Political crisis to significantly affect economy: PRI

The ongoing political crisis, foreign powers' interest in the upcoming national election, and labour and human rights issues are deepening the economic uncertainty in the country, the Policy Research Institute (PRI) of Bangladesh said yesterday.

"Apart from economic challenges, there are non-economic challenges for the government. These may significantly impact the economic outcomes," PRI Executive Director Ahsan H Mansur said in a press briefing at the PRI office in Dhaka.

PRI Research Director MA Razzaque said the macroeconomic situation had become unstable after a period of stability.

"For the first time, political uncertainty has been added to macroeconomic instability," he said.

Mansur added that foreign powers did not show interest in Bangladesh's elections in the past. "But this year, this [foreign interest in Bangladesh's elections] is present at different levels. This has to be tackled. Otherwise, it would not be right to expect that we will be at peace," he said.

Mansur also opined that the government should not have neglected to resolve the labour issues. "Labour issues have become important this time. It can hurt our export, especially garment export," he said. "Now it has become an issue."

There have also been various discussions on human rights issues which the country must respond to, he added.

"Our record is not good in these areas. It is also not like we are on a path to improvement," said Mansur, citing the fact that opposition leaders were in jail.

"So, we have a number of non-economic challenges apart from economic challenges."

The private non-profit research organisation arranged the briefing to share its observations on Bangladesh's performance against the targets set by the International Monetary Fund (IMF) as part of the $4.7-billion loan it gave to the nation earlier this year.

The PRI said the economy stood at a crossroads.

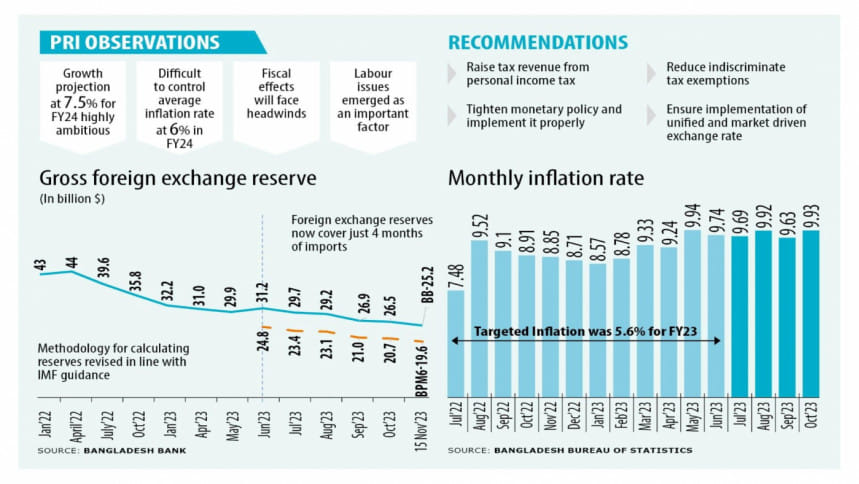

Inflation has been persistently high for the last several months and average inflation stood at 9 percent in the fiscal year 2022-23 ending in June, crossing the targeted levels of 5.6 percent. For the current fiscal year, it will be tough to keep it within 6 percent.

"Similarly, the country is also struggling with foreign exchange reserves. Though several measures like curbing imports and providing incentives to remitters were taken, the measures were not adequate in preventing the downslide in the reserves," the PRI said in a statement.

Mansur, also a former economist at the IMF, said unofficial rates were being observed in interbank trade amid a crisis of the greenback, adding that the unified rate for the dollar had not been working.

As a result of this, Mansur said, banks are preparing the wrong data.

"The financial sector data is being corrupted through this," he said.

"This is unacceptable. The exchange rate should be adjusted after the elections," Mansur said, suggesting the central bank implement a market-driven exchange rate after the national polls.

The PRI said maintaining foreign reserves in line with the IMF's conditions would prove difficult in the coming months. It will also be tough to achieve the revenue collection target set by the multilateral lender.

Mansur added that the IMF had significantly revised down the target for Bangladesh on net international reserves to $17.5 billion at the end December and $19.5 at the end of June, 2024.

"This is a modest target. This should be achieved. But the economy will not be on the right track if politics is not on the right path," he said.

Mansur said the government would need to take a number of policy measures in the financial sector, foreign exchange market and in terms of revenue collection to attain the IMF's targets.

And the recommendations are critical for ensuring macroeconomic stability, he said.

"We expect that the government will deliver," he said, albeit conceding that it would be tough, particularly in the banking sector where influential beneficiaries will resist.

Resistance against reforms and automation will also come from officials of the National Board of Revenue because they will want to maintain the status quo, he said.

"So, there is a formidable challenge," Mansur said, adding the government will also need to tighten the monetary policy to stabilise the foreign exchange rate.

The PRI said the NBR made some progress in revenue collection in FY23, but added that it would be more difficult to collect the targeted revenue for FY24 given the growing dollar crisis, a notable decline in import activities, and a downturn in business performance.

"In the context of the ongoing election year, political unrest poses a substantial risk to business and economic activities, with the attendant possibility of diminished revenue collection. In light of these circumstances, it is imperative for the NBR to strategically plan revenue initiatives, accounting for the potential impact of these issues."

The PRI suggested the government raise more tax revenue from personal income tax and cut tax exemptions. It also advised monetary policy tightening and ensuring the implementation of a unified and fully market-driven exchange rate.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments