Asian banks less exposed to Lehman chaos

Asian banks could be spared the worst of the global financial meltdown thanks to conservative lending that has avoided the worst mistakes of risky subprime US mortgage loans, analysts say.

Banks in Asia were scrambling to shore up investor confidence Tuesday as share prices tumbled sharply following the collapse of US investment bank Lehman Brothers, which sparked steep losses on markets worldwide.

But analysts say that, psychological shocks aside, the actual impact of Lehman's failure on Asian banks should be limited, even in Japan -- where two financial institutions were Lehman's top unsecured creditors.

"Japanese banks' exposure this time was very small because they have been cautious and taking little risks," said Masamichi Adachi, Tokyo-based senior economist at JP Morgan Securities.

"They are spared the worst, direct shock from the Lehman incident. But now everybody will become cautious, and every country is connected to the US financial system," Adachi said.

Lehman said in its bankruptcy filing that its top lenders are Aozora Bank, with loans worth 463 million dollars, and Mizuho Corporate Bank, a unit of Mizuho Financial Group, at 289 million dollars.

Shares in Aozora plunged 15.76 percent even though the bank said that, due to protective measures it had taken, its real exposure was estimated at less than 25 million dollars.

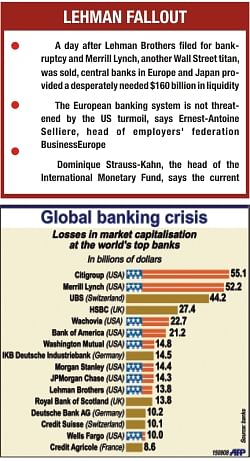

Lehman Brothers and other US institutions have been hit hard by the subprime mess, which saw easy loans for underqualified home-buyers evolve into a spate of foreclosures and a massive credit crunch.

Japanese banks have avoided aggressive risk-taking, particularly after feeling the pain earlier this decade for clearing massive bad loans accumulated in the "bubble economy" through the early 1990s.

"We went through the bubble era and we all know what happened," said Mitsumaru Kumagai, senior economist at Daiwa Research Institute.

"For the time being, the Japanese financial sector is not likely to be dragged into a full-out financial crisis," Kumagai said. "But concerns are there for the real Japanese economy."

In South Korea, the Financial Services Commission said the country's banks have invested about 720 million dollars in Lehman.

"South Korean financial institutions' exposure to Lehman will have a limited effect on their financial soundness," the commission said in a statement.

The Bank of China said it was closely watching its unsecured debt with Lehman. But the bank's New York branch is only owed around 50 million dollars by the failed Wall Street titan.

"We will closely watch the development. It's a big matter," said Wang Zhaowen, a spokesman for the Bank of China.

Macquarie, Australia's largest investment bank, said its exposure to Lehman was negligble. The Commonwealth Bank of Australia said its exposure was less than 150 million dollars (118.5 million US).

But the sheer scale of Lehman's failure could still leave marks in the regional economy, especially nations that rely on exports for US consumers, analysts said.

"There is no doubt that we are going to see significant financial uncertainty of global scale," Kumagai said.

In Hong Kong, Zachariah Au, a dealer at Prudential Brokerage, said there were concerns for the health of local financial institutions.

"The chance of other major banks and US firms falling apart is high," Au said.

"The situation is bound to seriously affect Hong Kong and the mainland market since the US is our largest investor. I'm now advising my customers to just hold what they've got and not to buy any more.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments