Straighten out the NBFI crisis

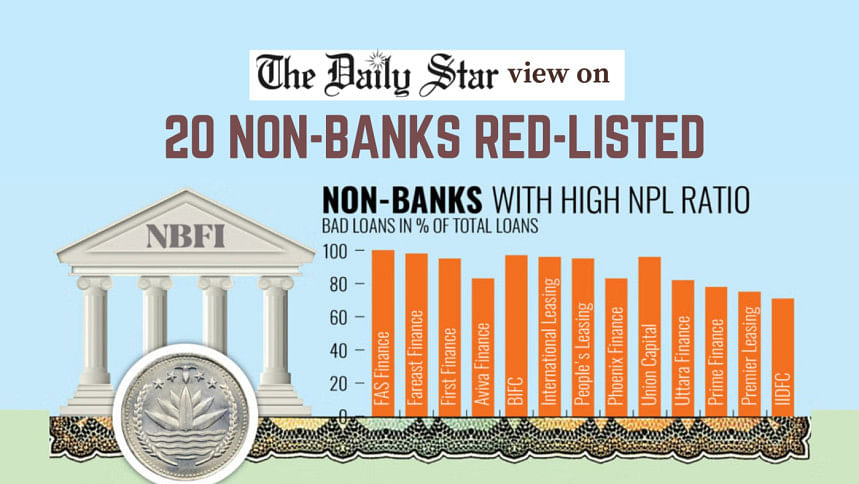

That non-performing loans (NPLs) have become a headache not just for banks but also non-bank financial institutions (NBFIs) should not surprise us. What's alarming, however, is the scale of trouble NBFIs find themselves in and how little attention they have received from the authorities, unlike the crisis-ridden banks. According to a report by this daily, as many as 20 NBFIs—out of a total of 35 currently registered to operate under the Bangladesh Bank—have been put on the "red list" for giving out loans more than three times larger than the value of collateral they hold. And now the majority of these loans have turned bad. This needs urgent intervention.

According to our report, as of December 2024, the NBFIs in question disbursed Tk 25,808 crore in loans against collateral worth Tk 6,899 crore—26.73 percent of the loan amount. To make matters worse, 83.16 percent of these loans—or Tk 21,462 crore—have now been classified as NPLs. As the central bank has discovered, many of the loans were approved without adhering to due diligence: no proper assessment of the loan-seekers' repayment ability, no independent verification of collateral information. These NBFIs are now drowning in a crippling liquidity crisis, unable to pay off their depositors.

This crisis has long been in the making, as irregularities and mismanagement have been ailing both banks and NBFIs for a long time, particularly during the tenure of the Awami League regime that all but decimated the financial sector. However, troubles in the banks have always overshadowed problems in the NBFIs, owing to the sheer scale of the crisis in the former. An NBFI sector leader pointed out that they had been raising the issues debilitating the sector with the authorities over the last several years, yet no action was taken to prevent its slide. Even after the August 5, 2024 political changeover, the central bank undertook a number of reform initiatives to straighten out the banking sector, but no visible steps were taken to restore the NBFIs.

This imbalanced approach to resolving our financial crisis needs to change. While we appreciate the central bank's belated assessment of the NBFIs' current state and the measures taken so far to sort out the mess, a lot more needs to be done, and urgently. Reform initiatives must focus on the entire financial sector, which means troubles gripping the NBFIs must be given due attention. The Bangladesh Bank and the government must take their fair share of responsibility, too: they must not only employ stringent policies and strict regulatory oversight for the NBFIs to operate under, but also work with them to figure out a plan to recover the money they lost to bad loans so depositors can be paid back. Most importantly, actions must be taken to restore the confidence that people have lost in the NBFIs due to the persistent problems.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments