Enabling Inclusive, Green, and Climate-Resilient Development

Ali Reza Iftekhar, Managing Director and CEO, Eastern Bank

The Daily Star (TDS): What role do you see banks playing in promoting environmental sustainability in Bangladesh, especially in the context of climate change and green growth?

Ali Reza Iftekhar (ARI): Banks are uniquely positioned to act as catalysts in Bangladesh's transition toward a greener economy. As financial intermediaries, we have both the ability and the responsibility to provide capital to environmentally sustainable sectors. At Eastern Bank (EBL), we believe that climate change is not merely an environmental concern but also a significant financial risk that demands urgent and proactive action. That is why we have embedded environmental considerations into our lending and investment decisions. From integrating climate risk assessments into our financing framework to collaborating with international development institutions like IFC, DEG, ADB, FMO, and JIM Foundation, we are aligning our operations with both national climate priorities and global sustainability standards. We believe that through responsible banking, we can accelerate Bangladesh's journey towards a low-carbon, climate-resilient future.

TDS: Can you highlight any specific green finance initiatives, sustainable investment strategies, or eco-friendly banking practices your institution has adopted recently?

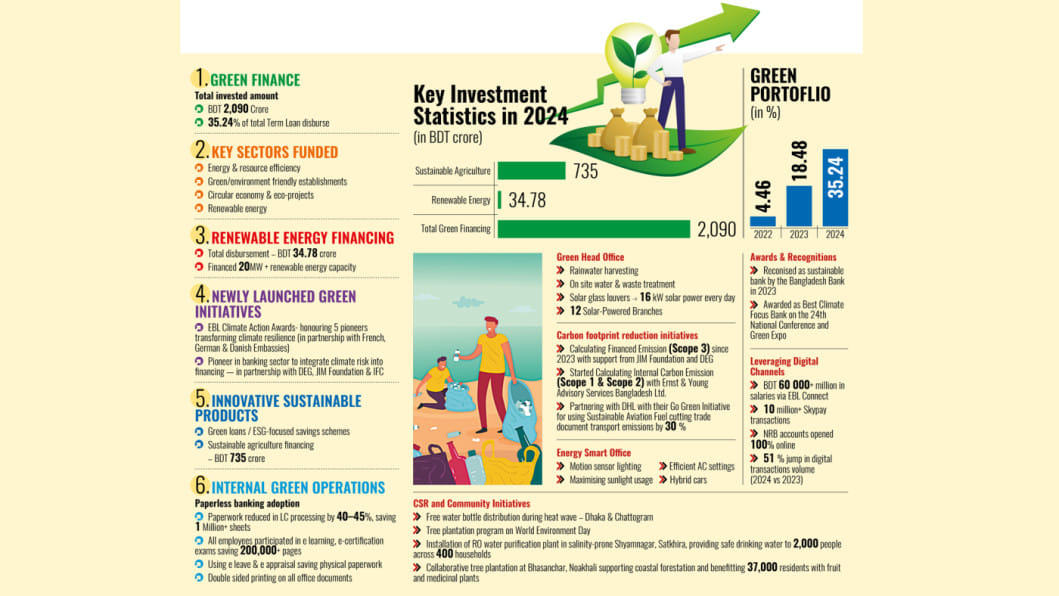

ARI: At EBL, we are driving sustainability through a diverse range of green finance initiatives as well as internal eco-conscious practices. Our green loan portfolio has expanded significantly—from 18% in 2023 to 35% in 2024. We have financed over 204 projects that enhance energy and resource efficiency, and supported 23 LEED-certified factories and buildings that reflect our commitment to promoting green infrastructure.

We are also proud to have invested in two new renewable energy projects in 2024, directly contributing to Bangladesh's clean energy transition. We have also initiated carbon accounting through the JIM Foundation, allowing us to track financed emissions from our business and set targeted carbon emission reduction strategies.

Digitalisation is a core pillar of our sustainability strategy. By streamlining LC documentation and adopting e-learning, e-certification, e-leave systems, and digital performance appraisals, we have saved over one million sheets of paper. In 2024, our digital transaction volume rose by 51% compared to the previous year—demonstrating our strong commitment to reducing environmental impact through technology-driven solutions.

On the operational front, our Green Head Office is equipped with solar power generation, rainwater harvesting, and on-site water and waste treatment facilities. We have eliminated single-use plastics across our premises, introduced hybrid vehicles into our fleet, and adopted energy-efficient technologies, including motion-sensor lighting and optimised HVAC systems, to reduce the environmental footprint of our offices.

TDS: How is your bank aligning its long-term corporate strategy with global environmental goals, such as the Sustainable Development Goals (SDGs) or Bangladesh's national climate priorities?

ARI: EBL's corporate strategy is strongly aligned with the Sustainable Development Goals (SDGs) and Bangladesh's national climate objectives. Our green finance and climate initiatives directly support key SDGs—particularly Goal 7 (Affordable and Clean Energy), Goal 9 (Industry, Innovation, and Infrastructure), Goal 13 (Climate Action), and Goal 17 (Partnerships for the Goals).

We are working actively to contribute to Bangladesh's Nationally Determined Contributions (NDCs), including the national target of reducing carbon emissions by at least 6.73% by 2030. To achieve this, we have embedded sustainability into our strategic roadmap by promoting climate-resilient infrastructure, financing clean energy solutions, and measuring Scope 3 emissions, particularly those from our financed activities.

Moreover, our strategic partnerships with global DFIs such as IFC, DEG, FMO, the OPEC Fund, and ADB allow us to mobilise not just financial resources, but also technical expertise to strengthen our capacity in climate finance. These partnerships enable us to stay ahead of emerging environmental risks and global regulatory trends while supporting the broader national development agenda.

TDS: As a corporate leader, what message would you like to share on World Environment Day about the responsibility of financial institutions in building a greener, more resilient future?

ARI: On this World Environment Day, my message to the financial sector is simple but urgent: finance must be a tool for sustainability. We must become enablers of inclusive, green, and climate-resilient development.

Through strategic green investments, carbon-conscious lending, and partnerships with innovators across industries, EBL is demonstrating that business success can go hand-in-hand with environmental stewardship. By greening our own operations and promoting sustainability across our value chain, we are helping to build the resilience needed to face the environmental challenges ahead.

This is a defining decade. It is time for all financial institutions to take bold and decisive steps—to finance not only economic growth but also the well-being of people and the planet.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments