High priority project limping for 4 years

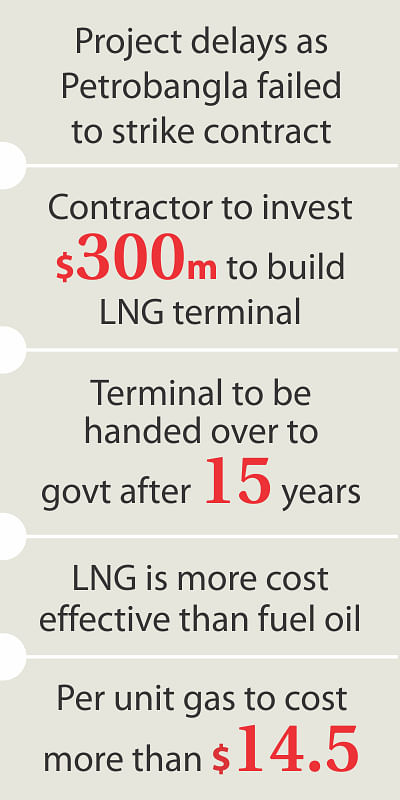

Due to flawed negotiations and a lack of model contract, the Petrobangla could not award the job of setting up a liquefied natural gas (LNG) terminal at Maheshkhali even in about four years.

If built, the terminal would be able meet the country's current gas shortfall of 500 mmcfd.

But the Petrobangla has been limping with this “fast track” top priority project and trying to strike a deal with an American consortium of Astra and Excelerate, which was found non-responsive in evaluation.

After the Awami League government took office in January, the Petrobangla aimed to sign an agreement with this consortium on the basis of unsolicited negotiations by March.

The consortium offered to build the LNG terminal for around $300 million and operate it for 15 years before transferring it to the government.

But during negotiations it was found the consortium offer did not say anything about who would provide various services for the ships that would import the LNG.

The Petrobangla did not prepare any model agreement, apparently leaving the job to the contractor.

“We have come to an understanding with Astra and Excelerate that they would prepare a term sheet and resume negotiations with us late this month. This term sheet would serve as the basis of the agreement,” said a competent Petrobangla source last week.

If the draft is prepared by Astra and Excelerate, it will presumably be biased. In that case, the Petrobangla would have to scrutinise it to make it a win-win situation. This would require time.

The American consortium had proposed a service charge of $46 cents per million cubic feet per day (mmcfd) gas for using the terminal it would build with its own fund. This price excludes the cost of handling of the LNG-importing ships.

Now that the government has asked it to include the cost of service for the ships -- which would be mandatory -- the cost might go up by at least $10 cents per mmcfd.

The LNG terminal would be able to handle import and supply of 500 mmcfd of equivalent liquid gas, a fifth of the country's gas consumption.

Globally, the LNG price is very high -- around $14 per mmcfd equivalent at the moment. Together with the terminal service charge, the price would stand at over $14.5. In contrast, the highest price of gas produced by oil companies is below $4.

“But this is still an attractive option. If you compare the cost of LNG-fired electricity with that of heavy fuel-fired electricity, the LNG-fired power would be cheaper and cleaner,” said the Petrobangla source.

“And if you mix the LNG with the local gas, it is even cheaper,” he added. “The price of not having gas when you have consumers is also very high.”

As per their proposal, Astra-Excelerate will get service charges, even if it sits idle, in case the government does not import LNG after the terminal is constructed.

“This is a standard business term in the power sector. They will invest $300 million and they need a guarantee,” the source said.

The government planned to build the terminal in 2010 and subsequently signed an agreement for importing LNG from Qatar.

Import and transport of LNG is a time-consuming and risky matter and the government could have thought of transferring this risk to the terminal builder, said another official.

Petrobangla's attempts to expedite the implementation of the project suffered heavily first due to poor negotiations over selecting a consultant and then Petrobangla's insistence on some qualified bidders to complete the job within 18 months. Bidders maintained that such a project needed two to two and a half years to complete.

In mid-2012, Petrobangla received bids from three technically qualified companies, including Astra-Excelerate. But all the three bids were disqualified by the project's consultant.

The two other companies were Samsung C&T Corporation and Hiranandani Electricity Private.

But instead of going for a re-tender, the Petrobangla picked Astra-Excelerate and began an unsolicited negotiation with it.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments