Price hike fuels credit growth

Commercial banks said yesterday the price hike of consumer items had driven up the credit growth.

The comment came against the backdrop of the central bank's worry about high growth in credit to "unproductive sectors".

The commodities that were selling at Tk 100 earlier cost Tk 200 now, bankers said, adding that the price hike had led consumers to take more loans from banks than before.

“The growth rate on the percentage basis shows high growth in credit to unproductive sectors, but the credit volume doesn't reflect that the credit growth is so high,” K Mahmood Sattar, president of Association of Bankers Bangladesh (ABB), told reporters after a meeting with Bangladesh Bank (BB).

The central bank yesterday sat with different commercial banks to review the situation of local banks in view of the financial debacle in the Western economies, largely caused by huge credit flows into housing and consumers spending.

According to a BB review of internal credit situation during June 2007-June 2008, the private sector witnessed robust growth in non-productive sectors such as credit card, consumer products, apartment buying and land purchase, which the central bank considers 'risky'.

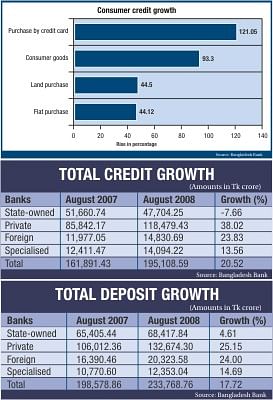

The break-up of the percentages of credit growth on non-productive fronts is: Credit cards-121 percent, consumer products-93.30 percent, land purchase-44.50 and flat procurement-44.12 percent.

According to BB statistics, in the specific period of last one year the average bank credit growth rate was 19.52 percent.

Private commercial banks experienced the highest credit growth of 38.03 percent, while foreign banks witnessed 23.83 percent growth, specialised banks 15.31 percent and state-owned banks 7.63 percent.

Mahmood Sattar, also the managing director of City Bank, said: “We will respond to the BB's request on reducing high credit growth.”

Officials at the meeting however said some of the bankers argued with the central bank saying that all sectors are productive, as the sectors help develop the standards of life.

As there is demand for such loans from middle-class, these sectors are not unproductive, said the bankers.

In response, the central bank told the bankers that it does not discourage banks to give loans. If the credit growth is too high, it raises doubt over the loan quality, the BB governor told the bankers.

Meanwhile, Muhammad A Rumee Ali, BRAC Bank chairman, told The Daily Star that the total consumer credit recipient in the country is not more than five percent, which contributes a little to the rise in inflation.

The high inflation rate is not a result of credit growth at non-productive sectors, but it is a price-pushed inflation.

“Although excess credit growth is not good in any particular sector, Bangladesh Bank should identify why banks go to non-productive sectors,” he said.

Industrial credit has some limits in interest rates, which discourage private banks to go to other sectors, he observed.

Defending the real estate sector, Rumee Ali said he does not believe the real estate is unproductive. “It's a booming sector where a huge number of people work and a lot of income generating activities are going on."

Ali, also a former deputy governor of Bangladesh Bank, said BRAC Bank maintains good balance in distributing credit among SMEs, industrial and rural sectors.

K Mahmood Sattar, the ABB president, said at the meeting with the BB the private sector credit growth would increase in the coming days amid demand from the private sector.

On banking services, Sattar said the banks could reach international standards. “We are always trying to improve our services and the efforts will continue,” he added.

At the meeting, the central bank asked the commercial banks to remain careful about the credit-deposit ratio.

The BB cannot ask banks not to give loans to unproductive sectors, said BB Governor Salehuddin Ahmed. “I've asked the banks to be cautious and give loans after proper scrutiny so no bad loan is created,” he said. "The recent global financial turmoil is blamed on bad loans."

The BB governor also instructed the bankers to lend to such productive sectors as agriculture and small and medium enterprises. Credit to the farm sector will draw production, create employments, contribute to GDP growth and help tame inflation, he explained.

“The banks will have to be cautious about those credits that will not create goods and services,” he suggested.

“Increase in credit to the productive sectors will help banks reduce their surplus liquidity,” Salehuddin said. The response came when he was asked whether the banks would accumulate excess liquidity further due to a possibility of slowing down investments as the fallout of global financial crisis, news agency UNB adds.

“I've congratulated the bankers for safeguarding the local banking sector from the possible shock stemming from the global financial crisis," Salehuddin said.

The bankers also appreciated the central bank for its strong role regarding the global crisis, admitting that the BB's control over the commercial banks is necessary, said the officials who attended the meeting.

Bangladeshi banks are well managed under the control of the central bank and the banks will not face any crisis due to the ongoing global financial turmoil, the bankers said at the meeting.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments