Taka depreciation expected to continue amid financial outflows

The taka is expected to depreciate further against the US dollar due to huge outflows, said the Bangladesh Bank in its quarterly released yesterday.

The observation comes as Bangladesh registered a higher deficit in its external account stemming primarily from an elevated level of deficit in the financial account driven by negative trade credit and increased outflow of other investments.

The deficit in the financial account stood at $3.9 billion in the first quarter of the current fiscal year of 2023-24, down from a surplus of $839 million during the same period a year ago.

In the four months to October, the deficit in the financial account, which includes foreign investments, trade credits and loans, was $3.96 billion though the nation recorded an improvement in the current account, which shows the difference in value between exports and imports.

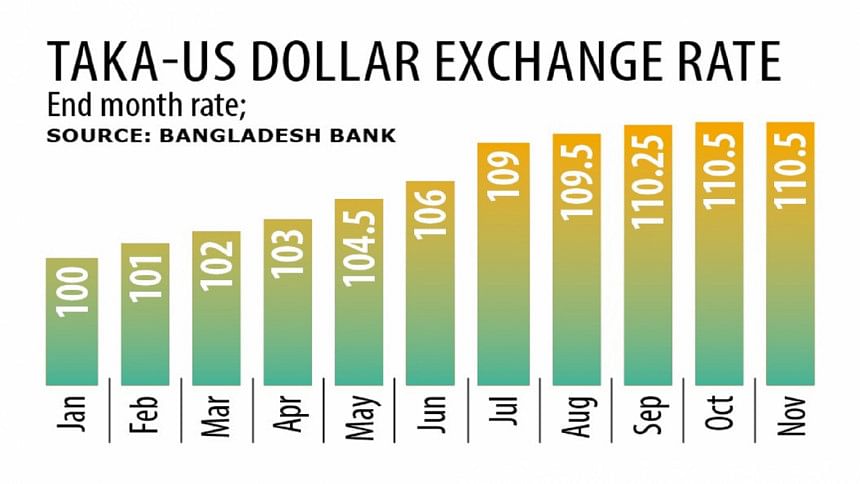

As a result of the consistent pressure of external payments, the local currency has lost its value by about 28 percent since January last year when foreign exchange reserves started to decline at a faster rate.

It weakened by 8.14 percent year-on-year in September this year, said the July-September issue of Bangladesh Bank quarterly.

To contain the downturn and reduce the demand-supply gap in the market, the central bank sold $3.17 billion in the foreign exchange market in the first quarter.

It said the adoption of several policy initiatives aimed at promoting exports and remittances, strong foreign direct investment inflows, and improvement in the trade balance may stabilise the exchange rates of the taka in the coming months.

"However, downside risk may arise from the disruption in the global energy and food markets, the adoption of unprecedented monetary policy to combat decades-high inflation, and slower-than-expected growth in the global economy."

Moreover, the report said, the tightening of global financial conditions may trigger broad-based capital outflows and affect the cross-border portfolio, lower foreign direct investments, increase borrowing costs and debt hardship.

The publication also discussed the performance of the overall economy, challenges of high inflation, improvement in fiscal balance, and risk to the banking sector owing to high non-performing loans (NPLs).

The BB said Bangladesh's overall macroeconomic trajectory remained largely on course in the first quarter aided by robust agricultural performance, and a rebound in industrial production.

The first quarter witnessed substantial export growth, signifying a considerable steadiness in global demand. However, the service sector's growth remained moderate, primarily due to reduced credit flow in trade, commerce, and consumer finance, a response to tightened monetary conditions.

As higher inflation remained a challenge for the economy, current monetary and fiscal policies have provided the topmost priority to contain the inflationary pressure.

In addition to continuously increasing the policy rate to abate the inflationary pressure, the BB has stopped lending to the government by increasing reserve money. Besides, the government has taken various austerity measures for effective fiscal management, it added.

"Looking ahead, all the policy initiatives undertaken by Bangladesh Bank and the government signal to anchor the inflation expectation and are expected to have a favourable impact on inflation outcome in coming periods."

The BB said the growth in agriculture and industry would continue during the rest of the fiscal year leading to a sustained recovery in economic activities.

"BB's tight monetary policy stance, coupled with ongoing fiscal austerity measures, is expected to play a crucial role in mitigating the inflationary pressures in the near future."

Spending, tax collections may gain momentum after elections

It said there has been a surplus of Tk 7,100 crore in the fiscal account as revenue collections exceeded expenditures.

The overall receipts rose 24.4 percent in July-September compared to 17.2 percent in the same period a year ago, mainly due to the increase in collections by the National Board of Revenue (NBR).

Expenditures jumped 21.2 percent.

The expenses under the Annual Development Programme and others, however, declined in the three-month period.

The BB said the maximum share of the spending financing came from domestic sources, a majority of which from the banking sector.

Despite a slight increase in non-bank finances, government borrowing from the banking sector and international sources has decreased dramatically.

The quarterly, however, said the government spending has returned to its usual levels as most of the infrastructure megaprojects have been completed.

"After the upcoming election, both government spending and tax collection may gain momentum. Moreover, the general recovery of the local and international economies indicates that the budgetary position will improve in the next years."

The fiscal outlook could be affected by downside risks associated with the global economic slowdown, it warned.

Concerns regarding NPLs

The NPL to total loans exhibited a marginal decline in the July-September quarter.

"Yet, the persistence of a substantial volume of NPLs continues to be a matter of concern," the central bank said.

"Furthermore, the continuous efforts of Bangladesh Bank, involving the sales of US dollars to stabilise the foreign exchange market may reduce banks' liquidity. Moreover, the lingering effects of the ongoing domestic and international economic downturn add a layer of apprehension for the months ahead."

Amidst these challenges, it said, the resilience of the banking industry can be maintained through a commitment to good governance, an improved loan recovery process, sustained growth in deposits, and vigilant monitoring.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments