Build it in Bangladesh

“The pessimist sees the difficulty in every opportunity. The optimist sees the opportunity in every difficulty” Winston Churchill.

If Winston had the opportunity to visit Bangladesh I believe he would be convinced that this is the land of optimists, in particular the country's entrepreneurs and business people.

And there are reasons for optimism. Last year Bangladesh suffered multiple natural disasters and political upheavals. It also saw the move towards recession in the USA, one of our most important export markets. Yet Bangladesh's exports to the USA grew by almost 5 per cent in 2007, according the US Department of Commerce. US exports to Bangladesh also grew.

So how does one reconcile this growth with the weakening of one of Bangladesh's main export markets? I think the key to this lies in what has been going on in China, and in the need for companies around the globe to spread their sourcing risks.

At present China is the undisputed “factory of the world”. Its planners have generated growth of nearly 10 percent a year over the past 15 years. In the process it has developed economies of scale in businesses such as textiles, apparels, toys, white goods and footwear, decimating production in many other parts of the world. From steel plants in the US, to foie gras in France; from automobiles in Germany to leather production in Italy, the Chinese manufacturing juggernaut has irreversibly changed the global manufacturing landscape.

Today, for example, 2 out of every 3 pairs of footwear exported in the world are made in China; 80 percent of toys sold in America come from China.

However it is exactly this kind of dominance that may be China's undoing, as its own leaders and people start to count the costs of this growth spiral. Moreover some of China's buyers are starting to have their own reservations about being so dependent on a single source.

This latter idea is often referred to as the “China + 2” sourcing strategy. Having realized their overwhelming dependence on China, many major buyers of merchandise are starting to diversify their sourcing. Quite simply, they are trying not to put all their eggs in the Chinese basket. Although there is often a political or social angle to this new trend, the primary driver is economic rationale: a need to reduce risk. China will continue to be the primary source, at least for the medium term, but there is definitely room for other players to gain market share.

India is the most popular first option for most buyers. China's share of world manufacturing exports is 8 percent whilst India's share is less than one. But even with this huge mismatch “Made in India” is now rising to the challenge. According to the European consultancy group Cap Gemini outsourcing of manufacturing to India is now a higher priority among major corporations than outsourcing back office work. Manufacturing wages in China average USD 250-350 per month whereas in India starting wages are still as low as USD 60 per month.

Having conceded the bride's slot to our neighbours, it is my personal belief that Bangladesh can be a very eligible bridesmaid. In the global sourcing sweepstakes, bridesmaid honours would be acceptable, for the moment at least.

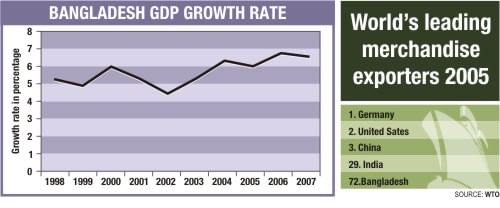

If Bangladesh is to achieve its desired minimum economic growth rate of 10 per cent per annum to raise our population out of poverty we need industrial growth to create jobs. Our Ready Made Garment(RMG) Industry has shown we can play in what is still the biggest and possibly most competitive market: the US.

But while the success of the RMG sector in Bangladesh is well known, what is exciting today is the interest from the US in the NON RMG sector during the past few months. Major US brands have visited Bangladesh to explore footwear sourcing, the big 3 US automakers are exploring sourcing automotive components and major investment banks and equity funds are showing an interest in Bangladesh. The interest is not limited to the US. Look at the Danish and Dutch groups placing orders for new ships. We are no longer just ship breakers, but also ship makers!

Bangladeshi business needs to capitalize on this interest, and ensure that US businesses in particular see beyond the “cheap” labour story. We need to capture the moment and we need a few early wins. RMG has shown it can be done; it is now up to the rest of Bangladeshi business to prove that we have what it takes. To do so, we must learn to push productivity not just production, acquire knowledge not just assets, and strive for efficiency not just survival.

Another English PM, Benjamin Disraeli, said: “ the secret of success is to be ready when opportunity comes”. The opportunity is here now for the eternally optimistic Bangladeshi business person to convince US businesses they can Build it in Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments