Mobile importers seek duty cut in budget

Mobile handset importers have urged the government to cut import duty to Tk 100 from existing Tk 300 on each set in the upcoming budget, saying such a tax reduction will help users get quality products and discourage substandard handset imports.

Leaders of Bangladesh Mobile Phone Importers Association (BMPIA) said yesterday that a Tk 300 duty on imported handsets also precludes them from competing with low-cost handsets usually imported through illegal channels.

"A big untapped market remains in the poor segment. And for them affordable handsets is a demand," said Mustafa Rafiqul Islam, acting president of BMPIA, at a press meet at La Vinci Hotel in Dhaka.

The tax reduction will discourage importing handsets through illegal channels, he said, adding that the government's revenue will also go up as handset imports will increase riding on a reduced duty.

Mobile handset imports increased by 92 percent to 60.82 lakh pieces in fiscal 2006-07, while the figure was 31.70 lakh in fiscal 2005-06. The imports shot up as the import duty on handsets was cut from Tk 300 in fiscal 2005-06 to Tk 200 in fiscal 2006-07, said BMPIA leaders.

Handset imports in fiscal 2007-08 however witnessed a 13 percent downtrend as the government re-fixed Tk 300 duty in that fiscal year when a total of 53 lakh handsets were imported.

Besides the legal imports, BMPIA claimed that around 20 lakh handsets enter Bangladesh market every year through illegal channels.

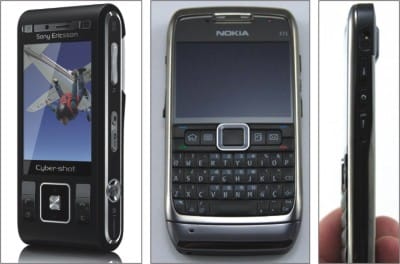

Nokia, Motorola, Samsung, LG, Sagem and Sony Ericsson are the leading brands in Bangladesh's 46 million subscribers' market.

A parliamentary standing committee on telecom recently recommended full duty waiver for mobile handsets valued up to Tk 3,000.

Welcoming the move, the association leaders however said the government should introduce a unified duty structure for mobile sets of all ranges.

"Mobile handset price fluctuates every day in the global market. So it will be difficult to fix duty considering handset prices," said Islam.

He suggested a specific and unified duty structure should continue.

The BMPIA leaders also urged the government to fix advanced tax on value at Tk 10 in the upcoming budget. The importers now have to pay 1.5 percent advanced tax on each mobile set price.

For ensuring better after-sales service for the customers, the association also proposed reducing duty on mobile phone accessories from existing 55 percent to 15 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments