SMEs to be gifted with turnover tax cut

Small and medium enterprises (SMEs) are likely to get a respite from paying turnover tax in the next fiscal year as the government looks to support businesses that suffered sales losses owing to the more than two-month-long shutdown.

The lockdown, which began on March 26, partially ended on May 30. But its fallout continues to remain deep as many businesses are struggling to clear salaries and wages of employees because of unprecedented demand collapse and supply chain breakdown.

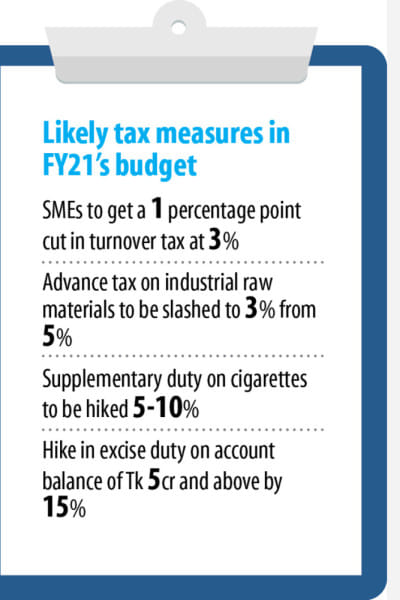

So, to give relief to small businesses, the turnover tax may be curtailed to 3 per cent in fiscal 2020-21 from 4 per cent now, said officials of the finance ministry.

At present, businesses that register an annual turnover of Tk 50 lakh to Tk 3 crore pay 4 per cent in turnover tax.

Officials say as the lockdown has shattered businesses in almost all sectors of the economy, the tax relief would reduce the pressure on them.

The country has more than 78 lakh economic units and 12 per cent of them are micro and SMEs, according to the Bangladesh Bureau of Statistics' Economic Census 2013.

The government may also reduce advance tax (AT), a form of value-added tax (VAT) levied on imports, to cut the operational cost of industries, said revenue officials.

Currently, businesses, mainly domestic market-oriented industries and traders, pay 5 per cent AT during the import of goods.

The AT rate for the import of industrial raw materials may be set at 3 per cent, the officials said.

However, smokers are likely to face higher taxes as the government is considering increasing the prices of the cigarettes to attain the increased revenue collection target of Tk 128,800 crore in fiscal 2020-21 from VAT, up 19 per cent from the revised target of Tk 108,000 crore in the outgoing fiscal year.

Cigarette, the biggest sources of VAT and supplementary duty (SD), brought Tk 22,000 crore, which is 28 per cent of the total VAT and SD collected in fiscal 2017-18.

Depending on price slabs, smokers now pay from 55 per cent to 65 per cent of SD for every 10-stick.

The price-slab fixed by the NBR may be hiked by 5-10 per cent in the next fiscal year.

To achieve a higher tax collection target to finance the budget, the government may also increase the excise duty on accounts with debit or credit balance of above Tk 5 crore at any time of the year by as much as 15 per cent.

At present, account holders with such balances have to pay Tk 25,000 per account annually, according to the NBR.

The pandemic has a significant impact on the country's fiscal position.

The tax revenue collection was expected to increase due to sustained economic growth and a newly implemented VAT scheme.

Nearly 90 per cent of the government revenue comes from tax collection, of which 65 per cent are from indirect taxes, including VAT and other duties.

However, the pandemic and consequent stoppage of economic activities is expected to significantly reduce tax receipts, said the Asian Development Bank (ADB) recently.

A minimum revenue loss of 2 per cent of GDP, or $6.7 billion, is projected by the government.

If income-generating activities decelerate and economic recession sets in, the generation of direct taxes would reduce, said Abu Hena Md Rahmatul Muneem, chairman of the NBR, in a letter to the government on May 14.

Similarly, if domestic demand goes down, imports would fall. If industrial production declines, the demand for raw materials and machinery would fall. This will have a huge negative impact on the collection of indirect taxes.

It would be tough to realise the Tk 330,000 crore targeted for the upcoming fiscal year, Muneem has said.

Bangladesh's economy might lose $13.3 billion for the coronavirus outbreak and a slowdown in domestic economies is a major reason behind the loss, which is 4.9 per cent of the country's gross domestic product, the ADB said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments