Stimulus for large, small industries: Tk 50,000cr fresh funds see tepid disbursement

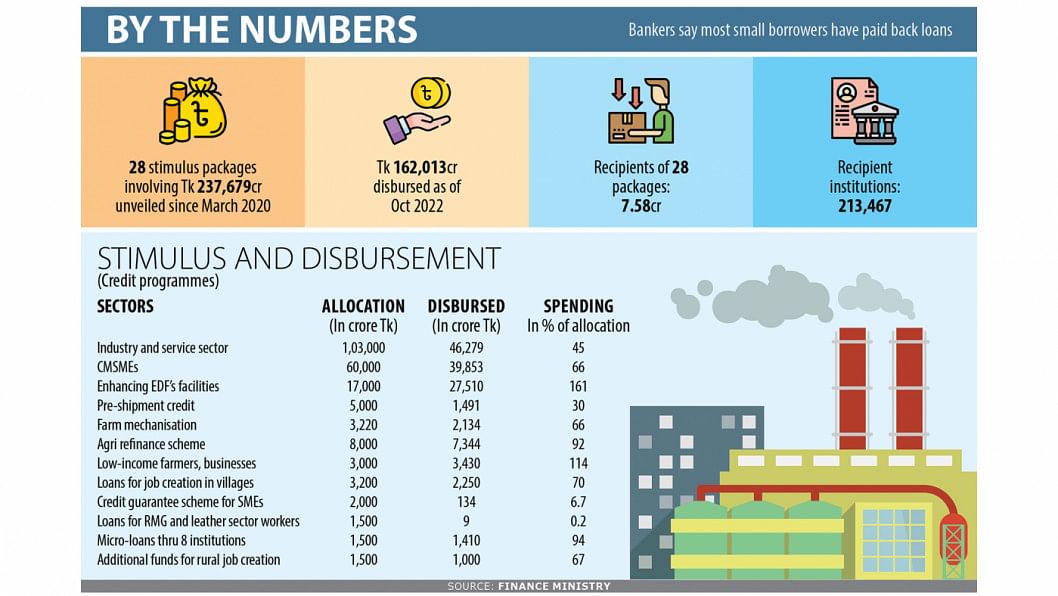

Two of the government's 28 Covid-19 stimulus packages saw a fresh injection of Tk 50,000 crore in the ongoing financial year, but only 4 per cent of the fund was disbursed between July and October.

The two packages each aimed at providing working capital to large industries and service sector firms and cottage, micro, small, and medium enterprises (CMSMEs) saw a collective disbursement of Tk 2,151 crore as of October, according to a finance ministry report.

Officials said many of the borrowers who already took loans under the stimulus packages in the previous two rounds have not paid back. So, they have not qualified for fresh loans from the allocations made in the latest round.

"At present, we are getting a tepid response from loan-seekers," said Zaid Bakht, chairman of Agrani Bank.

"A reason behind this could be that the packages are in their final year of implementation."

Some borrowers are repaying the loan on time while others are unable to pay back and they are seeking extensions of the repayment period.

"If a borrower is granted an extension, he or she will not be eligible for a new loan at the subsidised interest rate," Bakht added.

The overall interest rate on the loans made from the stimulus packages is 9 per cent. Half of the interest is borne by the government as a subsidy.

The government introduced stimulus packages after Covid-19 was first detected in Bangladesh in March 2020.

It started with a Tk 5,000 crore stimulus package for apparel manufacturers, providing them low-cost funds so that they can keep paying wages and salaries to the workers in the country's largest export-earning sector.

Since then, the government has announced 28 stimulus packages involving Tk 2,37,679 crore. Of the sum, Tk 1,62,013 crore, or 68.16 per cent, was disbursed as of October, according to the finance ministry report.

Of the total amount, Tk 1,63,000 crore has been allocated under the two large programmes for the large industries and service sector firms and CMSMEs.

In April 2020, the government unveiled a fund of Tk 30,000 crore for large industries and services sector firms. The fund was expanded by Tk 10,000 crore in the same year.

Tk 33,000 crore was added to the package in July 2021 and another Tk 30,000 crore in the third round that was unveiled in July last year. This means that the package saw a total allocation of Tk 1,03,000 crore, out of which, Tk 46,278 crore was disbursed as of October.

Finance ministry data showed, of the Tk 30,000 crore allocated in the third round, Tk 839 crore has been disbursed.

In July last year, the government injected Tk 20,000 crore for the package for CMSMEs in the third round, raising the total to Tk 60,000 crore.

As of October, the total disbursement under the package stood at Tk 31,853 crore. Of the total disbursement, Tk 1,312 crore was lent in the first four months of FY23.

This shows that the disbursement under the CMSMEs package is higher than the package for large industries and services sector firms.

"Small borrowers did better than the large borrowers in terms of loan repayment," Bakht said.

Many large borrowers could not repay loans because of fund shortages and have sought extensions, the economist said.

"The government's stimulus packages have played a vital role in the economic recovery during the pandemic."

The government first introduced a refinance scheme of Tk 5,000 crore for the agriculture sector. The size of the fund was later expanded by Tk 3,000 crore to Tk 8,000 crore. Of the amount, Tk 7,344 crore was disbursed.

One of the stimulus packages is to modernise the agriculture sector by ensuring the use of technologies. Tk 3,220 crore has been allocated for the package and Tk 2,133 crore has been spent so far, with 13,694 agricultural equipment being provided to farmers.

A Tk 3,000 crore refinance scheme for low-income farmers and businessmen was also initiated, and Tk 3,430 crore has been disbursed.

The government allocated Tk 5,000 crore under the pre-shipment credit refinance scheme, which aims at enhancing the capacity of exporters, in April 2020, and Tk 1,491 crore was disbursed.

The disbursement rate was sluggish initially and it later accelerated thanks to the amendment to the policies and the unveiling of some support packages to address the problems faced by banks. Banks have been given the task of executing most of the credit support packages.

Still, a few of the packages saw little progress.

One of them is a cash transfer of Tk 1,500 crore among the jobless workers in the garment, tannery and footwear sectors. Only Tk 9 crore has so far been spent.

The government set aside Tk 750 crore for state employees who died because of Covid-19. So far, about Tk 98 crore was given to the families of 245 deceased as compensation.

A finance ministry official said the government is expecting that the disbursement will pick up as there is plenty of time in the current financial year, which ends on June 30.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments