Pension for all: Roll-out in a year

The long-awaited universal pension scheme, one of the pledges of the ruling party's 2008 election manifesto, is expected to take off within a year.

"We are expecting that the [scheme's] implementation will start within six months to a year," said Finance Minister AHM Mustafa Kamal while presenting an outline of the scheme at a virtual press conference yesterday.

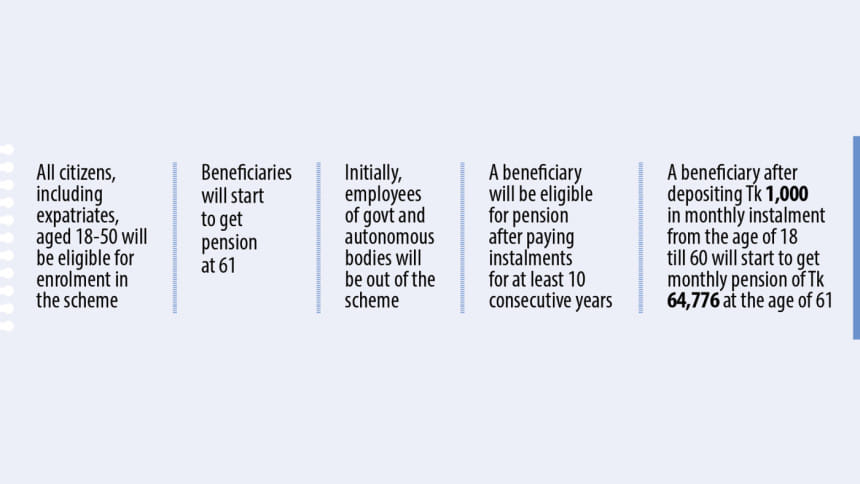

Any citizen, including expatriate Bangladeshis, aged between 18 and 50 can sign up for the scheme.

A beneficiary can receive a monthly pension of Tk 64,776 after the age of 60 and start to contribute towards the scheme with a monthly instalment of Tk 1,000 from the age of 18.

Experts, however, are sceptical that the scheme would be rolled out in a year.

"It took the government several years to prepare the strategic paper for the universal pension scheme," Zahid Hussain, a former lead economist of the World Bank's Dhaka office, told The Daily Star.

Considering past experiences, it will be difficult for the government to start implementing the scheme within a year by formulating a law and establishing the universal pension authority, he said.

"Different stakeholders are involved in the process. So, it will be wise to formulate the law after taking opinions from all stakeholders," Hussain added.

While presenting the outline of the scheme, Kamal said everything will be specified in the relevant law, which will be formulated soon incorporating Prime Minister Sheikh Hasina's directives.

Hasina has instructed the finance division to enact the law on an urgent basis, according to ministry officials.

Opinions from all stakeholders will be solicited while preparing the draft law, Kamal said.

Once the law is formulated, a full-fledged outline will be visible.

If any loophole is found after the law's enactment, the necessary amendment will be made, he added.

"The proposed scheme is a good initiative, especially when Bangladesh is graduating from the least-developed country bracket," said Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue.

While it is possible to start implementing the scheme within a year, it might not be possible for the government to include all beneficiaries initially.

The scheme should be piloted first, he said, adding that the government must have its contribution if it wants to make the scheme mandatory for all.

The government will also have to fix what will be the employer and employee's contribution in the case of the formal sector, he added.

At yesterday's press conference, Kamal said the process will be optional to start with but mandatory in future.

A beneficiary will be eligible for the scheme after paying instalments for at least 10 years in a row.

For each citizen, a separate pension account will be created. As a result, the account will remain unchanged even if a beneficiary changes his or her job.

The proposed scheme says there will be an option for institutions to participate. However, in such a case, the amount of subscription fee for the institution or its employee will be fixed by the national pension authority.

There will be a minimum amount of monthly subscription fee. However, expatriates will be able to pay the subscription fee quarterly.

A beneficiary will ensure the minimum annual savings. Otherwise, his or her account will be frozen. Later, the account can be resumed by paying a late fee and the due subscription fees.

A beneficiary will be able to save any amount of money in addition to the minimum amount as a subscription fee based on his or her financial capacity.

There will be no option for a one-time withdrawal of the deposited money at any time. However, through an application, a beneficiary can take a maximum 50 percent loan against the deposited money, which must be paid back with interest.

If a beneficiary dies before depositing the instalment for at least 10 years, then the accumulated amount will be returned with profit to the nominee.

The instalment for pension will be considered as investment and tax rebate while the monthly pension will remain out of income tax.

The government may pay a portion of the monthly instalment for the lower income group people and bear the necessary expenditures of the pension authority and the other relevant organisations.

The pension authority will invest the amount deposited to the fund as per guideline (in ensuring maximum financial return).

If a beneficiary starts to pay an instalment of Tk 1,000 per month at the age of 18, then he/she may receive Tk 64,776 a month as pension after the age of 60, Kamal said.

The minister made the estimate considering 10 percent profit and 8 percent gratuity on the invested instalments.

For a beneficiary who enrols at the age of 30, the monthly pension will be Tk 18,908.

The World Bank provided technical assistance to the initiative in light of the best practices from other countries such as India, Malaysia, Sweden and Australia.

In particular, it uses India's experience in developing the national pension scheme.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments