Taka gains ground under flexible rate regime

Local currency taka has started to gain strength against the US dollar for the first time in several years, as a steady inflow of foreign currency drives down the official exchange rate.

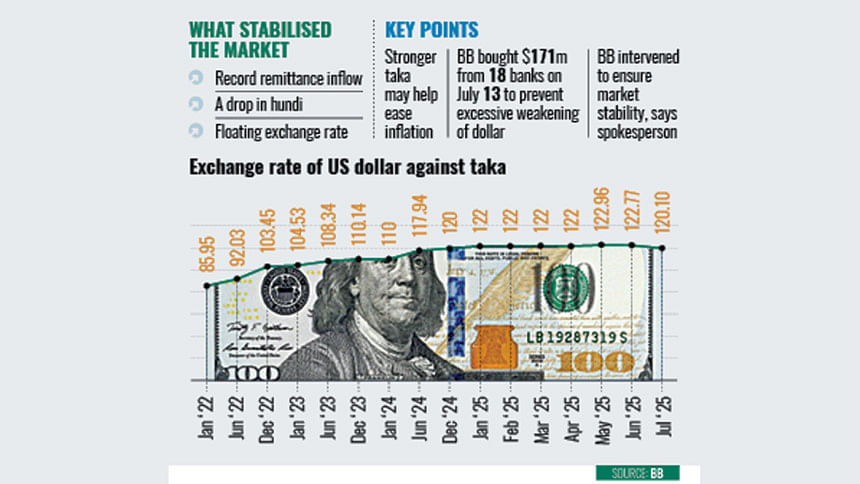

Over the past five days, the inter-bank rate for selling dollars has fallen by Tk 2.20. As of Monday, it stood at Tk 120.1, down from Tk 122.3 on July 9, according to the Bangladesh Bank (BB).

The buying rate at the inter-bank level was Tk 119.5 per dollar.

This is completely the opposite of the weakening trend that began in 2022. Following the economic shocks of the Covid-19 pandemic, the taka depreciated by roughly 30 percent as instability hit both the global and domestic markets.

Industry insiders point to several reasons behind the currency's recent recovery.

These include a rise in remittance flows after the political changeover last year, a drop in illegal cross-border transactions and money laundering, and fresh fund disbursements by multilateral lenders.

Remittances in the recently concluded fiscal year (FY) 2024-25 reached a record $30.32 billion, up by 26.81 percent or $6.4 billion year-on-year, according to BB data.

In May this year, the central bank moved towards a more flexible exchange rate regime, one of the conditions tied to the ongoing $4.7 billion loan package from the International Monetary Fund (IMF).

Although there were initial concerns that this would lead to further depreciation of the taka, it has shown the opposite effect so far.

Preferring anonymity, a senior Bangladesh Bank official said the policy shift helped restore market confidence, which in turn contributed to an uptick in foreign currency reserves.

As of July 10, reserves stood at $24.54 billion under the BPM-6 calculation method maintained by the IMF, up from $21.06 billion a year earlier.

BB steps in to stabilise market

Reacting to the sharp drop in the dollar rate, the BB on July 13 bought $171 million from 18 commercial banks through an auction, the first such move under the floating rate system.

Areif Hussain Khan, executive director and spokesperson of the central bank, told The Daily Star that the regulator acted to prevent excessive volatility.

"We want to keep the forex market stable, because both a rise and a fall are not good indicators," he said. "If the dollar weakens too much, exporters and remitters feel discouraged and suffer losses."

"We purchased $171 million from 18 commercial banks, and the cut-off rate was Tk 121.5 per dollar," he added.

Mixed signals from economists

While some economists believe the taka's rebound could ease inflation, others remain cautious about whether the trend will last.

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank, said the central bank's move to support the dollar rate made sense.

He said that from mid-2022, the forex market had been deteriorating rapidly.

"While the dollar was strengthening globally, the taka was in freefall. So clearly, some macroeconomic fundamentals must have improved on our side for this reversal to happen," he said.

However, the top banker added that the broader economy remained sluggish.

"Real employment isn't happening. Sure, informal employment has been generated, but formal employment isn't increasing," Rahman said, adding that while inflation had cooled off slightly, most people still do not have disposable income.

Zahid Hussain, former lead economist of the World Bank's Dhaka office, cited both positive and negative factors behind the dollar's decline.

"The good reason is that there used to be an additional demand for settling various outstanding payments. For example, electricity bills of the IPPs, payments for fertilisers and LNG, and the backlog of deferred LCs; most of these have now been cleared."

That demand has faded, suggesting stronger financial management, Hussain said. But there is also a less encouraging side.

According to the economist, the main reason the demand for dollars has weakened is that investment remains stalled. Imports linked to investment, especially capital machinery, have slumped.

Capital machinery imports fell by 19.6 percent to $2.62 billion during the July–May period of FY25, he said.

Hussain also questioned the central bank's intervention in the market, arguing that allowing the dollar rate to drop further could help contain inflation.

"Over the past three years, various analyses have been presented regarding why inflation has risen in Bangladesh. While there are differing opinions, there is one point where everyone seems to agree: the rise in the value of the US dollar."

He added that bringing the rate down from Tk 120 to around Tk 110 could have made a remarkable difference in taming inflation.

"So, the question is, why is this opportunity to curb inflation being missed?"

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments