Remittance up on Eid cheer

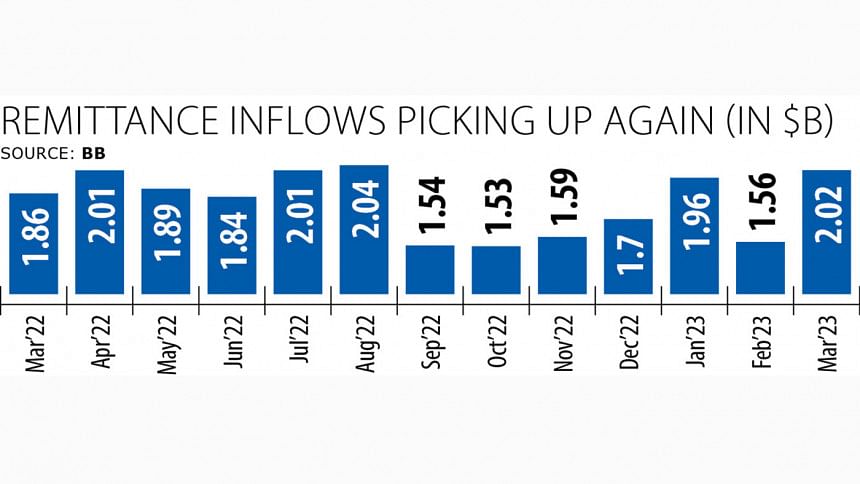

Remittance inflows hit a seven-month high in March as expatriate Bangladeshis sent more money home for Ramadan and Eid-ul-Fitr.

Last month, non-resident Bangladeshis sent $2.02 billion, up 8.6 percent from a year earlier, according to data from the Bangladesh Bank.

The development will bring some relief to the government, which has a minimum foreign currency reserves target hanging over its head as part of the conditions for the $4.7 billion loan from the International Monetary Fund.

The IMF has set a floor on net international reserves (NIR) for every quarter. The floor must be met for getting the approval of successive tranches.

For programme monitoring purposes, the NIR is defined as gross international reserves minus reserve-related liabilities.

As per the lender's balance of payments and investment position manual (BPM6), gross foreign reserves calculation does not include the various funds that the Bangladesh Bank has formed from the reserves as well as the loan guarantees provided for Biman, the currency swap with Sri Lanka, the loan to Payra Port Authority and the below-investment-grade securities.

Bangladesh's NIR cannot be below $22.9 billion in March, $24.5 billion in June, $25.3 billion in September and $26.8 billion in December.

As of March 29, gross international reserves stood at $31.1 billion, down 29.9 percent from a year earlier, according to data from the BB.

For Bangladesh, exports and remittances are the two main sources of foreign currency.

Remitters now get Tk 107 for each dollar, about Tk 2 more than exporters, along with a 2.5 percent cash incentive.

But on the kerb market, each dollar is selling for more than Tk 110, compelling many to send money home through the illicit channel of hundi despite the risks involved.

So an uptick in remittance, which has been underwhelming in recent months for multiple exchange rates, despite the wide difference between the official and kerb market rates is a welcome development.

"This will bring some respite," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

March's inflows take the receipts so far this fiscal year to $16.03 billion, up 4.8 percent from a year earlier.

Remittance inflows usually go up ahead of the two Eids, the biggest festivals in Bangladesh, according to Selim RF Hussain, chairman of the Association of Bankers' Bangladesh, a platform for the managing directors of banks.

In recent times, the central bank has heightened its monitoring of the foreign exchange market to tackle money laundering, said Hussain, also the managing director of Brac Bank.

This might have helped in propping up the remittance receipts.

At a meeting with bankers yesterday, BB Governor Abdur Rouf Talukder said the value of imported goods has declined recently but the volume of letters of credit did not drop, Hussain said.

This means the over- and -under-invoicing has narrowed, which had a positive impact on remittances, he said quoting Talukder.

There is a correlation between hundi and over- and under-invoicing as the money launderers chiefly settle their illegal transactions through hundi.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments