Over 80% of businesses say tax rates are unfair: CPD survey

Some 82 percent of businesses surveyed believe that the current tax rates imposed on them are unfair and pose major challenges for their growth, according to a survey by the Centre for Policy Dialogue (CPD).

In addition, over two-thirds of businesses identified a lack of accountability among taxmen, widespread corruption, and the absence of a fully digital tax submission system as major concerns.

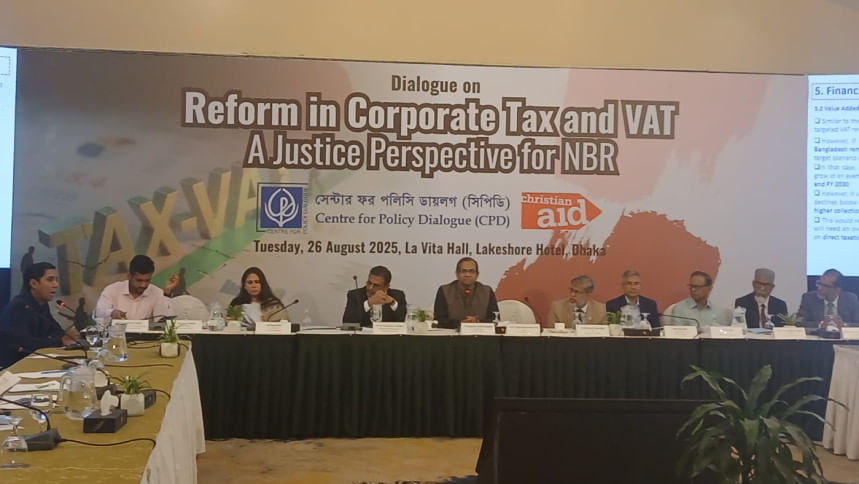

For example, 79 percent of the businesses surveyed reported a lack of accountability and 72 percent blamed corruption among tax officials, according to the CPD study, which was unveiled today at a dialogue on reforms in corporate tax and VAT at Lakeshore Hotel in Dhaka.

The CPD, in partnership with Christian Aid (CA), conducted the survey among 123 companies located in Dhaka and Chattogram this year.

The CPD study said 65 percent of businesses face persistent disputes with tax officials regarding tax claims.

This issue was echoed by many interviewed business leaders, who claimed that tax officials often impose taxes arbitrarily without proper justification or prior communication.

Such practices, they argue, create an intangible burden that often outweighs the tax amount itself, making the overall tax practice unfair.

In another survey, businesses termed the multiple rates of Value Added Tax (VAT) as a major challenge.

According to the survey, 73.5 percent of respondents cited the complexity of VAT laws as a key barrier.

Other challenges that businesses surveyed highlighted include unclear VAT rules and guidelines, limited cooperation from tax officials, insufficient training and awareness, difficulties in classifying goods and services, and high compliance costs.

The survey on VAT-related issues was conducted based on the structure of the World Bank Enterprise Survey.

The CPD conducted the survey among 389 firms, including those from Dhaka city and its surrounding districts.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments