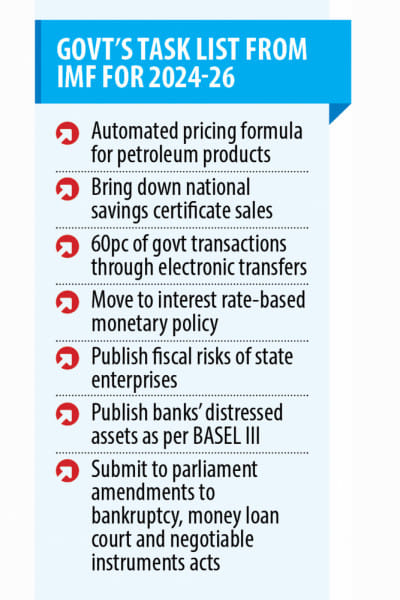

An automated pricing formula for petroleum products, which is scheduled to kick in next fiscal year, is one of the 11 conditions of the IMF's newly-formed Resilience and Sustainability Facility that helps low- and middle-income countries vulnerable to climate change address the challenges.

"This is a high urgency," said the IMF staff report.

Bangladesh is the first Asian country to access funds from RSF. Of the $4.7 billion that the country is getting from the IMF, $1.4 billion is coming from RSF.

"To further enhance climate mitigation, Bangladesh has ramped up its reform efforts toward transparent market-based pricing of fossil fuels," the IMF staff report said.

Going forward, the authorities plan to regularly adjust petroleum product prices via a formula-based pricing mechanism and thereby lock in zero structural subsidies for petroleum products.

"These actions are expected to help ease budget pressures for energy subsidies and encourage more efficient fuel consumption going forward."

In addition, barring further global price shocks, the government has committed to not increase these subsidies during the programme and explore options to gradually reduce them further, while scaling up social protection schemes.

The government has also committed to adopting a sustainable public procurement policy paper and an associated action plan to integrate climate and green dimensions by September as part of the reforms under RSF. The IMF has marked this as a top reform priority.

By the end of this year, the central bank will adopt guidelines for banks and financial institutions on reporting and disclosure of climate-related risks in line with the recommendations of the Task Force on Climate-Related Financial Disclosures.

In fiscal 2024-25, the government will adopt a national disaster risk financing strategy while integrating social assistance measures. This reform was agreed upon following a discussion with the WB.

Next fiscal year, the finance ministry will adopt and implement a methodology for embedding climate change in the medium-term macroeconomic framework, by analysing macro-fiscal risks from climate change and publishing it in the Medium-Term Macroeconomic Policy Statement.

This reform agenda is synced with the WB and the ADB's prospective financing conditions.

By December next year, BB will conduct and publish climate stress testing for the overall financial system and update the guidelines on stress testing for banks and financial institutions to include climate change considerations. This is another high-urgency reform agenda of the programme.

By June 2025, the government would adopt an updated PPP policy and framework that integrates climate-related risks and develop relevant guidelines.

"This has been discussed with the WB and the ADB for synergies," the IMF staff report added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments