Banks get new deadline to cut stock investment

Bangladesh Bank (BB) has set a fresh deadline for banks to bring down their investment in the capital market within the limit.

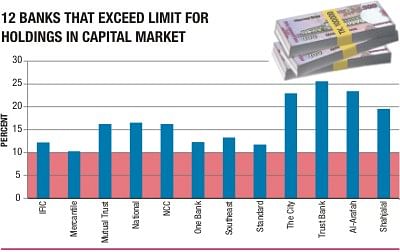

The shareholdings by 12 banks in the capital market till August 31 is above 10 percent, and the central bank has asked them to keep their holdings within 10 percent by November. The banks failed to meet the previous deadline in September.

Although the overall holdings of the banks are within the limit, the shareholdings of the 12 private banks range from 10.25 percent to 23.44 percent of their liabilities.

Till August 31, the banks' total holdings in the capital market were Tk 23,664 crore against their liabilities of Tk 3,77,487crore, which is 6.27 percent of the total liabilities.

A BB high official said the capital holdings of a bank cannot cross 10 percent of the bank's liabilities in line with the banking regulations.

However, there are some differences between the banks and the central bank about the concept of shareholdings, and the banks are now trying to convince the BB to relax the definition of shareholdings.

But the BB turned down their arguments and said the banks will have to bring down their shareholdings by November within the limit, or float subsidiary company to participate in the capital market.

In the last one and a half months, the central bank held one-to-one meeting with the banks that have more than 10 percent shareholdings.

The BB held such a meeting with National Credit and Commerce Bank Ltd (NCCBL) last week. The BB officials said the banks were apprised of the deadline at the meetings.

According to the BB explanation, capital holding means own portfolio of the share, share under lien, and share under custody.

The banks during the one-to-one meetings argued that the value of the shares at the time of purchasing the shareholdings was within the limit set by the central bank. But the percentage of their holdings crossed the limit as the present market value was taken into consideration.

The bankers also said the shares in their own portfolios were much lower than the limit, but as the customers' purchase of the shares through their BO (beneficiary owner's) accounts was considered, the shareholdings crossed the limit.

The risk of the banks in case of purchasing this category of shares is very low, the officials said.

However, the BB said it has fixed the ratio of the banks' investment in the capital market in line with the international best practices, and so it does not want any change to it.

A central bank official said the BB is thinking over a long-term economic benefit. It does not want to see that the banks crowd in the risky short-term investment. The banks' main business should be investment in the industry, trade and export sectors and it also has an impact on employment generation.

A high official of NCCBL said these banks' investment in the stockmarket cannot be brought down overnight. So the banks have requested the BB to extend the deadline.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments