Fresh gas price hike can choke textile sector

The proposed 130 percent hike in gas price for captive power plants will badly hurt the country’s primary textile sector, which is already struggling for the deluge of cheap fabrics and yarns from China and India.

The hike will take the price of gas to Tk 19.26 per cubic metre from Tk 8.36 now. The government had already raised the price of gas for captive power plants as recently as September last year from Tk 4.36 per cubic metre to the current rate.

“Probably the highest hike has been proposed for the captive power generators,” said A Matin Chowdhury, managing director of Malek Spinning Mills, a leading spinner.

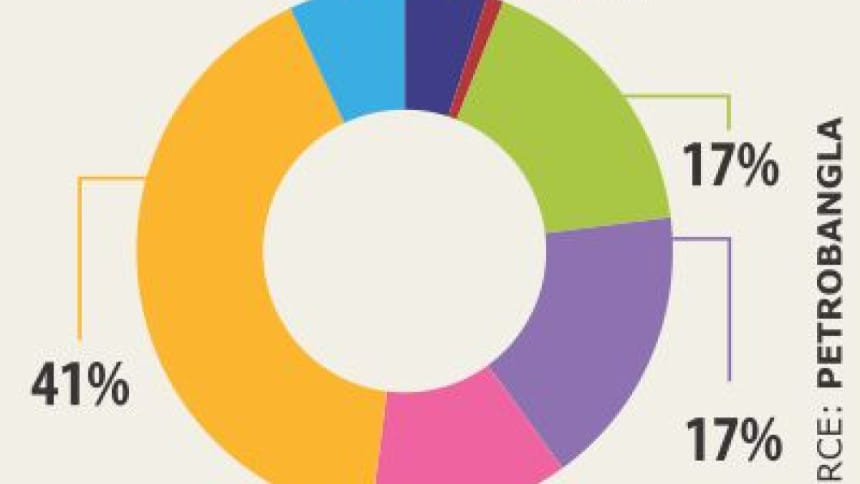

Captive power generators account for 17 percent of total gas consumption, according to data from Petrobangla, the national oil, gas and mineral exploration company.

Primary textile accounts for 4 percent of the electricity generated by captive power plants.

The primary textile sector, where more than $5 billion has been invested so far, would be affected, said Chowdhury, who is also a former president of the Bangladesh Textile Mills Association.

“All the investment would be in difficulty if the gas price is hiked, as the sector is already going through a rough patch due to imported raw materials, particularly yarns and fabrics,” he added.

For sustainability in yarn trade, a mill requires a profit margin of at least $1. At present, the millers’ margin has dropped to below 60 cents.

Spinners and weavers have already expressed their concern over the proposed price hike in a meeting with the high-ups of Bangladesh Energy Regulatory Commission.

If the proposed hike in gas price is implemented, the price of yarn will increase 3-14 percent and the price of fabrics 3-10 percent in the local market, according to the BTMA.

The garment makers are not ready to pay the extra price as they now have the option of imported yarns and fabrics at a lower price, Chowdhury said. “And, they would continue to enjoy the zero-duty benefit.”

Earlier, garment exporters had to use local fabrics and yarns to enjoy duty benefits, but in 2011 the rules were relaxed.

If the gas price is hiked, spinners will not be able to supply the raw materials to the knitters and garment makers at competitive prices, said BTMA President Tapan Chowdhury at a press conference last week. “In such a scenario, local garment makers would simply switch to imported yarns.”

The demand for local yarns is higher due to a shorter lead time and better quality, he said. Currently, more than 400 mills have a spinning capacity of 10 million bales of cotton (one bale is equal to 480 pounds or 218 kilograms).

But they cannot use their full capacity due to higher power prices and interrupted and inadequate supply of power and gas to production units.

At present, Bangladesh imports 6.1 million bales of cotton a year and the local growers can supply only one lakh bales.

The majority of the demand for cotton in Bangladesh is met through imports from India. Due to superior quality, lower price and shorter lead time, India has become the largest cotton sourcing country for Bangladesh.

In 2015, Bangladesh imported 6.1 million bales of cotton, 49 percent of which came from India. The primary textile sector includes the spinning, weaving, dyeing, finishing and printing sub-sectors and is considered a backward linkage industry for the garment sector.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments