Robi sees record profit surge in 2024

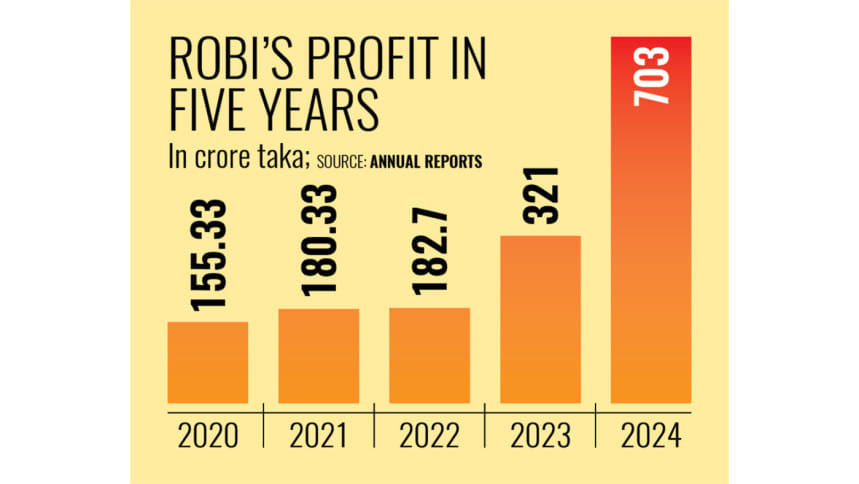

Robi Axiata Ltd posted a record profit of Tk 703 crore in 2024, marking the fifth consecutive year of growth in earnings by the second-largest mobile phone operator in Bangladesh.

Robi recorded a 119 percent year-on-year spike in profit, despite reporting a significant decline in revenue growth.

Banking on the profit, the mobile phone operator, majority-owned by Malaysia-based Asian telecom giant Axiata Group Berhad, announced a cash dividend of 15 percent (Tk 1.50 per share), amounting to Tk 785 crore.

Robi will cover the remaining amount from its cash reserves, said its officials.

The operator logged Tk 155 crore in profit in the financial year 2020, marking 4.5 times growth in five years to 2024.

According to the company, this was achieved through improved operational efficiency during a year that was marked by economic instability, high inflation, and a prolonged mobile internet shutdown during the mass uprising against the Awami League government in July.

Robi closed the year with a revenue of Tk 9,950 crore, reflecting a modest 0.1 percent year-on-year increase. Its revenue had grown 15.79 percent in 2023.

In 2024, voice revenue grew 0.7 percent while data revenue increased 2.2 percent year-on-year.

Quarterly performance comparisons showed mixed results. On a year-on-year basis, voice revenue grew 1.7 percent in the fourth quarter of FY24 while data revenue saw a sharp decline of 13.9 percent, largely due to intense market pressure to reduce data prices and the knock-on effects of high inflation, the company said in a statement.

The rise in SIM tax from Tk 200 to Tk 300 in 2024 posed additional challenges for subscriber acquisition, further compounded by aggressive market strategies from competitors.

As a result, Robi's subscriber base declined by approximately two million, ending the year with 56.7 million active subscribers.

Internet subscribers fell by 2.1 million to 42.6 million, although the company added more than 500,000 new 4G users in 2024, meaning 4G users accounted for 63.9 percent of active subscribers.

Robi maintained over 18,000 4G sites, ensuring 4G network coverage for 98.96 percent of the population.

Robi's capital expenditure reached Tk 1,638.4 crore in 2024, including Tk 446.1 crore in the fourth quarter. The company contributed a total of Tk 6,287.3 crore to the government exchequer for the year, representing 63.2 percent of its annual revenue. In the fourth quarter alone, 70 percent of its revenue was paid to the government.

The company made Tk 299.9 crore in the fourth quarter of 2024.

Its annual earnings per share (EPS) for the year stood at Tk 1.34.

Commenting on the company's performance, acting CEO M Riyaaz Rasheed stated: "Our primary focus remains on delivering long-term value to our shareholders and ensuring sustainable growth. While we continue to navigate a dynamic market, our commitment to operational efficiency and investment in digital infrastructure positions us well for the future. It is essential that regulatory and taxation policies support a balanced and competitive telecom sector to allow operators like Robi to thrive."

Rasheed also welcomed recent regulatory reforms aimed at streamlining the telecom sector, emphasising the need for swift implementation to maximise benefits for consumers, but expressed concern over the increased supplementary duty from 15 percent to 20 percent and the higher SIM tax, noting that these measures could hinder Bangladesh's progress in digital adoption and the qualitative use of digital services.

Shahed Alam, chief corporate and regulatory officer at Robi, said: "The year 2024 has been a significant one for Robi, achieving substantial year-over-year profit growth despite a challenging macroeconomic environment.

"This financial performance reflects the implementation of a prudent business model, driving structural efficiencies across functional and non-functional costs and delivering an EBITDA (earnings before interest, taxes, depreciation and amortization) margin exceeding 50 percent.

"These systematic and disciplined strategies position Robi for continued growth and improved performance in the coming year, supported by commercial excellence and enhanced scale advantages," he concluded.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments