BB profit up 50pc

Increased value of gold and income from foreign and domestic sources have helped Bangladesh Bank (BB) to post about 50 percent more net profit in the immediate past fiscal year compared to the previous year.

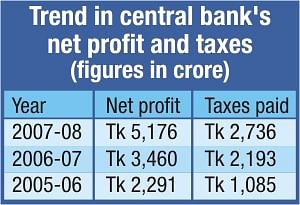

The central bank's earnings reached Tk 5,176 crore in the 2007-08 fiscal year (FY), a 49.57 percent rise from Tk 3,460 crore in FY 2006-07.

Of the amount, Tk 2,736 crore is payable to the national exchequer for FY 2007-08, according to central bank officials. BB had contributed Tk 2,193 crore to the government in FY 2006-07 and Tk 1,085 crore in 2005-06.

Income from gold and silver was 832 percent more in FY 2007-08 than in the previous year.

Gold and silver accounted for Tk 223 crore in FY 2007-08 from only Tk 24 crore in FY 2006-07.

“Revaluation gain increased due to the fluctuation of conversion rates of the taka against major currencies and increased gold value in the international market,” a senior BB official said.

Gold price has been rising constantly since July 2001 due to the changing balance between supply and demand.

The price of per ounce gold reached $1,000 in February-March of 2008 from below $300 in 2001.

Income from foreign currency revaluation witnessed 100 percent and 38 percent growth respectively. Total profit from currency revaluation stood at about Tk 1,800 crore.

Bangladesh maintained a handsome foreign exchange reserve last fiscal and the figure crossed $6 billion mark for the first time in Bangladesh's history in February 2008.

Earnings from foreign sources reached Tk 1,781 crore or 39.72 percent more than Tk 1,250 crore in FY 2006-07, which the central bank attributed to higher volume of investment.

Income from domestic sources was relatively lower only 2.55 percent more than the previous fiscal year. BB earned Tk 2,368 crore in FY 2007-08, which was Tk 2,309 crore in FY 2006-07.

An increase in the interest from REPO has pushed up the income from domestic sources.

While revaluation of foreign currency and gold and silver prices have raised BB's income, relatively poor expenditure also contributed to the profit.

BB spent Tk 996 crore or 21.11 percent lower in FY 2007-08 than Tk 1,263 crore in FY 2006-07.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments