Why more banks?

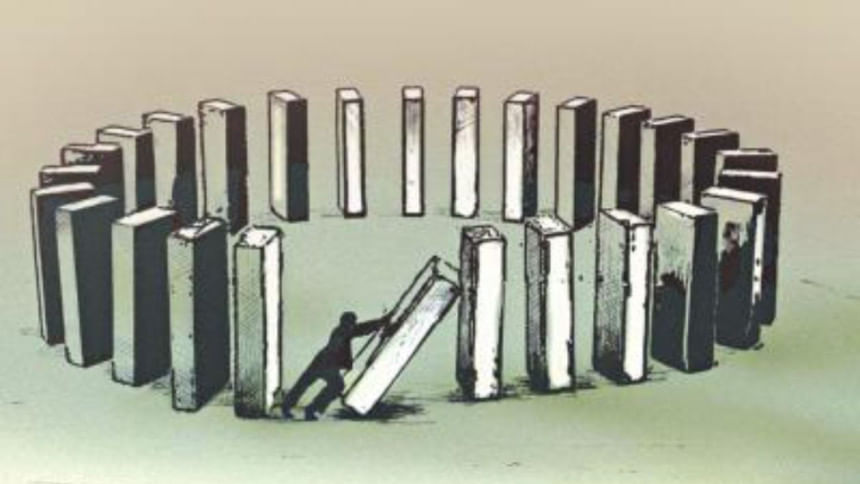

The approval of three more banks by the central bank in an already crowded industry will bring no good but push the sector to a more vulnerable state. The banking sector has been the backbone of our national economy for decades which is now in serious trouble because of rampant malpractices and anomalies.

The sector has been plagued by soaring NPLs (non-performing loans) which stood at Tk 1 lakh crore not so long ago. The depositors are losing their confidence in the industry. All the three banks that managed to get the nod from the central bank have political affiliations. Earlier in 2013, nine banks got the licence and some of those too had political affiliations and how they performed in the last five years is known to all. We all know what happened in Farmers Bank. With so many anomalies in the sector to be resolved, do we really need more banks in the industry? Shouldn't we be focusing on stabilising the sector by ensuring good governance and taking exemplary punitive steps against willful defaulters?

Mostafa Al Hossaini

Department of Finance, University of Chittagong

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments