Only 0.1% of account holders control 42% of deposits: PRI study

A tiny fraction of account holders and just two districts -- Dhaka and Chattogram -- dominate banking deposits and loans, exposing deep inequalities in access to financial services in Bangladesh, according to a new study by the Policy Research Institute (PRI).

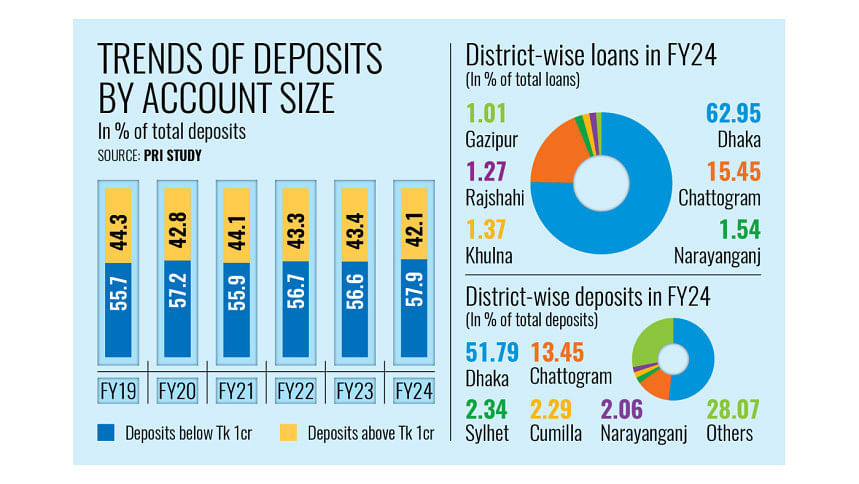

Only 0.1 percent of account holders, each with deposits of Tk 1 crore or more, control nearly 42 percent of total bank deposits as of the end of the fiscal year (FY) 2023–24, according to the research.

This points to a worrying concentration of wealth in the hands of a few, according to the report by the local think tank, titled "Spatial and Historical Trends of Financial Development in Bangladesh", presented yesterday at an event at a hotel in Dhaka.

The imbalance extends beyond deposits. Just 1.2 percent of loan accounts hold loans worth Tk 1 crore or more, yet they account for nearly 75 percent of all loans in the banking system.

Presenting the findings, PRI Principal Economist Ashikur Rahman said, "Despite decades of financial liberalisation and branch expansion, the promise of equitable banking remains largely unfulfilled."

The study shows that 78 percent of all bank loans are concentrated in Dhaka and Chattogram, while just 1 percent of borrowers control three-quarters of the lending.

"This is not just a statistical anomaly. It reflects a structural bias in financial intermediation," Rahman said.

He criticised private banks for being nominally present across the country, yet actually confined to the wealthier eastern belt, reinforcing financial exclusion.

"What emerges is a system where credit is not democratised but hoarded, where banks are not instruments of inclusive development but facilitators of entrenched inequality," the economist said.

Rahman added that if finance is the lifeblood of the economy, then the country's peripheral districts remain chronically anemic.

In his final remarks, Zaidi Sattar, chairman of the PRI, said, "The data indicates private banks are not banking the poor.

"So, the goal of the banking sector should make the financial system inclusive while their complementary role would be contributing to the development of the country," he added.

The study also shows that regional disparity in lending and deposit is also high.

PRI found that more than 64 percent of all deposits come from Dhaka and Chattogram alone.

Lending follows the same pattern. As much as 78 percent of loans are issued in these two districts.

At the programme, Bangladesh Bank (BB) Governor Ahsan H Mansur said the government needs to take these findings into account for policymaking. The central bank was already moving towards a strategy to ensure financial inclusion.

"Bangladesh has one of the highest banking branch densities in the world," said the governor. "So our priority is not to open more branches, but to make better use of the ones we have."

The banking sector must reach customers at their doorstep, said Mansur.

He said that banks were being encouraged to appoint more female agents, especially in rural areas, where women could gain access to households and help bring informal savings into the formal system.

Once agent banking expands to rural lending, microcredit interest rates will naturally fall due to competition, he said.

As part of its financial inclusion drive, the BB is also pushing for wider use of QR code transactions.

However, Mansur believes that unless local governments are empowered, local economies will remain weak, and political steps must be taken to minimise such imbalances.

The PRI report also flagged troubling localised trends. Over the past five years, 126 upazilas saw a decline in loan accounts, while in 60 upazilas, the number of loan accounts more than doubled.

A similar trend was seen in deposit accounts, which dropped in 46 upazilas but more than doubled in 66 others.

Speaking at the event, Abdul Moyeen Khan, a member of the BNP's national standing committee, said policymakers should take the findings seriously. "As representatives of the people, we understand their pulse better. But we must also take advice from experts," he said.

Khan said that reform is a continuous process and should evolve in response to changing realities.

Nasiruddin Ahmed, former chairman of the National Board of Revenue (NBR), described financial inclusion in Bangladesh as highly uneven.

He called on the government to respond to the data and formulate policies that would correct the uneven flow of finance.

The PRI study also highlighted sectoral disparities. Between 2019 and 2024, 40 to 42 percent of total loans went to the industrial sector, while agriculture received just 4 to 5 percent.

Bangladesh Bank Executive Director Anis Ur Rahman said if loans in the agriculture sector could be increased, it might be possible to reduce the government's subsidy burden in the sector.

Md Habibur Rahman, deputy governor of the Bangladesh Bank, also spoke at the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments