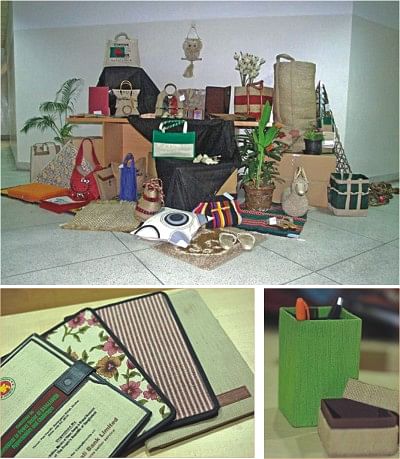

Jute items in everyday life

Folders made out of jute are colourful, attractive and handy. Pharmaceuticals and financial institutions generally buy jute products to give as gifts at seminars and annual general meetings. Photo: Traidcraft

Jute diversified products (JDP) of Bangladesh have immense potential for growth in the domestic market because more and more leading business organisations are adopting a 'go green policy' as their corporate mottos, said a recent study.

The domestic market can grow by another 300 percent from an existing Tk 20 crore to Tk 60 crore a year in the next couple of years due to the strong growth in the boutiques and retail industry and increasing corporate interest on environmental friendly products, said the study.

Innovision Consulting Private Ltd, a leading local research organisation, carried a study on jute diversified products that was assigned by Katalyst, a market development project funded by Swisscontact and GTZ International Services, and Traidcraft, a British development organisation, for the capacity building and market expansion of small and medium enterprises (SMEs).

The research was conducted on 40 institutional buyers selected from several sectors, said Rubaiyath Sarwar, managing director of Innovision. These sectors included pharmaceuticals, financial institutions, non-government organisations, advertisement and event management firms, educational institutions, real estate companies, tour and travel service operators, hotels, ready-made garment makers, training and human resources development service providers, home furnishing retailers, superstores and fast moving consumer goods companies.

Sarwar, who led the research team, said, “Our assessment suggests that domestic market potential is good for grocery and shopping bags; gift items; seminar, convention and promotional bags; file folders; visiting cards and paper products.”

The market potential for grocery bags is high (worth about Tk 12 crore with a potential to expand to Tk 50 crore), shopping bags (Tk 6 crore), gift items (Tk 13 crore with potential to expand to Tk 27 crore), seminar, convention and promotional bags (Tk 2 crore), file folders, visiting cards and paper products (about Tk 55 crore), said the study.

Extrapolation suggests that export and domestic sales of JDPs accounted for Tk 102 crore in 2009 with export accounting for Tk 81 crore or 80 percent of total trade. The sector recorded average growth of 20.4 percent a year over the period 2007-2009.

With more than 60 percent market share, the jute bag is the top selling jute diversified product in the local and global markets. The range of jute bags includes shopping bags, summer/beach bags, fancy bags, merchandise bags, wine bags, purses, pouches, wallets and file covers. Other major products include rubs (12 percent market share), paper and pulp products (8 percent) and decoration and stationary items (6 percent).

Potential institutional buyers include pharmaceuticals, mobile phone and ICT companies, public institutions and NGOs, boutiques and consumer retailers, hospitality and tourism organisations, training and education service providers, advertising and event management, and financial institutions.

They generally buy the jute-diversified products for special occasions, promotional campaigns and internal consumption.

For example, pharmaceuticals and financial institutions generally buy JDPs to give as gifts at seminars and annual general meetings.

Mobile phone and ICT companies procure gift bags for special occasions, and prefer to buy jute paper to print invitations and greeting cards.

The boutiques and consumer retailers buy shopping bags, vanity bags, grocery bags and gift products for their customers, whereas the hospitality and tourism sector collects souvenirs, slippers and bags for foreign tourists.

The training and education service providers could use folders, photo covers, training bags made of jute to a great extent.

NGOs and development projects usually buy jute products for regular corporate consumption, like using jute paper to make visiting and invitation cards and seminar bags.

JDPs can be classified into three groups on the basis of what they are made of -- pulp, fibre, and yarn.

Pulp items include paper products like greeting cards, visiting cards, invitation cards, handicrafts, gift items, packaging boxes and bags. Fibre items include fashion accessories, gift items and utilities.

Yarn items include handloom and power-loom fabrics (used for home furnishings, floor coverings, fabrics for bags and apparels), knitted fabrics (for sweaters, warm clothes, upper garments and decorative bags), non woven cloth and handicrafts (for shopping bags, house decoration, tapestry and mats)

Even though the use of jute products is still at early stages, it is expected that a number of organisations would procure JDPs for special occasions and promotional campaigns.

The study said JDP manufacturers also face major difficulties in catering to buyer's needs in terms of consistency in size, shape, dyeing, printing and finishing; flexibility in design, size, shape, dyeing, printing and finishing; on-time delivery; wash and reuse of the items; and finally, competitive pricing.

They study suggests that a Business Facilitation Centre (BFC) should be created for the JDP makers to improve access to buyers. The BFC will be responsible primarily for market promotion and marketing. Currently, the JDP makers depend on national and international trade fairs for market promotion.

JDP manufacturers have to position their products in the minds of the customers as conveniently priced and good quality, handmade products by creating a unique symbol.

This symbol will appear on the price tags that are marketed through boutiques, retail chains and superstores. As a result, it will boost sales and in turn, attract more institutional buyers to purchase JDPs, said the study.

“A big disadvantage of jute-diversified products is that all the products look similar and quickly tend to lose their appeal,” said the Innovision study. “So, the JDP manufacturers have to focus on continuous product development, partnering with selected advertising and event management companies and institutional buyers.”

In international markets, the buyers act as an agent of change and a source of new designs and products.

In the domestic market, the source of change will be with the advertising and event management companies, brand and marketing departments of institutional buyers, and the designers for retailers.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments