Strengthening the legal protections of foreign investment

Promotion, protection, and dispute resolution are the three core structures of an international investment agreement (IIA). While investment facilitation, policy incentives, and infrastructure readiness dominate the headlines, it is essential to remember that legal certainty remains the bedrock of investors' confidence.

Foreign investors, particularly institutional or strategic ones, always look beyond short-term policy incentives. They want to know what would protect them if policies shift, or where they can go to seek remedies if disputes arise. These are not just hypothetical concerns. They are addressed by tangible legal frameworks— domestic investment laws and, more importantly, the IIAs e.g. bilateral investment treaties (BITs).

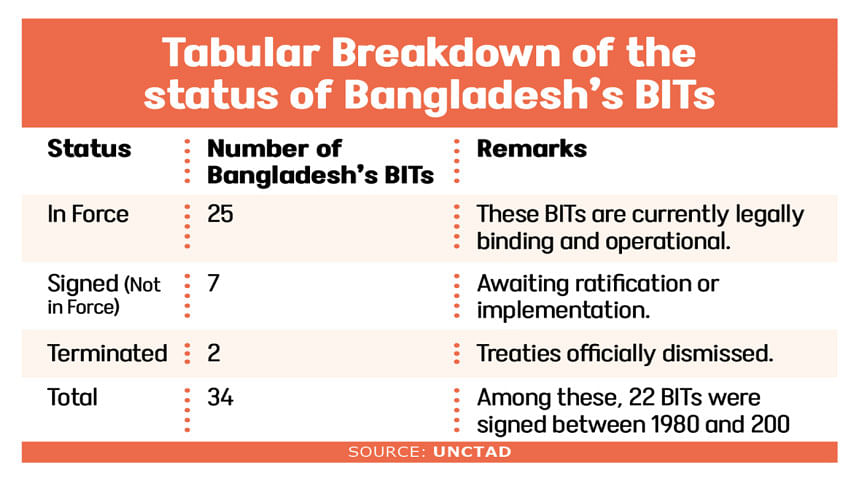

Bangladesh, so far, has signed 34 BITs with countries including the United States, the United Kingdom, Germany, China, and the Netherlands. Most of these treaties were signed during the 1980s and 1990s, reflecting Bangladesh's early integration into the global investment regime. These BITs typically promise investors protection against expropriation, guarantees of fair and equitable treatment, and access to Investor-State Dispute Settlement (ISDS) mechanisms such as ICSID or UNCITRAL arbitration.

However, many of these BITs have grown outdated. They lack clauses on sustainable development, responsible business conduct, and the host state's right to regulate in the public interest. Moreover, they do not appear to be publicly discussed or promoted as part of Bangladesh's overall investment narrative.

Additionally, Bangladesh's investment climate has already faced international legal scrutiny. A prime example is Saipem S.P.A. v The People's Republic of Bangladesh (ICSID Case No ARB/05/7), where the tribunal ruled that Bangladesh had indirectly expropriated the investor's rights through judicial interference. Although Bangladesh ultimately prevailed in other proceedings, the case set a precedent that judicial actions can trigger treaty-based liability.

Similarly, in the commercial arbitration involving Chevron Bangladesh Block Twelve Ltd and BAPEX, disputes emerged over gas-sharing agreements. While not a treaty-based dispute, it nevertheless signaled the complexities in contractual enforcement within the country. These experiences have shaped international perceptions of Bangladesh's legal reliability and dispute resolution landscape.

As Bangladesh positions itself on the global investment map, it must ensure that the legal foundations are just as strong and inviting as the economic incentives. After all, capital does not just chase incentives— it chases certainty. And certainty comes from the legal framework.

Furthermore, with ISDS mechanisms embedded in many BITs, foreign investors often prefer destinations where they know disputes can be resolved at neutral international forums rather than relying solely on domestic courts. As Bangladesh aspires to become a regional manufacturing and logistics hub, especially in light of its LDC graduation, it is imperative to reform and modernise its investment treaties and legal infrastructure. As noted above, many of the existing BITs signed decades ago are outdated and lack sustainable development considerations or balanced dispute resolution frameworks.

Countries such as India, South Africa, and Morocco have adopted new Model BITs or investment laws that better align with contemporary global standards. Bangladesh, too, should consider adopting a Model BIT in order to recalibrate and negotiate the BITs accordingly, and invest in legal capacity building within BIDA and relevant ministries. Careful evaluations of existing laws including the Foreign Private Investment (Promotion and Protection) Act 1980 are necessary in order to modernise and standardise the procedures.

Legal certainty is not just a post-investment concern. It is, in fact, a pre-investment requisite. However, the presentations and agenda materials of the recently held investment summit in Bangladesh appeared not to address the legal aspects sufficiently. To make our investment pitch truly robust in the investment forums, the authority can dedicate a showcase session on legal aspects for investments. Moreover, the relevant authority may initiate expert consultation on revising existing BITs to align with the best global practices, enhance transparency by publishing all IIAs and dispute outcomes, establish a legal helpdesk or unit within the authority to guide foreign investors on legal matters. Therefore, the legal experts, international negotiators, and foreign investors should be able to discuss not just the "how" of investing in Bangladesh, but also the "under what legal terms" as well.

As Bangladesh positions itself on the global investment map, it must ensure that the legal foundations are just as strong and inviting as the economic incentives. After all, capital does not just chase incentives— it chases certainty. And certainty comes from the legal framework.

The writer is Lawyer and Researcher in International Investment Law.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments