April exports lowest in 10 months

Bangladesh recorded the lowest level of exports so far this fiscal year, both in terms of value and growth, in April as the production of apparel, the main export item, suffered in many areas amid an energy crisis.

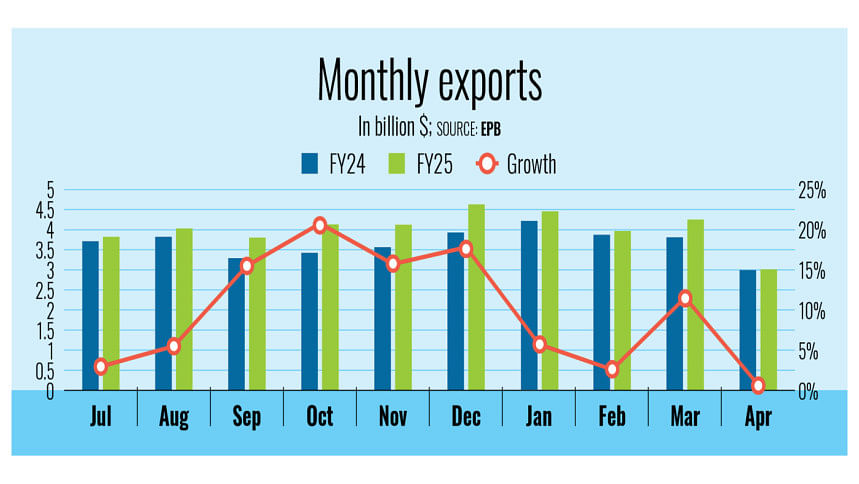

Last month, exporters fetched $3.01 billion, registering only 0.86 percent year-on-year growth, data released by the Export Promotion Bureau (EPB) yesterday showed.

Apparel, which generates more than three-fourths of the country's export earnings, recorded 0.44 percent year-on-year growth in April. Although knitwear exports — the biggest earner — increased, woven garment shipments fell.

"The gas crisis has affected production and lead times. There was also unrest in some places last month," said Shams Mahmud, managing director of Shasha Denims, a leading exporter.

Over the past two weeks, production at many textile mills has slumped to just 30 to 40 percent of capacity as gas pressure plummeted across key industrial zones surrounding Dhaka.

Mahmud said the diversion of gas to power generation facilities affected supply.

"We are taking fewer orders because of this," he said. "The future of exports depends on ensuring gas supply with adequate pressure. Unless that is ensured, there will be no export growth."

He added that the effect of the tariffs imposed by the Trump administration on Bangladesh's exports will depend on how the government negotiates with the US.

In early April, the Trump administration announced a 37 percent reciprocal tariff for Bangladesh on top of the existing 16 percent duties, creating concern among exporters.

However, there is scope to bring the rates down through negotiation with the US during a 90-day pause before the tariffs go into effect. Currently, all products entering the US market face a 10 percent baseline tariff.

Mahmud added that the buyers' reactions to the new tariff were mixed. Some cancelled orders while others reduced orders. However, some US buyers placed extra orders to take advantage of the 90-day pause.

Bangladesh is the third-largest garment exporter to the US for its $90 billion apparel market. The country shipped $7.34 billion worth of garment products to the US in 2024, marking 35.95 percent year-on-year growth.

BGMEA Administrator Md Anwar Hossain said there was trade uncertainty in April. "This could be a contributing factor," he said, adding that the gas crisis in the past two weeks was another factor.

"Hopefully, the gas problem will be resolved soon. Shipments will pick up in May," he said.

Despite April's sluggish growth, overall shipments grew 9.83 percent year-on-year to $40.20 billion during the July–April period of this fiscal year thanks to higher apparel exports.

The RMG sector maintained its leading position, contributing $32.64 billion and registering a 10 percent year-on-year increase, the EPB said.

"This is good," added Hossain, also vice-chairman of the EPB.

Exports of primary commodities, namely frozen fish and agricultural products, declined in April, but other major sectors such as leather and leather goods as well as jute and jute goods recorded growth, EPB data showed.

Dilip Kajuri, chief financial officer at Apex Footwear Ltd, said the export volume of leather footwear increased, but exporters are unhappy as they are not making profits.

"Although the shipment figures look better than last year, exporters are being forced to sell at production costs. Buyers have not increased prices although production costs have gone up over the past two years due to the appreciation of the US dollar," he said.

Kajuri added that the European market remains sluggish, preventing buyers from offering profitable rates.

"Still, we need to keep the business running. If we don't export, revenue won't come in and the business won't survive."

He also said that Japanese buyers had stopped placing orders in the last quarter. "Japanese brands usually wait until their existing stock is sold out before making new purchase orders," he said.

However, he said exporters are keeping their factories running in hopes of a better future.

Ashikur Rahman, principal economist at the Policy Research Institute of Bangladesh, said the balance of payments outlook has improved owing to decent growth in exports and remittances.

The trade deficit and current account deficit continue to narrow, while the financial account further supported external sector stability with a surplus of $1.42 billion. The overall external balance shortfall also narrowed to $1.11 billion, down by 75 percent from a $4.44 billion deficit in the previous year.

As of April 24, gross forex reserves recovered to $21.4 billion, sufficient to cover more than four months of imports.

"Most importantly, export and remittance performance have indeed been the lifeline for the Bangladeshi economy while it undergoes a fragile recovery," Rahman said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments