No margin loan for stock investment below Tk 5 lakh

The stock market regulator has moved to tighten rules on investing in shares through borrowed funds, after years of mismanagement of margin loans weighed heavily on the market.

The Bangladesh Securities and Exchange Commission (BSEC) on Tuesday published a draft amendment to margin rules on its website, inviting public feedback within two weeks.

The proposals seek to check excessive lending by brokerage houses and banks, which fuelled the bubble of 2010 and left the market stumbling for more than a decade.

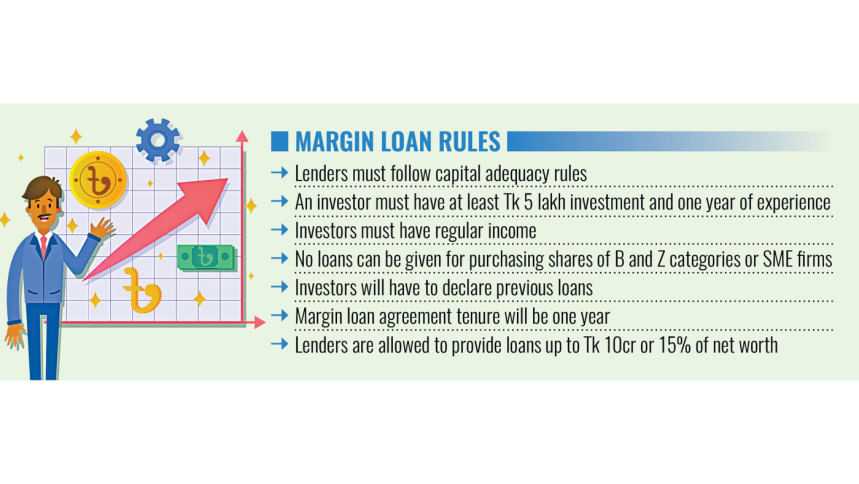

According to the draft, an investor must have at least Tk 5 lakh invested, one year of trading experience and a regular source of income to qualify for a margin loan.

Those with less than Tk 10 lakh in investment would be eligible for loans worth up to half their portfolio. Investors with more than Tk 10 lakh would qualify for loans up to the full value of their holdings.

"The regulator is going to make the margin rule conservative, which is welcoming, as the stock market is not a place to invest by taking loans," said Md Moniruzzaman, managing director and CEO of Prime Bank Securities.

After the market crash during 2011 and 2012, negative equity from margin loans crossed Tk 15,000 crore, decreasing to about Tk 9,700 crore by October 2024.

This erosion of capital forced many institutional investors out of the market, even when prices hit rock bottom, Moniruzzaman said.

Analysts have often described margin loans as the "cancer" of the market.

The draft also proposes that no firm will be able to offer margin loans unless it complies with risk-based capital adequacy requirements.

Firms already in breach would have to gradually wind down existing loans until their capital base is strengthened.

Current rules require brokerage houses to hold Tk 15 crore in paid-up capital, while the requirement for merchant banks is Tk 35 crore.

No institution will be allowed to extend margin loans above Tk 10 crore or more than 15 percent of its net worth, according to the draft amendment.

Moniruzzaman said many firms, already weakened by years of losses, would struggle to comply within a year and urged the regulator to extend the timeframe to three to five years.

Individual investors would have to disclose all margin loans taken from other firms before opening a new margin account, which must be backed by a one-year agreement.

Only individuals with a regular source of income would be eligible to open such accounts. Borrowers who use margin loans to meet minimum shareholding requirements would not be allowed to sit on a company board.

According to the draft, margin loans could not be used to buy B and Z category shares, while newly listed firms would only become eligible after 90 trading days.

Companies with a trailing price-to-earnings (P/E) ratio above 30 would also be excluded. In such cases, the lower figure between trailing P/E and sectoral P/E would determine eligibility.

Market stakeholders, however, argue that sectoral P/E often fails to reflect underlying realities.

Firms would be barred from lending against unrealised gains. They would be required to call investors to add funds once the portfolio value falls to 175 percent of the loan value, and must enforce a forced sell if it drops below 150 percent. If a provider fails to act on time, it would be fully liable for the resulting negative equity.

According to the draft, each firm will also have to adopt its own conservative margin loan policy, set up a two-member risk management committee including one board member, and seek approval before offering shariah-based lending products.

Some analysts questioned whether involving board members in day-to-day business is appropriate.

Afzal Hossain, a stock investor, said the new rule would sharply reduce the advantages of margin loans. Some investors might need to adjust their portfolios quickly once it comes into effect.

"Lower margin loan advantage has both positive and negative sides. The stock market index can sometimes fall sharply in a downward trend due to forced selling. This type of problem may not happen, which is a positive," he said.

Yesterday, the Dhaka Stock Exchange, the main bourse, closed at 5,379.41 points, down 31.48 points from the previous day.

"However, the market may suffer from reduced liquidity because of limited margin lending, and small investors will not be able to access these loans," added Hossain.

He acknowledged that, in the long run, stock market investment should not rely on borrowing.

Mazeda Khatun, president of the Bangladesh Merchant Bankers Association (BMBA), said margin loans are not suitable for all investors, which is reflected in the proposed rules.

She welcomed the checks and balances in the draft, noting that investors should not assume they can buy shares with borrowed money and hold them for years in expectation of profit.

"Lenders should also have clear recovery plans in their own policies."

Khatun said lenders must assess a borrower's risk appetite and behaviour to prevent these loans from turning into further negative equity.

"When banks give a loan, they go through a massive selection process and loan recovery activities. It is also necessary for margin loans," said the association president.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments