Interest burden 6pc heavier in next fiscal

The government's interest burden is set to get heavier in the incoming fiscal year, thanks to its inability to better choose from its financing options.

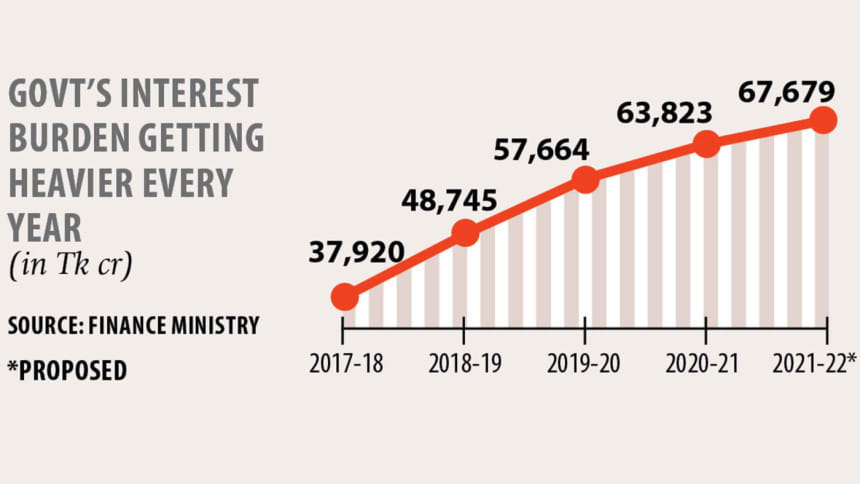

In the proposed budget for fiscal 2021-22, Tk 67,679 crore has been set aside for debt servicing purpose, up 6 percent year-on-year, according to finance ministry officials.

And as much as 92 percent of the sum would go towards paying interest on debt taken on from domestic sources: national savings certificates and local banks.

As of September last year, the total stock of domestic loans stood at Tk 540,935 crore -- and 58 percent of the sum is attributed to the high interest-bearing national savings certificates.

The government is offering about 11.3 percent interest on an average on the savings instruments, whereas most of the banks are collecting deposits at 4 percent interest at most.

Subsequently, sales of national savings certificates in the first nine months of the fiscal year overshot the full-year target by 66 percent.

The government had set a target of borrowing Tk 20,000 crore by way of savings certificates in fiscal 2020-21.

"When the banks are sitting on excess liquidity, why are we taking on debt through savings certificates? This is unnecessary," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

The government could have very well gotten the funds at 2-3 percent interest had it turned to the banks, which are sitting on excess liquidity of about Tk 198,400 crore as of March, up a whopping 120.7 percent from a year earlier.

What is more, the government was a loser in two ways for its excessive borrowing through savings certificates: a big amount that it mopped up was black money.

On one hand, the black money holders had evaded tax over the years, and on the other hand, they would be getting higher interest on the sum.

In the first nine months of the fiscal year, a record Tk 14,295 crore was legalised, and a major sum was by investing in savings certificates and fixed deposits.

"Given the state of the economy, we could have easily taken on more debt. And we could have done better on the loans we are taking and the interest we are paying," Hussain said, adding that the government's foreign aid use could have been better.

External debt indicators are below their thresholds and the public debt level is below the benchmark under the baseline and stress test scenarios, said a recent report of the International Monetary Fund.

As of September last year, the government's stock of outstanding foreign loans stands at $45.3 billion, according to the Economic Relations Division of the finance ministry.

The interest rate on funds from the WB is 1.25 percent, the Asian Development Bank 2 percent and from Japan International Cooperation Agency less than 1 percent.

Besides, as of April, about $50.2 billion of foreign aid is sitting idle in the pipeline, while the WB, the ADB and other development partners have expressed their intent to provide budget support to the Bangladesh economy to better manage the pandemic whirlwind.

More funds would flow into Bangladesh give the negative interest rates in the developed world but the Bangladesh government's low absorption capacity is getting in the way.

The government's foreign aid utilisation has improved and it is thanks to different steps taken in recent times, said Kazi Shafiqul Islam, a former ERD secretary.

Foreign aid utilisation in a year hovered around the $6 billion-mark but in fiscal 2019-20, it was about $7.3 billion -- which is the highest yet.

If the $735 million of cash support from the IMF for the pandemic is considered, the amount crosses the $8 billion-mark.

And Bangladesh's under par foreign aid utilisation is not always of its doing, according to Islam.

"Delays take place because of issues on both sides."

The donor side lays out conditions for projects, particularly for procurement, which can be time-consuming.

"Those conditions are sometimes necessary as there is less corruption."

On the Bangladesh side, there are efficiency issues amongst the ministries and divisions.

"Projects are revised many times," Islam added.

Regardless, the government needs to undertake reforms to address the weak fiscal capacity, which necessitates turning to expensive borrowing instruments, said Ashikur Rahman, senior economist at the Policy Research Institute, a think-tank.

"Our current tax to GDP ratio is extremely low and is around 8 percent, which contradicts what was planned in the 7th Five-Year Plan [2016-2020] and 8th Five-Year Plan [2021-2025]. This underscores the urgency with which finance ministry should prioritise critical fiscal reforms that should, over time, reduce our dependence on expensive borrowing instruments," he added.

At the granular level, the higher interest payments mean the government has less to spend on important areas such as infrastructure, health and education systems, and social protection, said Syed Akhtar Mahmood, a former economist of the WB.

"Increasing interest payments are a consequence of high and increasing public debt, which, in turn, is due to a mismatch between government expenditures and revenues. Thus, it is important that government makes a greater effort to boost its revenue earnings -- our tax/GDP ratio is rather low -- and ensure that its expenditures are efficient," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments