Trade deficit widens amid economic fallout

The economic fallout brought on by the ongoing coronavirus pandemic has had an adverse impact on the country's balance of payments as both trade gap and deficit in the current account widened remarkably in April.

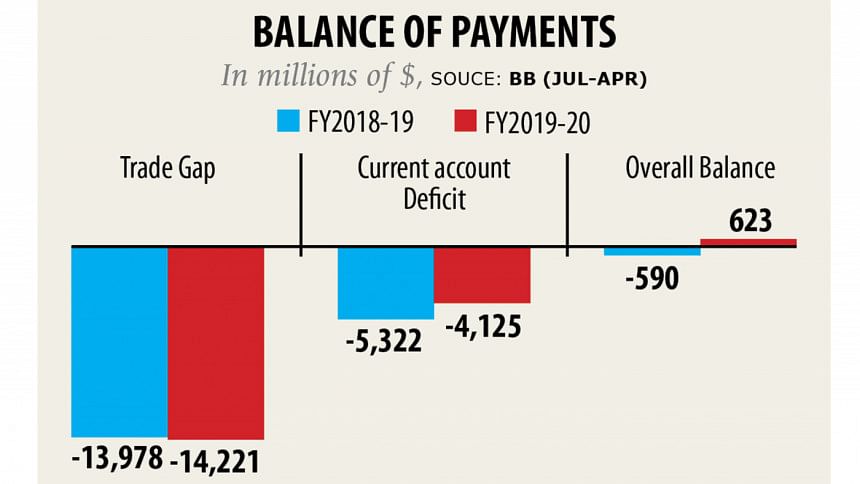

Trade deficit stood at $14.22 billion in the first 10 months of the current fiscal year in contrast to $12.07 billion in the nine-month lead up to March, according to data from the central bank.

Between the months of July and April, the trade gap also increased by 1.73 per cent from that of one year ago, when the figure was $13.97 billion.

The existing global recession is mainly responsible for the upward trend of the trade deficit and the financial indicator will get worse in the days ahead, economists said.

The significant decrease in both exports and remittance has also had a negative impact on the country's current account, which can be viewed as a wake-up call to take the required policy measures, they said.

Current account deficit in the July-April period stood at $4.12 billion, up 71.16 per cent from the first three quarters of this fiscal year.

The current account records a nation's transactions with the rest of the world—specifically its net trade in goods and services, its net earnings on cross-border investments, and its net transfer payments—over a defined period of time.

The deficit in the first 10 months of 2019-20, however, was still lower than the same period of the last fiscal year, when it was $5.32 billion.

Both the trade and current account deficit will increase significantly in the months to come, said Ahsan H Mansur, executive director of the Policy Research Institute.

"The trade deficit is still in a stable condition. But, the ongoing trend indicates that it will be unstable in the future as the global economy will take more time to get an expected turnaround," he said.

He feared that the current account would face a major challenge in the coming days as the global oil market will take at least two years to return to normalcy.

Oil price is one of the major components for the rebound of the global economy and the price will return to its previous position if countries like China, India and the US can restart full-fledged economic activities.

This means Middle Eastern countries will not recover until the global petroleum market gets a boost, said Mansur, also a former official of the International Monetary Fund.

Remittance will not rebound if the economy of the gulf countries does pickup, he said.

Nearly 80 per cent of the 1.20 crore Bangladeshi migrant workers are based in the Middle East.

Against this backdrop, the country's foreign exchange reserve will face trouble due to the probable large deficit in the current account, Mansur said.

Foreign exchange reserves stood at $32.92 billion as of April 30, which is good enough to settle for export earnings of 5.9 months.

The central bank should stop its intervention on the exchange rate, which will help decline the reserve.

Zahid Hussain, former lead economist of the World Bank's Dhaka office, echoed the same, saying the central bank should stop selling US dollar to banks in the interest of the reserve.

A good volume of a foreign exchange reserve is highly important to tackle the upcoming rainy days, he said.

"Flexibility in the exchange rate will depreciate the local currency [taka] against the US dollar. The policy will have to be taken by the central bank to keep the macro economy stable," he said.

However, this is not good enough to strengthen the foreign exchange reserve, he said while adding that the government will take more initiatives to this end.

The authority should explore more avenues to mobilise foreign currencies in the form of foreign loans, grants and aids from the donor agencies and multilateral lenders.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments