Net-Zero Commitment at the Core of Our Strategy

Md Ziaur Rahman, Deputy Managing Director and Chief Risk Officer, Prime Bank

Prime Bank has successfully completed the Proof of Concept (POC) for the "Green LC," executing Bangladesh's first inland LC on a locally developed blockchain-based digital trade platform. "Green LC" is Bangladesh's first-ever locally developed digital trade platform, with Prime Bank issuing the inaugural LC transaction.

The Daily Star (TDS): What role do you see banks playing in promoting environmental sustainability in Bangladesh, especially in the context of climate change and green growth?

Md Ziaur Rahman (MZR): The growing urgency surrounding the climate crisis compels banks to recognise their potential role in fostering positive environmental change. It is imperative for banks to assume responsibility and confront pressing climate challenges by financing necessary transformations. The financial sector is vital in the fight against climate change, and the banking industry is particularly well-equipped to facilitate the shift towards a low-carbon economy. Providing financial support at concessional interest rates for renewable energy initiatives, energy-efficient projects, environmentally friendly establishments, and clean transportation is essential.

Furthermore, within the banking institution, we are witnessing changes such as the installation of additional ATMs and Cash Deposit Machines (CDMs), which promote the use of electronic banking methods. Encouraging customers to engage in online banking, mobile banking, and digital banking allows them to conduct their transactions at any time and facilitates online payments. Additionally, transforming internal communication within the bank and with customers—from traditional methods to digital communication channels such as email and WhatsApp—and utilising digital platforms for meetings, proposal presentations, and credit assessments is crucial. Implementing energy-efficient and low-carbon emission electrical equipment within the bank, and effectively managing internal operations, will contribute to reducing our overall carbon footprint.

TDS: Can you highlight any specific green finance initiatives, sustainable investment strategies, or eco-friendly banking practices your institution has adopted recently?

MZR: Prime Bank has successfully completed the Proof of Concept (POC) for the "Green LC," executing Bangladesh's first inland LC on a locally developed blockchain-based digital trade platform. "Green LC" is Bangladesh's first-ever locally developed digital trade platform, with Prime Bank issuing the inaugural LC transaction. This milestone signifies a major leap in trade digitisation, paving the way for a fully digital, paperless, and seamless trade ecosystem. This initiative aligns with Bangladesh Bank's directive encouraging financial institutions to adopt electronic solutions for all stages of LC transactions—including transmission, advising, presentation, acceptance, and subsequent processes.

Prior to this successful execution, Prime Bank and technology partner Spectrum Software & Consulting (Pvt.) Ltd. initiated the project, which was subsequently supported by three additional leading banks. These banks joined and significantly contributed to this transformative initiative. Their combined efforts have established a secure, transparent, and efficient digital trade ecosystem.

This milestone reinforces Prime Bank's commitment to digital innovation, setting the stage for a future where trade operations are fully digital, paperless, and seamless.

TDS: How is your bank aligning its long-term corporate strategy with global environmental goals, such as the Sustainable Development Goals (SDGs) or Bangladesh's national climate priorities?

MZR: Sustainable development necessitates a comprehensive approach that requires transformative shifts, particularly in knowledge, policy, and institutional frameworks across all segments of society. The SDGs and the Paris Agreement represent collaborative global responses to this pressing challenge. We are devoted to aligning with the United Nations and its partners in creating a more equitable world where no individual is marginalised.

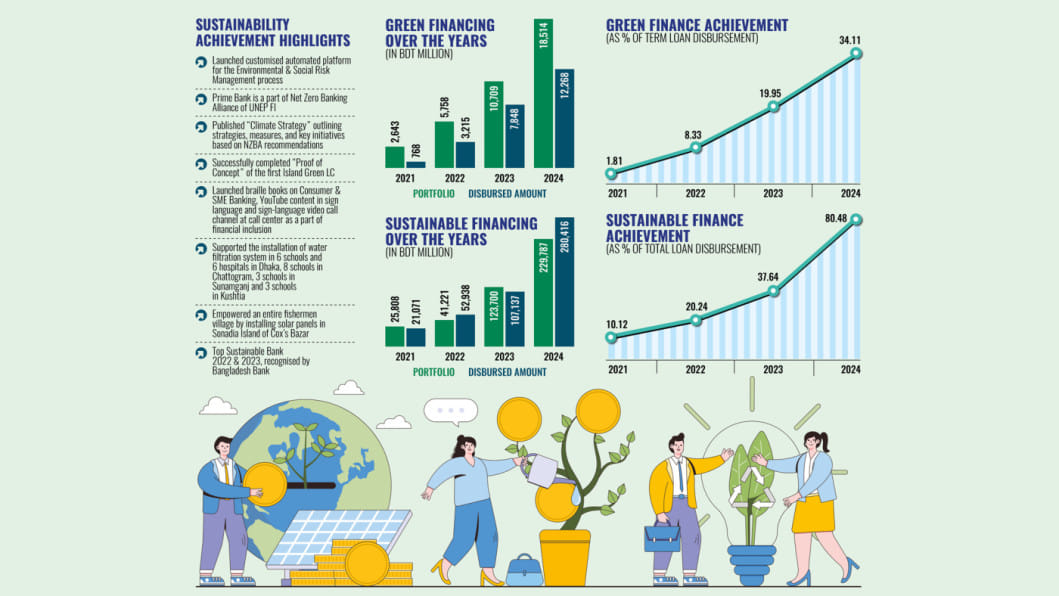

Prime Bank is honoured to be a member of the Net-Zero Banking Alliance, and we successfully released our inaugural Climate Strategy document at the end of 2024. Prime Bank is at the forefront of an economic transition aimed at providing value to investors, clients, and customers. Committing to achieving net-zero emissions is a fundamental aspect of our corporate strategy and signifies our commitment to environmental stewardship.

Prime Bank aspires to lead in sustainability, showcasing that responsible banking practices can coexist with financial success. Together, we can create a greener, more inclusive economy for generations to come.

TDS: As a corporate leader, what message would you like to share on World Environment Day about the responsibility of financial institutions in building a greener, more resilient future?

MZR: We need to possess the bravery to venture into new paths and adopt an economic model that is not only low in carbon emissions and environmentally sustainable but also transforms poverty, inequality, and the absence of financial access into new market opportunities for intelligent, forward-thinking, profit-driven enterprises.

Taking decisive action today can instigate systemic change within the financial sector and help foster a more sustainable future. Our stakeholders can have confidence that our commitment is supported by tangible actions, quantifiable results, and a progressive vision for climate resilience.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments