Biman Bangladesh: Gaining strength, yet losing market

Even with its aging fleet, Biman carried over 32 percent of all international passengers to and from Bangladesh in 2006-07. But now, despite having modern aircraft, its share has come down to about 27 percent.

According to aviation experts and Biman insiders, the national flag carrier is losing international passengers mostly due to mismanagement, flight delays, suspension on some routes and a lack of smart business strategies.

Biman’s grip on the market loosened also because of stiff competition with other local and international airlines, though it now carries almost twice the passengers it used to get a decade ago.

Mohammed Salahuddin, general manager (marketing and sales) of Biman, mentioned that amid growing number of passengers, the airline has increased the frequency of flights.

But since Biman could not increase its routes due to aircraft shortages, the share of passengers fell. Besides, there has been a rise in the number of airlines operating from Bangladesh.

He, however, said Biman’s share of international passengers, which is around 27 percent, is highest among all the airlines operating from Dhaka.

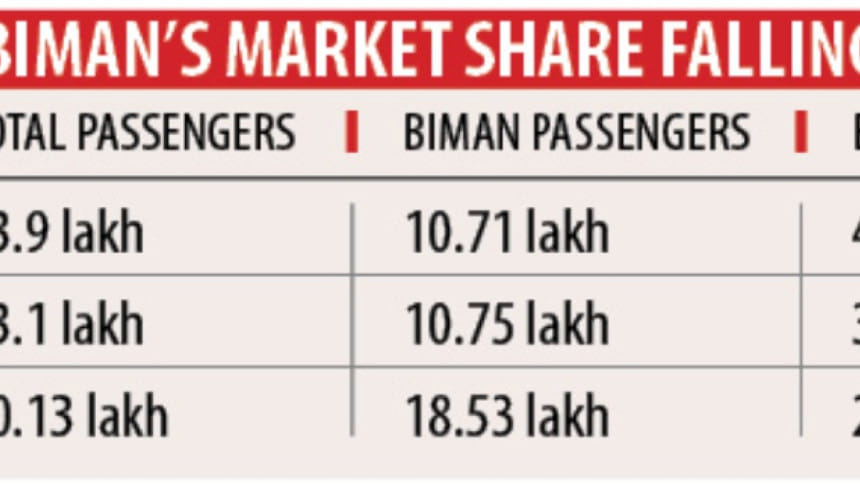

The national airline ferried 11.9 lakh out of 33.1 lakh international passengers to and from Bangladesh in 2006-07. It had three types of aircraft -- four DC10-30s, four F-28s, and three A310-300s -- in 2007.

In 2018-19, it carried around 18.53 lakh out of around 70.13 lakh international passengers. The rest went to 26 foreign and local airlines operating in Bangladesh, according to data provided by Biman officials.

As per the trend in the aviation industry, a national airline should enjoy about 55 to 65 percent share of all traffic to/from the country.

In the case of Bangladesh, its national flag carrier has been losing market share -- from 44.85 percent in 2002 to 32.49 percent in 2007.

And with the condition of existing fleet, this downward trend will continue, said an internal report of Biman prepared to devise a market plan before signing an agreement in 2008 to purchase 10 aircraft from Boeing.

“Biman failed to grab the market due to unbridled corruption and irregularities, inefficient management, improper route planning and absence of a proper business plan,” said leading aviation expert Kazi Wahidul Alam.

THE 2007 PLAN

To tighten its grip on the market, which has been marking a constant growth of 14 percent annually in Bangladesh, Biman devised the plan with the help of the Boeing in 2007 when Biman decided to buy 10 aircraft from the US plane maker.

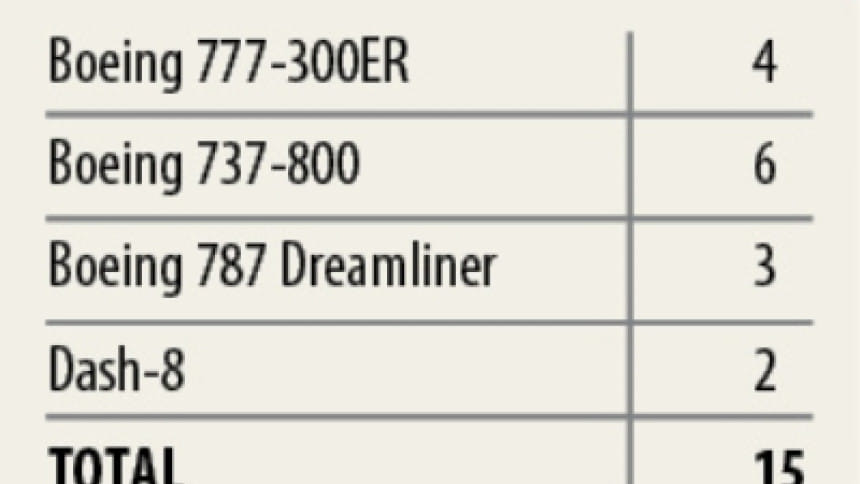

Nine of the 10 aircraft have already been delivered and the last Boeing 787 Dreamliner is scheduled to arrive next month. It has already purchased four 419-seater Boeing 777-300ERs, two 162-seater Boeing 737-800s and three 271-seater Boeing 787s.

With four more leased 737s and two 74-seater Dash 8s, Biman’s current fleet comprises 15 aircraft. Some old planes were phased out in the meantime.

The plan suggested Biman have a fleet of 24 aircraft by this year and recruit pilots on a regular basis.

It also recommended operating long-haul flights (6.5 hours or more) to Frankfurt, New York, Brussels, Manchester and Tokyo to ensure optimum use of the new aircraft. But Biman flies only on the Dhaka-London route.

Besides, Biman suspended Dhaka-Rome-Frankfurt and Dhaka to Manchester, Rome and Milan routes that take minimum nine hours each.

Captain Kamal Sayeed, who was a member of a sub-committee formed to prepare the 2007 plan, recently said, “Many routes were planned including many destinations in Europe. But later no initiative was taken.”

The route plan should have been implemented, he added.

“Biman has been operating its ultra long-haul aircraft [12 hours or longer] on short-haul routes,” said Wahidul Alam, who was a member of the Biman board of directors when the deal for the purchase of 10 aircraft was signed.

A top Biman official, wishing anonymity, said, “Without massive network expansion the best utilisation of the new aircraft is not possible. Market is there but what we need is a dynamic leadership.”

The plan, authenticated by KPMG, a global network of professional firms providing audit, tax and advisory services, and the Institute of Business Administration of Dhaka University, suggested launching flights to new destinations such as Sydney, Manila, Kunming, Toronto and Jakarta.

It also recommended steps to improve image, ensure on-time performance, and competitive customer services both on the ground and in flights and code-sharing with other airlines and joining carrier alliances like One World, Sky Team, and Star Alliance in which several carriers share code.

Code-sharing is an arrangement through which two or more airlines share the same flight. A seat can be purchased from an airline on a flight that is actually operated by another airline under a different flight number or code. All major airlines have one or multiple code-share agreements.

“Biman would not have faced such a situation had it followed the commercial plan devised with the help of the Boeing,” said an ex-Biman official, who was a member of the committee that devised the plan.

Asked why the plan was not implemented, aviation expert Wahidul Alam said, “In my view, Biman didn’t have the expert manpower required for this. May be the plan was shelved after the planes were purchased.”

LAPSES IN STRATEGY

Another Biman official pointed out that the national carrier’s 70 percent passengers are expatriate labourers who travel in economy class.

Business class usually takes one fifth of the space but generates two thirds of the whole revenue, he added.

“You have to operate on routes where you will get many business class passengers.”

He expressed dismay saying Biman is now operating its ultra long-haul aircraft Boeing 787s dreamliners on Dhaka-Muscat, Dhaka-Doha and Dhaka-Kuwait routes where hardly any business class passengers are available.

The official suggested Biman use the hub-and-spoke model, which allows a carrier to take passengers to their destinations after flying them to its hub and connect them to their flights. This gives the carrier more flexibility.

For example, Biman will carry passengers from Dubai to its hub in Dhaka and give him a connecting flight to other destination after a two to three hours transit.

For this Biman flights must have to operate on time as Biman would have to count huge amounts for passengers’ accommodation and food in case of flight delays.

According to the official, Biman’s on-time performance is 60 to 65 percent whereas world standard of on-time performance is around 85-90 percent.

The lack of capacity of Hazrat Shahjalal International Airport is one of the major reasons for the delays as the airport has only eight boarding bridges. Sometimes, 14 planes land at a time.

So, six aircraft have to wait until those on the boarding bridge are offloaded. It hugely affecets Biman since this airport is the hub of the airline.

Officials say the lack of proper infrastructure, insufficient passenger lounges, lack of logistics to carry passengers to an aircraft parked far away, technical issues, sometimes crew shortage, sometimes bad weather and overstay of planes in other stations are some other reasons behind the delays.

Biman incurred losses for most of the years since its inception in 1972 and hogged the headlines for irregularities and corruption on numerous occasions.

The loss stood at Tk 201 crore in 2017-18 while Biman made a profit of Tk 272 crore in the last fiscal year, State Minister for Civil Aviation and Tourism M Mahbub Ali told the media last month.

Amid widespread allegations of anomalies, the parliamentary standing committee on the ministry in 2010 had formed a five-member parliamentary sub-committee which found corruption involving Tk 700 crore in purchase and maintenance of aircraft and equipment of Biman in 18 years since 1992.

The committee also found corruption in Biman’s other sectors that include ticketing, money recovery, signing contracts and hajj operations.

Recently, the Anti-Corruption Commission after conducting a probe made some recommendations to address corruption in Biman. These include forming purchase committee with local and foreign experts, fixing condition of lease, analysing records of procurement to find out the magnitude of corruption.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments