Supporting small and medium enterprises through the Covid-19 pandemic

Khwaja Shahriar, Managing Director and CEO, LankaBangla Finance Limited

We are aware that the SME sector is going through a difficult phase due to the COVID-19 pandemic. According to the Bangladesh Bureau of Statistics, there are about 78 lakh SMEs in Bangladesh, with 25 million workers working in the SME sector. According to a BIDS report, there has been an overall decrease in revenue in the SME sector of about 66 percent (FY2019-20). If we do not help the SME sector soon, it will become tougher for them to sustain themselves in future.

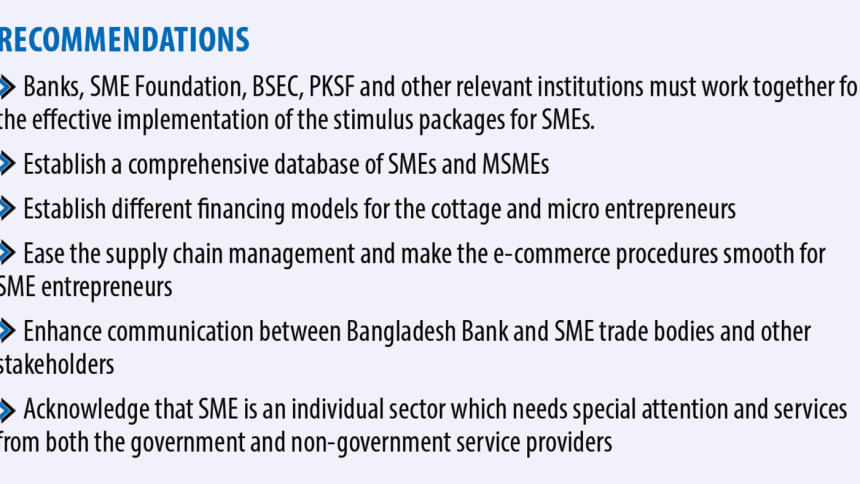

The government and Bangladesh Bank have both committed stimulus packages during this pandemic, to help the SME sector overcome its struggles. The government, banks, financial institutions and all stakeholders of the SME sector also need to work together to help revive this sector. For that, it is extremely important now to figure out exactly where the challenges lie.

Syed Ashfaqul Haque, Executive Editor, The Daily Star

We should be aware that our SME sector, when fully functional, contributes to 25 percent of our overall GDP. The world has been brought to a grinding halt by the current pandemic. Almost every business globally is experiencing some sort of crisis. However, a crisis also implies that businesses have the opportunity to re-think and re-invent.

Selim R.F. Hussain, Managing Director and CEO, BRAC Bank Limited

A recent report by Access to Information (a2i) indicates that almost 20 million Bangladeshi workers are out of work, including in 11 of the most high-impact sectors in the country. Even many informal sectors are experiencing a downward spiral in employment. At BRAC Bank, we had conducted a survey in June, 2020 amongst 6,000 of our SME customers. According to the survey, our small customers are recovering relatively well. Our estimates from July and August indicate that 80 to 85 percent of our loan disbursements are of the preceding year, which implies a state of normalcy. The recovery and collection rates are also seemingly good. Therefore, there is a segment of SME clients or small clients which is resilient, even though they are under pressure during the pandemic.

I believed if the general holidays across the country went beyond June, many businesses would have crumbled under financial stress. Since June, however, with banking support, businesses around the country have rebounded well. We and other similar service providers are also tailoring our offers to meet the demands of these customers.

Md Mahbub ul Alam, Managing Director and CEO, Islami Bank Limited

When it comes to stimulus packages, Bangladesh Bank helped our bank by decreasing our cash reserve ratio (CRR) and increasing our advance-deposit ratio (ADR). It led to a surplus creation amounting to a stimulus package worth around Tk 50,000 crore. When we entered the market to disburse this money, we initially received only 1,500 applications and processed all of them after conducting the credit risk assessment. This led us to encourage and bring in more customers, leading to approving around 2,200 applications. We have approved almost 5,000 applications so far. All stakeholders of the SME sector need to be aware of the needs of the day, and how they can contribute more to the industry.

The SME sector is making a quick comeback. Orders for the garments industry have picked up again. Construction companies, shops and businesses around the nation have already re-opened and resumed from where they had left off. I am hopeful that the economy will do even better in the coming days and that Bangladesh's growth rate will surpass 10 percent.

Monzur Hossain, Senior Research Fellow, Bangladesh Institute of Development Studies (BIDS)

We estimate that there has been a loss of around Tk 92,000 crore to the SME sector, due to the pandemic. The comeback cannot be made as quickly as some have indicated, as many businesses do not have the required capital to reach the levels of past times. The stimulus packages have been accompanied by re-financing schemes and elements alike, but the overall process seems to be bank-based. The risks faced by banks and their liquidity are being focused on, but the demand side is not being addressed properly. Banks cannot themselves build awareness, and the general public must be properly notified of the objectives of the stimulus packages. Also, only bank-based stimulus packages are not suitable as a lot of important documents are unavailable and the customers do not fully abide by the bank rules.

The overall demand in the country has decreased, affecting production levels and demand for SME products. Various incentives and facilities, such as tax benefits, can be provided to revive SMEs. SMEs are engines of growth for an economy and Bangladesh is no different. SMEs also provide great support to Bangladesh's garments industry via backward-linkage. SMEs are responsible for providing a large number of jobs in our country. We have about 54,000 manufacturing SMEs, 49,000 of which are small businesses. The stimulus packages alone cannot help improve the overall situation for SMEs, as MFIs and NGOs will also need to make their own contributions.

Ferdaus Ara Begum, CEO, Business Initiative Leading Development (BUILD)

I would recommend that small and micro entrepreneurs take advantage of the stimulus packages available to them and make use of the time period within which the packages are available; an increase in the number of stimulus packages would also be beneficial. For small entrepreneurs, the repayment time period is one year. We need to reassess this clause because many such businesses would not be able to repay loans quickly, given they need time to start utilising the funds properly. Moreover, the guidelines of Bangladesh Bank stated that the repayment period for new entrepreneurs will be halted for the time being. However, the banks' software is not updated with this information which is making it difficult for these entrepreneurs to cope up.

The financial model for cottage and micro enterprises should be different, especially in relation to the disbursement of funds. Micro and cottage entrepreneurs are accustomed to long-term loans payable in small installments, and not with overdrafts. BIDS and PKSF have already put in the request for 14,000 crore taka for micro and small entrepreneurs to be distributed by MFIs. A solution could be providing them financing on a work-order basis. Bangladesh Bank has a policy in this regard.

Dr Mohammad Abu Eusuf, Professor, Department of Development Studies; Director, Centre on Budget and Policy, University of Dhaka; and Executive Director, Research and Policy Integration for Development (RAPID)

I conducted a study on about 102 women-led enterprises with the support of The Asia Foundation. According to that research study, 87 percent women entrepreneurs stated that access to finance was their main barrier and 95 percent said that they had received no support from any stimulus packages. Banks need to pay attention to their 'women-dedicated desks' at their respective branches and pay attention to how many such women customers at micro levels are actually receiving collateral-free loans at the field level. Usually, personal guarantors are required in such cases which are difficult to manage. Thus, the loans are not collateral-free.

Those who lie outside the realm of the banking system (micro and small entrepreneurs) could be reached through MFIs. Thus, entrepreneurs are not being able to obtain MFI, NGO or government support adequately, making it harder for them to survive. Micro and small enterprises need to be considered independently. With time, women's chambers and local chambers need to be brought within the micro-credit system. Personal guarantors, guarantees from the chambers and even guarantees from SME foundations are all fundamental.

Under the existing system, we will not be able to properly assist micro, small and women-led enterprises. We must think of alternatives to reach out to such women. In fact, I personally got to know of cases where potential entrepreneurs were blocked out by factors like excessive paperwork.

Dr Khondaker Golam Moazzem, Research Director, Centre for Policy Dialogue (CPD)

The government was responsible for handling the subsidies associated with stimulus packages; the banks were supposed to shoulder the other responsibilities, but they have not fulfilled them. It seems many businesses which do not necessarily need loans, have been issued funds. Industrial loans are important for export-oriented businesses, since they make big contributions to our economy. However, only this sector has been given most loans since banks find them to be risk-free, though SMEs are deemed to be important during this crisis. The government has established a loan guarantee scheme for risky businesses like SMEs and a 2,000 crore taka package has been declared for this purpose. Yet, no proper implementation is being seen by the banks.

The government has built a database for the informal sector. However, this database is still going through various difficulties. Cottage, micro, small and medium enterprises need to be brought under one database. This would allow the government to regulate its plans and schemes in a more concise and clear manner. For example, cottage and micro enterprise owners, who are not currently able to go to banks, could be helped in many other ways (exemptions on electricity, water bills, VAT and tax, etc).

Loan disbursements need to be made available to the marginalised communities in peripheral areas as well. Besides, we can even help cottage and micro enterprises in non-financial ways. BSEC, banks, MFIs and even NGOs can provide the required data in creating a database for enterprises.

Md Kamruzzaman Khan,

Senior Vice President and Head of SME Financial Services, LankaBangla Finance Limited

85 percent of enterprises of the Cottage, Micro and Small (CMS) sector are involved in trading business. The government has tried to shift the focus to the manufacturing sector but to no avail. The reason why there is not enough focus on the manufacturing sector is the lack of entrepreneurship. Everyone tries to initiate ready-made businesses and obtain immediate profit. The Ministry of Industries should establish skill development programmes for new entrepreneurs who can work in the manufacturing sector in the future.

Organisations like ours can motivate entrepreneurs to focus on the manufacturing sector. In the CMS sector, we have financed approximately 3,200 people, and 35 percent of them are associated with manufacturing, while 45 percent of the businesses in our portfolio are in trade.

Borhan Uddin, Executive Director, IIBM and Senior Consultant, SME Sector

A significant amount of work is being done in the SME sector by NGOs on capacity and product development, but no effort was made to develop supply chains or sales. SME Foundation has developed software with a list of goods. However, most of the goods are not always available. If the private sector, government and banks came forward and worked together to give logistical support, then this sector would flourish, improving the supply chain.

USAID conducted a study on why the price of goods worth 10 taka per kg becomes 60 taka per kg when it comes to Dhaka. It is because the middleman who brings the goods to Dhaka does not have any packaging or security for the goods and so half the goods become rotten during transport. The middleman is forced to assume that half of the goods will be wasted and hence prices are set with this situation in mind. If the goods can be packaged in a way that they do not rot, and if the middleman has better logistical support and transportation, the goods could easily be obtained at a lower price. The private sector is interested in working on these supply chain issues, and there is a need for logistical support to implement the plans.

Shabbir Shawkut, Technical Advisor, Capacity Building and Public-Private Dialogue, WEESMS, The Asia Foundation

There should be alternative methods in evaluating credit ratings based on technological transactions. The utility payment behaviour of entrepreneurs can also be tracked.

Most people in marginal villages have never gone to the information booths in upazilas provided by the government. This shows a need for sync between financial management in these areas and the governmental support system.

During the COVID situation, people moved to their hometowns. There is uncertainty surrounding whether these workers will return after not finding work in the villages. This has caused a break in the supply chain. Many SMEs are unaware of how to overcome the break in the supply chain because they were never at the supply end. They mostly stay at the production end and reach out to secondary suppliers, but never reach tertiary suppliers. The government's attention is important in this matter, for example, through in-kind support.

Trade license renewal fees have increased compared to last year, causing a reluctance to renew licenses. This reluctance affects them in terms of taking bank loans since banks are not interested in providing loans to insolvent customers. The bank's support in reaching the supply chain from the sectoral aspect should be increased.

Nazeem Sattar, General Manager, SME Foundation

The government has given banks the responsibility to implement the incentive package. Banks are prioritising existing clients and not showing any interest in providing loans to new clients. Therefore, those who are outside of the existing pattern need to be brought within the system. Government banks are even reluctant to fund the SME sector and have shown negligence in implementing the incentive package. The government must address the issue of banks not providing loans for SMEs.

Many government agencies provide loans outside of banks. We should look into whether they can be used as an alternative to banks for the segment of people at the bottom of the pyramid. We also have to increase the agencies' ability to function for these people. The government can take policy initiatives to help these people grow their businesses. An alternative loan delivery channel needs to be established besides banks.

Asif Iqbal, Joint Director, Bangladesh Bank

Recently, Bangladesh Bank made the application process much easier for SME entrepreneurs and has introduced a one-page loan application form. We have already launched a digital credit pilot through bKash and City Bank. If it can be launched successfully, then the financing end will be benefited greatly.

The banking system is more comfortable in dealing with collateral-based loans rather than cash flow-based loans. There is a need for a paradigm shift for the banking culture to start to promote cash flow-based loans. Many new businesses have opened during the pandemic. If micro merchant payment and retail merchant payment can be fully digitised, then the transaction will be fast and efficient.

The SME financing sector is continually trying to depend on banks, but, in reality, this might not be feasible. Banks will never be able to offer all kinds of financial activities. If we can focus more on supply chain financing, a lot of problems within the financing landscape can be solved.

M A Mannan MP,

Honourable Minister, Ministry of Planning

There is a perception in our country that the smaller the borrower, the more fearful they are to approach government banks. This fear is now fading away but at a slow pace. Hopefully, new generation banks will do everything they can to minimise this fear of small borrowers. The government must try to diminish the fear even further.

E-payments for small borrowers should be initiated within a year. Hopefully, an efficient way will be found to ease the process and relax the e-payment schedule for beneficiaries. There is a gap between manufacturers and traders. Traders are faster and more visible, whereas manufacturing units are spread all over the country with single person operators or family operators with lower educational, social, and networking levels. Naturally, the manufacturers are finding it difficult to adapt to the change. With the support of the government, we hope to find a way to strengthen the millions of manufacturers across the country. We are aware of the slow process within government banks, but the Ministry of Finance and Bangladesh Bank must energise and empower them. We also have to familiarise ourselves with alternative delivery mechanisms.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments