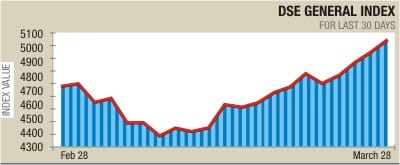

Dhaka index soars above 5,000 points

The benchmark index of Dhaka Stock Exchange yesterday broke through the psychological barrier of 5,000 points showing signs of stability in the market. The index rose for the fourth straight session.

The General Index reached 5,038 points, the gauge's highest level since January 18, after gaining 2.02 percent or 99.79 points at the end of the day's trading.

Optimism returned to the market which had experienced high volatility through the preceding year following a price debacle in January-February of 2011, operators said.

In February, DGEN touched 3,600 points, the lowest in more than two years.

After that, the market began to rebound slowly. The market gained its momentum in the last two weeks, when the DGEN declined in one session.

“As investor confidence got another boost, fresh funds seem to be entering the market, reinforcing the rising trend of the turnover over the past few days,” IDLC Investments Limited said in its regular market analysis.

“The DSE continued its upward movement as the retail investors were feeling optimistic about the market,” Green Delta LR Holdings said in its daily market commentary.

“The daily turnover was further upped due to heavy trades of Grameenphone, Titas Gas and Beximco.”

Turnover gained 9.2 percent yesterday, compared to the previous day. A total of 1.87 lakh trades were executed, generating a turnover of Tk 821 crore -- the highest in the last four months -- with 16.09 crore shares and mutual fund units changing hands on the DSE.

Prices of 212 issues gained, 42 declined and 11 remained unchanged.

Grameenphone topped the turnover leader with 20.26 lakh shares worth Tk 39.51 crore changing hands.

BANGAS was the biggest gainer of the day as it posted a 9.96 percent rise. The Fifth Investment Corporation of Bangladesh Mutual Fund slumped 6.89 percent only to be the worst loser.

The telecoms sector gained 4.94 percent, followed by power 3.95 percent, non-bank financial institutions 3.03 percent, pharmaceuticals 2.85 percent, while banks were marginally up 0.26 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments