POTATO PARADOX

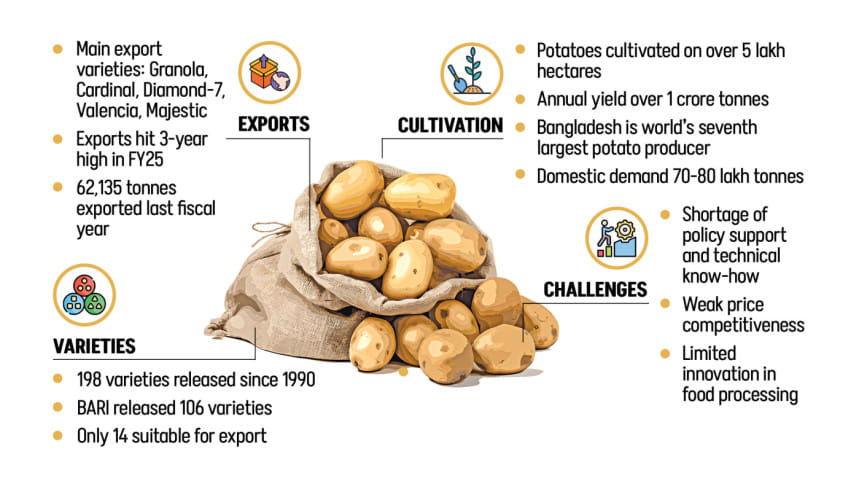

In the last 36 years, Bangladesh has developed 198 potato varieties, over five every year on average. Only a few of those are cultivated, and even fewer are deemed suitable for the international markets, leaving the world's seventh-largest producer struggling to turn bumper harvests into export earnings.

According to the Ministry of Agriculture, just 14 varieties of potatoes meet the export standards. Of the 106 developed by the Bangladesh Agricultural Research Institute (BARI), only three are considered exportable. The state-run Bangladesh Agricultural Development Corporation (BADC) and private firms introduced 94 more, identified as 'non-notified,' bypassing formal registration. Of these, only five are deemed exportable.

However, Mitul Kumar Saha, joint director of marketing at Hortex Foundation, said in reality, Bangladesh mainly exports potato varieties such as Granola, Diamond, Courage, and Sunshine. "Overall, the number of varieties shipped abroad generally does not exceed 8 to 10."

The disconnect between innovation and market readiness means that Bangladesh, which produces over 100 lakh tonnes of potatoes annually against a domestic demand of 75-80 lakh tonnes, struggles to offload a 30-35 lakh tonne surplus. All the while, that oversupply depresses prices and leaves farmers vulnerable.

THE EXPORTABLE VARIETIES

According to documents from the Ministry of Agriculture, the exportable varieties are the BARI Potato-7 (Diamond), BARI Potato-8 (Cardinal), and BARI Potato-13 (Granola).

Also included in this list are Dunastar, Adato, Arsenal, Livent, BADC Potato-1 (Sunshine), BADC Potato-6 (Kumbika), BADC Potato-7 (Queen Ani), BADC Potato-8 (Labella), BADC Potato-13 (Gina Red), AgriConcern Potato-9 (Opal), and AgriConcern Potato-10 (Marta).

According to exporters, of these, the major exported varieties are Granola, Cardinal, Diamond-7, Valencia, and Majestic. In particular, Valencia, a Dutch type with high dry matter content, is drawing attention for its export potential.

Despite the abundance of types, farmers overwhelmingly stick to a few familiar varieties.

"In Bangladesh, the adoption of new types depends on farmer motivation, local consumer demand, and international market interest," said Mosharraf Hossain Molla, principal scientific officer at BARI's Tuber Crop Research Centre.

"Farmers continue to grow familiar varieties like Diamond. Changing farmer behaviour is difficult, and new types take time to gain popularity," he added.

Exporters also shy away from untested varieties. "Although newer export-quality varieties have been developed, they have yet to gain widespread adoption."

The unregulated release of nearly 100 varieties has raised concerns, he also said, warning that the lack of regulation, particularly the release of non-notified varieties, poses risks, including the introduction of plant diseases.

In September 2019, the government declared potato as a non-notified crop for three years to simplify the introduction of new varieties. This decision aimed to facilitate the release of new, potentially exportable varieties by the private sector without the lengthy approval process required for notified crops.

EXPORTS RISE, BUT ON LOW PRICES

Bangladesh exported over 100,000 tonnes in fiscal year 2013-14 but has failed to sustain that momentum. However, in recent years, exports are gaining.

Potato exports climbed to a three-year high of 62,135 tonnes in the fiscal year 2024-2025 (FY25), the Department of Agricultural Extension (DAE) data show. The surge was driven less by variety breakthroughs than by a collapse in domestic prices, which fell as low as Tk 7- Tk 10 per kilogramme (kg).

"Last season, I was able to buy potatoes at Tk 7- Tk 10 per kg, whereas the year before it was Tk 30," said exporter Tawhidul Islam, who shipped 30,000 tonnes in FY25, up sharply from 1,400 tonnes the year before.

Farmers, however, often sold at losses. At the field level, potatoes fetched as little as Tk 11 per kg, below the DAE's estimated average production cost of Tk 14.

Beyond prices, exporters cite structural challenges. Older varieties are vulnerable to "Hollow Heart," a disorder that hollows out tubers, while high freight charges make Bangladeshi potatoes uncompetitive outside nearby markets.

"Potatoes are typically exported only to neighboring or nearby countries where freight costs are relatively low. Beyond these regions, exports are minimal or nonexistent, presenting a significant challenge," said FH Ansarey, managing director of ACI Agribusinesses.

Besides, the varieties produced in Bangladesh are not price-competitive in the global market, he said.

"This year, exports were viable only because local prices were low (Tk 12 - Tk13 per kg), allowing for profit at the export price of about $0.20 per kg," he noted.

"However, processed potato products such as French fries and flakes can bring nearly $2 per kg. That makes value-added exports far more attractive," added Ansarey.

According to Towhidul, Bangladeshi exporters will be able to compete in the global market if potato prices drop to Tk 10 - Tk 15 per kg in the local market.

POLICY LACKINGS

The government drafted a potato export roadmap in 2022, but exporters and farmers said it failed to reflect on-the-ground realities because stakeholders were not consulted.

"The government's plan was developed without consulting farmers or industry stakeholders and, as a result, may not reflect ground realities," noted Ansarey.

Ashrtaf Sarker, a farmer in Munshiganj, who cultivates potatoes on six bighas of land, said the knowledge and market connections necessary to try new varieties are not available to him. "That's why I stick to the local market."

"I do not have sufficient policy support from the government to explore new pro-export potatoes. I have no idea about the kind of help I will get from the government," he said.

Agriculture Secretary Mohammad Emdad Ullah Mian, however, told The Daily Star that Dhaka has since taken policy steps, including reducing port waiting times and offering transport at reduced fees, that helped lift exports in FY25.

Still, only about 15 potato varieties are popular among Bangladeshi farmers.

"A large portion of the varieties produced in the country have no demand internationally. Unless production focuses on global demand, exports will not rise," said Syed Md Rafiqul Amin, head of the state-run Horticulture Export Development Foundation, which facilitates various crop exports.

Few crops are as widely consumed worldwide as potatoes. About two-thirds of the world's population includes potatoes as an element in their diet, indicating the widespread reliance on this tuber for nourishment, according to a 2024 report by the United Nations Food and Agriculture Organization.

With around 5,000 varieties across the globe, the diversity of vegetables plays a vital role in global food security and nutrition.

If Bangladesh can tap into that potential with more competitive varieties, it might open up new doors for the country's export economy.

But for now, the country's potatoes mostly remain confined to domestic fields rather than foreign plates.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments