WB plans big to fund connectivity

The World Bank is preparing a five-year country strategy for Bangladesh, putting its focus on connectivity to link the country with three other nations, and for ensuring food and water security.

However, under the new country framework, Bangladesh may have to pay more in service charges for the funds it receives from the WB following the country's graduation to the lower middle income status from a low-income nation.

Last month a WB mission completed a round of consultations on the five-year scheme, which begins this fiscal year.

An official of the government's Economic Relations Division said the team will visit Bangladesh again in September when the framework will be finalised.

The ERD official said the WB plans to expand funding in the areas of infrastructure such as power, energy, roads and ports as well as water and railway transport.

The lender has expressed interest in regional infrastructure projects, including hydropower generation, cross-border power transmission and distribution, and regional trade facilitation projects with India, Bhutan and Nepal.

The five-year scheme will also focus on Bangladesh Delta Plan 2100, which aims to help the country ensure food and water security and fight disasters.

On June 16, Bangladesh, the Netherlands, the WB and the International Finance Corporation, the private sector lending arm of the WB, signed a joint agreement to support the Delta Plan.

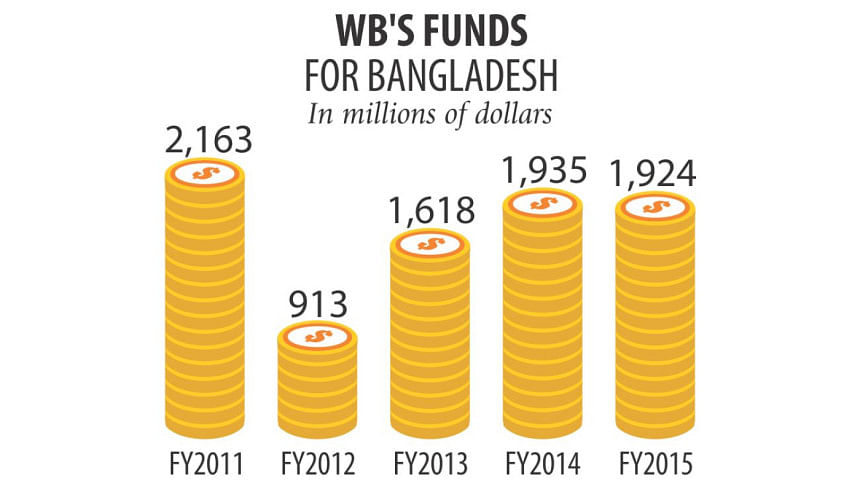

In five years till 2014-15, Bangladesh received $2 billion in loans from the WB, double the amount the country had got in the previous five years.

Lending will go up in the next five years, but the figure has not been finalised, a WB official said.

So far, Bangladesh got the loans as a low-income country from the WB's soft-loan wing -- International Development Association, known as IDA, which charges 0.75 percent and carries a repayment period of 38 years with eight years' grace period.

If the income increases in the next years, the country may lose the IDA eligibility quota. In this case, Bangladesh can take loan from the WB's commercial wing -- International Bank for Reconstruction and Development (IBRD).

The IBRD charges interest rates at LIBOR plus 1.35 percent, and the repayment period is between eight years and a maximum of 20 years.

However, Zahid Hussain, a lead economist at the WB in Dhaka, said it would be a mistake to assume that the access to IDA finance automatically stalls after a country crosses the IDA eligibility threshold.

Currently, there are 31 low-income countries but the number of IDA borrowing countries is 77, showing there are 46 countries above the lower middle income country threshold which are IDA borrowers.

Hussain said a country can become a 'blend' country after crossing the IDA eligibility threshold. A blend country has access to both IDA and IBRD finances.

The 'blend' category is used to classify countries that are eligible for IDA resources on the basis of per capita income but also have limited creditworthiness to borrow from IBRD.

Generally, given the access to both sources of funds, blend countries are expected to limit IDA funding to social sector projects and use IBRD resources for projects in the 'harder' sectors. Moreover, as their creditworthiness increases, such countries should be able to take on more IBRD financing, which in turn allows their access to IDA financing to be gradually reduced.

Over time, this results in a gradual hardening of the blend ratio, preparing the country for the eventual graduation from IDA, according to the WB.

Bangladesh's per capita income reached $1,080 in 2014, which is higher than the WB's lower middle income threshold of $1,046.

In the present calculation, if a country's per capita income goes above $1,215 it loses the IDA-only eligibility.

In the last fiscal year ending on June 30, Bangladesh's provisional per capita income was $1,315. But it came down to $1,217 in line with the WB calculation. The threshold is normally revised upward every year.

If Bangladesh continues to grow at the current pace and crosses the WB-fixed threshold, it would not qualify for the IDA-only finance.

"But it won't be a problem for Bangladesh," another WB official said. "The WB will assess the impact of soft loan on the country's overall need. If it needs concessional loans, it will continue to receive the financing."

The official gave the example of Vietnam, which receives IDA financing although its per capita income stands at $1,800.

A finance ministry official said Bangladesh takes a big amount of hard term loans from India and China. "Compared to the financing from India and China, the IBRD loans would be more flexible and less costly for Bangladesh."

Besides, the IBRD financing will open a new window for Bangladesh to implement large projects to meet infrastructure deficits, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments