Graft goes institutional amid lax NBR watch

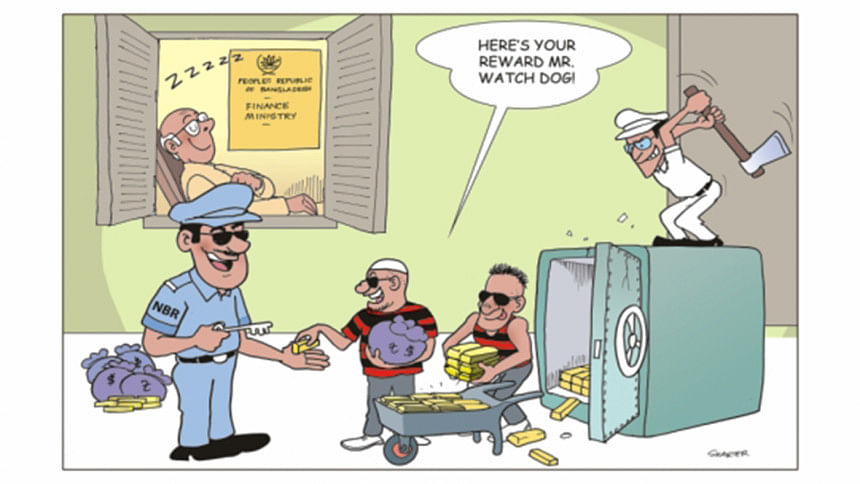

Rampant corruption in the control of imports became institutionalised as the bodies charged with monitoring trade, the National Board of Revenue (NBR) and customs, became partners in the crime, an investigation by The Daily Star can reveal.

Either through direct involvement or by turning a blind eye to the illegal actions of their colleagues, taxmen and customs officials joined the circle of some businessmen, politicians, and employees of pre-shipment inspection (PSI) firms who manipulated the system at will to enrich themselves at the country's cost.

And despite the recent clampdown on corruption the country is still missing out on over Tk 1,000 crore in revenue a year as the PSI companies continue to allow phoney declarations, under or over invoicing, false inspection and certification of consignments, say business observers and revenue experts.

The banks also have their share in the crime, as they do not effectively deliver their responsibilities entrusted by the central bank to help contain price-manipulation on commodities at the initial level.

"The L/C (letter of credit) opening banks can easily do the market price checking on commodities in consultation with the overseas banks of the suppliers," former NBR chief and Tax Ombudsman Khairuzzaman Chowdhury told The Daily Star.

Keep reading-

Had the L/C opening banks strictly followed the Bangladesh Bank's guidelines for foreign exchange transactions properly, the practices of under-invoicing to dodge customs duty and over-invoicing to do money laundering would have gone down dramatically, he said.

Related officials of all banks should check pricing on commodities including the credit rating of overseas suppliers, but the abundance of irregularities only shows banks are not strictly following the guidelines of the central bank, he observed.

Chairman of Krishi Bank Khondkar Ibrahim Khaled, also a former deputy governor of the Bangladesh Bank, thinks banks are supposed not to be a partner in money laundering. But he said, "Banks are responsible to compare commodity prices on L/C with those in the market. If there is significant difference between declared prices and market prices, then responsibilities lie with banks concerned."

But the ultimate responsibility to turn all these resources into strength against irregularities boils down to NBR, which is also blamed for not ensuring strict PSI rules for qualification of companies. Thanks to political interference and syndicated lobbying, some crucial provisions in the PSI rules were allegedly relaxed or made tough on several occasions in an effort to influence qualification of some companies with poor records.

The Internal Resources Division is responsible for the PSI rules, secretary of which is also chairman of NBR. However, some NBR top shots stopped short of accepting their failure in having effective measures to combat the corruption flourished around imports. They watched how devils in NBR and customs join hands with the corruption network to plunder the economy by manoeuvring the PSI system, which was introduced in 2000 against a backdrop of widespread corruption by a strong band of customs staff.

"Corruption has assumed an institutional shape in the Chittagong Port Authority and the Customs.... The rule of law and accountability have been almost non-existent here," laments a recent follow-up study by Transparency International Bangladesh on Chittagong port, through which 80 percent of the country's import-export takes place.

Instances of open bribery and PSI irregularities have declined to some extent and the speed at which containers are handled has increased sharply following the taskforce clampdown last year on Chittagong port.

However business people still claim bribes have to be paid in at least 30 spots for releasing a consignment from the customs and the port.

"Transaction of bribery are still continuing through agents outside the port and customs offices," states the TIB report, adding that "The credibility and performance of the PSI organisation have been put in question due to detection of large numbers of false declarations from among the on-the-spot checks carried out on only 5-6 percent of items."

The customs wing of NBR randomly checks only 10 percent of the PSI-inspected consignments. This is done manually and without any help from modern equipment, let alone sophisticated scanners being used at a majority of ports in the world.

"You can easily guess what a corruption network can do manipulating just a portion of the remaining 90 percent unchecked consignments, bribing people in right places," said a taskforce member involved with a mission to get the Ctg port back on track.

The age-old corruption in the sector is deep-rooted and enjoys the blessings of influential people in government and politics, a reality that discourages even the most honest and efficient NBR officials from acting against the syndicate or their corrupt colleagues.

Despite years of abuse, the most of punishments handed out so far to a corrupt NBR staff are transfers or suspensions. The blatant display of grafts put NBR and customs in a very embarrassing situation, with a few corrupt officials dominating the PSI matters under different regional banners like Barisal, Comilla, North Bengal and Sylhet groups.

Tasked with managing crucial taxmen, some PSI officials used their home district connections to engineer groupings in NBR. Some PSI companies know well how to play this game in Bangladesh.

On a certain day of every month, the corrupt officials in NBR and customs used to receive envelopes from employees of some PSI companies filled with takas usually amounting to between 50,000 and one lakh, confided PSI bigwigs, wishing not to be named. The envelopes ensured the smooth passage of wrongly declared or invoiced imports.

Retired NBR bigwigs are as valuable as ones still in service, and some PSI companies waste no time hiring them as high-salaried consultants to hold clouts in government machinery.

The Anti-Corruption Commission placed former NBR top-shot ATM Sarwar Hossain, himself in the thick of PSI things for being the all- powerful member of customs, on its list of high profile graft suspects last year.

Now on the run, Sarwar was jailed for 8 years in tax evasion case on September 20 last year and for 13 years over illegal wealth on May 15 this year by special anti-graft courts.

While directly not denying grafts by his staff, NBR Chairman Muhammad Abdul Mazid told The Daily Star, "We're taking disciplinary actions almost every day. NBR will not tolerate any irregularities, not anymore."

Business observers and anti-corruption campaigners meanwhile feel the government must recruit efficient manpower sufficiently, address weaknesses in screening system and make sure a transparent PSI arrangement is established to rein back the train of corruption.

"Customs people at appraiser level work manually without computers or internet facilities. How can they crosscheck valuation of different imported goods on the net and cope with the demanding job of policing?" said a top customs official, who is critical of the slow-paced automation process in NBR.

Renowned economist and staunch campaigner against corruption Professor Muzaffer Ahmad said the guardian of country's revenue is equipped with poor logistics to combat corruption. "The area of customs intelligence has to be really strong", he said, adding that, "If there is intelligence work, they will have the pre-history of exporter and importer. It will help them do the gate-keeping well."

Despite all these constraints, there have been occasions when NBR has attempted to punish offenders, but such moves have as often as not been always shot down by litigation. The number of writ petitions in the High Court and appeal cases in the Appellate Division has spiralled due to the detection of false declarations arising from non-transparent and weak PSI arrangements.

Importers file cases with or without valid grounds when the customs raises any objection against the release of any consignment.

"Most of the cases are lodged by debating the certified prices fixed by the pre-shipment company," stated TIB research, adding that, the number of such cases climbed to 10,033 till February last year, blocking revenues of nearly Tk 1,233 crore.

The PSI companies could afford to be non-transparent in their activities due to the lack of a PSI audit. Two attempts to set up such a body failed because of litigation and poor response to tenders. As a result, the PSI companies could avoid monthly screening by an audit organisation.

NBR however has taken a fresh initiative for a third try at PSI audit.

Tax Ombudsman Khairuzzaman Chowdhury, meanwhile, said NBR is just not equipped technologically and financially to fight corruption of this level. Computerisation of NBR apart, he suggests a major strengthening of the valuation department, which is responsible for crosschecking under and over invoicing.

"The valuation department should be given enough authority and funds to carry out intelligence works on commodity prices across the world," said Khairuzzaman. "If that can be done, then price manipulation will go down remarkably." NBR Chairman Abdul Mazid said the NBR is in the process of strengthening the valuation department.

"We've subscribed to an online wire service package on commodity prices. Automation of the department is also going on smoothly. So, we will be in a better position to man irregularities." But many observers and business leaders refuse to subscribe to the idea that corruption in imports will be laid to rest if PSI system manipulation is checked. Rather, they feel the structured corruption in customs has to be broken down first in order to contain grafts by PSI companies and importers.

Prof Muzaffer put the onus on the leadership to uproot graft in the institution. "Corruption can filter through every system. But leadership has to act to ensure a system full proof. There should be effective practice of reward and punishment." On the idea of higher salary keeping taxmen out of graft, he observed attractive wage is not a solution to contain corruption in customs. "The authorities can review the performance incentive for customs people and consider hiking it to a realistic level."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments