Is six percent growth a trap for Bangladesh?

In my student life in the early 1980s, I came across the concept of Richard Nelson's low-level equilibrium trap of income for developing nations. Also, Ragnar Nurkse's theory of Vicious Cycle of Poverty gave us a similar notion of entrapment, which implies that a nation is stuck up in the quagmire of repeated economic miseries and it cannot escape from that difficult situation when per capita income is very low. In my early childhood, I got surprised to see how rats are trapped in a device especially made to reduce the number of rats which are harmful to agriculture. Now in the mid-2010s, I am again surprised to see how this concept of entrapment is used to define Bangladesh's recent growth performances that posted an average growth rate of 6.2 percent over the last 10 years. Is this a growth trap for Bangladesh?

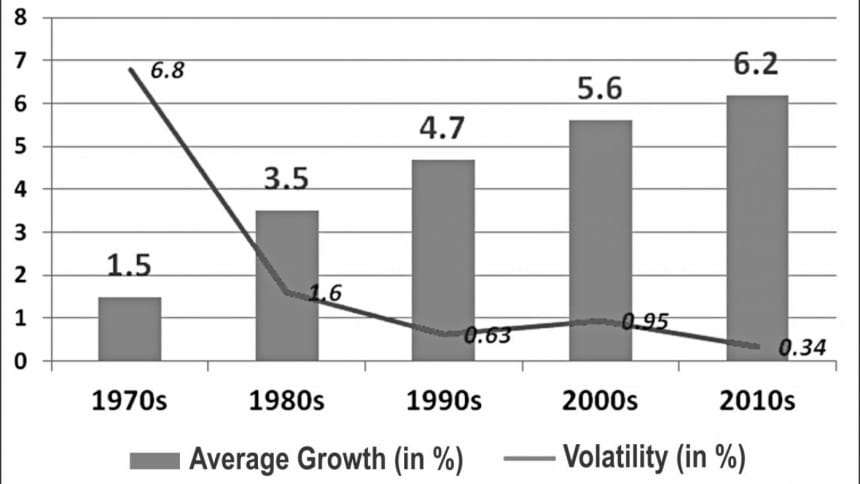

Defining Bangladesh's six-plus percent growth over a decade as a growth trap is not only erroneous but also a testimony of negative attitude. It is always advisable to get rid of a trap. If so, should Bangladesh get rid of the six percent growth rate and achieve growth rates even below 6 percent with high volatility? That won't be desirable. Since China embarked on liberalisation in 1978, its average growth for 33 years until 2010 was 10 percent with a standard deviation of only 2.7 percent. No one defined China's double-digit growth performance over those 33 years as a trap. Rather, it was credited as China's brilliant feat. Bangladesh's recent stable growth should not be branded as a low middle-income growth trap. Since independence, Bangladesh has consistently increased its average growth rate over every decade with a corresponding decrease in growth volatility, as shown in the figure.

The country does not show any sign of being trapped in a particular number such as the six percent rate as of late. Let us wait another four years to get the figures of the full decade of the 2010s. The figures will surely change. Although Bangladesh's average growth over the last 10 years (2006-2015) is 6.2 percent with a standard deviation of 0.55; viewing this stable growth as a trap is erroneous.

Many countries in their path to development had experienced periods of low growth volatility. There is no room to view that attribute as a defect. Rather, it is a sign of stability. Assessing the low standard deviation of growth in Bangladesh as a sign of trap is no less than an optical illusion. It ignores the simple math of growth.

Growth is an outcome variable which is derived through a highly complex process of interactions among numerous macro variables. Unlike the operational variables such as the interest rate or money supply, growth is an ultimate result of multiple equations and thus, we have too little control over this variable. At least there is no direct control over the growth variable.

If we look at the simple output equation [Y=C+I+G+X-M], it comprises major macro variables such as consumption (C), investment (I), government spending (G), exports (X), and imports (M). Many economists believe in consumption smoothing that suggests less fluctuations in consumption behavior. And this is true for Bangladesh, but investment is volatile by nature. Private sector credit growth, for example, rose to 26 percent in the fiscal year (FY) 2011 before it plummeted to 11 percent in FY2013. It slowly rose to around 13 percent in the FY2015. Thus, our private investment changed its course in an almost unpredictable way.

While growth in government spending [G] is less volatile, that is not true for the external sectors. The time when exports [X]and imports [M] posted more than 20 percent growth is not dated too back. Their growth rates are not symmetric either. Export growth was almost three percent and import growth 12 percent in the FY2015. By contrast, growth figures remain six percent-plus over the period under review. The whole point of stating these numbers is to convince that so many variables and their fluctuations ultimately determine the final value of output (Y) and thus, output growth [gt = (Yt - Yt - 1)/Yt-1]. Accordingly, the argument that our growth is in a trap is mathematically impossible, particularly when an economy is emerging and different sectors are evolving at different rates. No one can tamper with all the numbers GDP includes.

It could be a subject of research as to why Bangladesh's growth stability is outstandingly high and much higher than that for other neighbours in the region. The foreign investors view this feature as part of macro-stability. No one should interpret this stability as an inescapable hole of stagnancy. When Keynes spoke about the liquidity trap, he described a very low interest rate situation where injecting more money makes the situation even worse without further lowering the interest rate. Our growth performance is no way comparable to that economic predicament.

The writer is chief economist of Bangladesh Bank.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments