Poverty may worsen: World Bank

Bangladesh is confronting a potential rise in poverty and inequality as stubborn inflation, job losses and a slowing economy erode household welfare, according to a World Bank report.

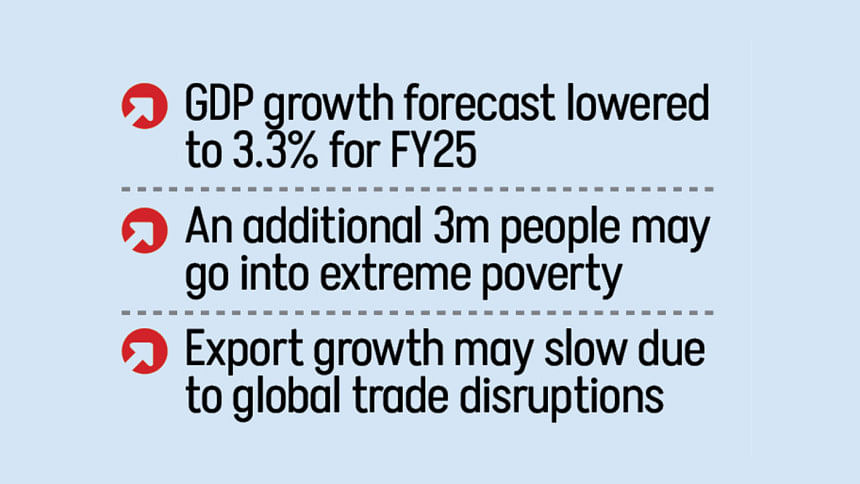

The national poverty rate is projected to rise to 22.9 percent in 2025, up from 18.7 percent in 2022, while the share of people living in extreme poverty -- those earning below $2.15 a day -- is expected to nearly double to 9.3 percent and push an additional 3 million people into this group. However, the poverty rate is forecast to ease in 2026.

"High inflation and job losses have strained economic welfare, particularly for low-income households who spend a larger share of their income on essential goods," the World Bank said in its Bangladesh Development Update released yesterday.

Nearly 4 percent of workers lost their jobs in the second half of 2024, while wages fell by 2 percent for low-skilled workers and 0.5 percent for high-skilled workers.

Bangladesh's labour force is showing signs of distress. The labour force participation rate declined to 59.2 percent from 60.9 percent, driven largely by a sharp fall in female participation, which dropped from 41.6 percent to 38.9 percent. The number of employed fell by 1.6 million.

Zahid Hussain, a former lead economist of the World Bank in Dhaka, said the poverty surge is primarily being driven by food inflation and prolonged wage stagnation.

"All research on poverty shows that the poverty rate is inversely related to food inflation," Hussain said. "The higher the food inflation, the higher the poverty rate, because the share of the budget that poor people spend on food is very high."

Hussain said real wages have been declining for over 40 months as nominal wage growth fails to keep pace with soaring prices. "Income has not grown at the same rate as expenditure due to inflation. That also increases the number of people below the poverty line," he said.

Inflation is expected to remain around 10 percent this fiscal year, with a gradual easing projected in the following year.

Three in five households are likely to have faced increased financial stress by depleting their savings, driven largely by deteriorating labour market conditions between 2023 and 2024, the World Bank said. "Vulnerable populations are likely to be disproportionately affected."

However, with over a million people leaving the country annually, remittance-receiving households are expected to remain more resilient amid the economic challenge.

The Gini index, a measure of inequality where 0 represents perfect equality and 100 indicates maximum inequality, is projected to rise to 36.1 in 2025 from 33.4 in 2022, according to the World Bank. Inequality is expected to ease slightly in 2026.

"The main reason for inequality lies in the labour market," Hussain said. "A vast number of workers are in low-productivity, self-employed occupations. Most are entrepreneurs by necessity, not by opportunity."

While the formal sector remains small, most of the 65-66 million working Bangladeshis are engaged in informal jobs with limited earnings potential, Hussain said. "The low productivity of self-employed young people in rural and urban areas means low average income," he said.

ECONOMIC GROWTH TO SLOW

The World Bank forecasts GDP growth at 3.3 percent in FY2025, down from 4.2 percent last year and 5.8 percent in FY2023. The slowdown has been driven by falling investment, policy uncertainty, high borrowing costs, and political unrest that disrupted activity in the first quarter.

Private sector credit growth hit a 30-year low of 7.3 percent in December 2024, and ADP spending declined 24.1 percent in the first half of the fiscal year. Imports of capital goods fell by 12 percent, reflecting weak investment sentiment.

Despite this, strong remittances and a rebound in garment exports helped narrow the current account deficit to $1.1 billion, and reserves have stabilised around $20 billion.

The World Bank projects a gradual recovery, though. GDP growth is expected to rebound to 4.9 percent in FY2026, assuming the successful implementation of financial sector reforms, improved domestic revenue mobilisation, and a more stable business environment.

The medium-term outlook hinges on restoring investor confidence, addressing macroeconomic imbalances, and delivering long-promised structural reforms across the banking, fiscal and regulatory landscape.

UNCERTAIN CLIMATE

The World Bank warns that delays in banking and fiscal reforms, coupled with persistent inflation and uncertainty surrounding the upcoming national election, could undermine Bangladesh's economic recovery.

"Higher costs of borrowing, policy uncertainties, and the timing of elections are expected to weigh heavily on investment growth," the World Bank said.

Beyond the economic risks, the report also flagged political tensions as a growing source of concern.

"Safety and security concerns remain and are likely to continue until the restoration of a fully functioning police force," it said.

"Policy uncertainty is significant and compounded by ongoing discussions about the timing of the next election. Disagreements between political parties and the interim government over the election date could heighten political tensions in the future."

TRADE DISRUPTIONS

Bangladesh's export outlook faces fresh risks in FY2026 due to mounting global trade disruptions and rising policy uncertainty, the World Bank said. While the economic impact is expected to be limited in FY2025, as disruptions occurred late in the fiscal year, the fallout is likely to be more pronounced in the following year.

The World Bank projects that Bangladesh's exports and real GDP growth could decline by 1.7 percentage points and 0.5 percentage points, respectively, in FY2026 compared to previous forecasts.

"There is considerable uncertainty around this outlook due to the rapidly evolving status of trade policy discussions," the World Bank said.

Lower fuel import payments, due to falling international energy prices, are expected to provide some cushion to the current account balance. Meanwhile, the Bangladesh government has expressed its intent to reduce the trade surplus with the United States by boosting imports, a move seen as part of broader trade diplomacy amid tensions over tariffs and reciprocal access.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments