Hit by US tariff uncertainty, exports slip 3% in Aug

Bangladesh's export earnings witnessed a slight dip in August as garment shipments to the United States, its largest market, slowed under a new tariff regime introduced by the Trump administration.

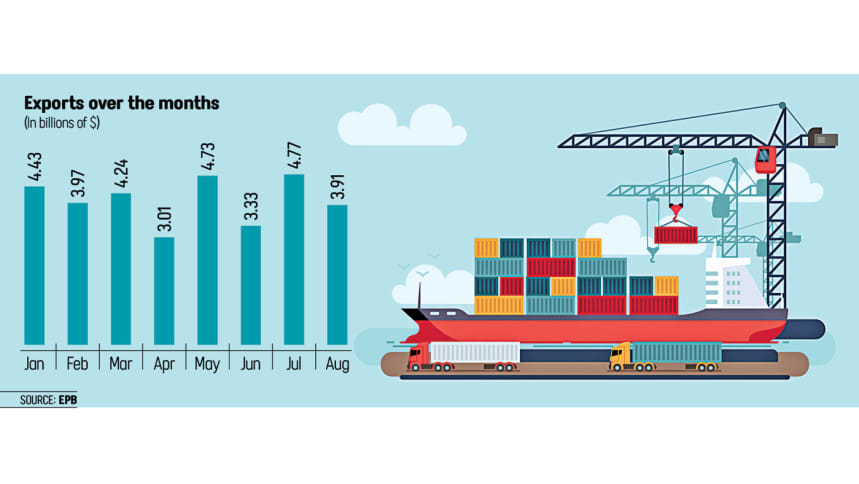

According to latest data from the Export Promotion Bureau (EPB), merchandise exports fell by 3 percent year-on-year to $3.91 billion in August.

The overall picture for the fiscal year's first two months, however, remains stronger. In July-August, total exports rose by 11 percent from a year earlier to $8.68 billion.

Garments, which account for more than four-fifths of national export earnings, dragged down the performance. Apparel shipments fell by 4.5 percent year-on-year to $7.13 billion during the two-month period. Within this, knitwear exports dropped 6.34 percent to $3.94 billion, while woven garments fell 2.65 percent to $3.18 billion, EPB figures show.

The weakness followed earlier declines. In June, garment exports fell 6.31 percent, contributing to a 7.55 percent overall drop in shipments that month. By contrast, July brought strong growth, when exports reached a 32-month high with garment exports up 24.7 percent and total exports up 24.9 percent.

The volatility in the apparel sector stems from adjustment to the new US tariff structure. In April, the Trump administration imposed a 37 percent tariff on Bangladeshi garments, later revised to 20 percent after lengthy negotiations.

Exporters said the uncertainty during the negotiation period prompted many American buyers to adopt a wait-and-see approach until early August. The disruption compounded the seasonal slowdown during the long Eid holiday, when factories paused production and shipments.

The US is the single largest export destination for Bangladesh and the local exporters ship more than $8.2 billion worth of garment to the American markets in a year.

Exporters are hopeful that the garment export will grow to the USA under the favourable duty structure compared with the competing countries such as India and China, which face a 50 percent and 30 percent, reciprocal tariffs, respectively.

"Exporters had front-loaded shipments earlier at the previous 10 percent baseline tariff, which helped boost July's figures" said Md Shehab Udduza Chowdhury, vice-president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA). In August, the uncertainty led to a slowdown.

"However, international retailers and brands, especially from the US, are now returning with a good volume of work orders after the tariff rates were finalised by the Trump administration," he added. "It is expected that garment shipments will rebound soon."

Meanwhile, several other sectors performed better in July–August. Exports of jute and jute goods, cotton products, home textiles, frozen fish, agricultural produce and plastics all grew.

"Particularly, jute and jute goods have made a good recovery, logging nearly a 9 percent increase, breaking a continuous trend of decline.

Industry insiders attribute the growth to diversified products.

"Jute in particular benefited from growing global demand for natural fibre alternatives to plastic bags. The responses from the international buyers are also positive as they are adopting the natural fibre bag jute products instead of plastic goods," said Md Abul Hossain, chairman of the Bangladesh Jute Mills Association.

Shipment of leather and leather goods and ceramic sectors did not perform well in August.

According to EPD data, leather and leather goods recorded a 1.55 percent year-on-year decline last month. During the July-August period, however, the sector logged over 13 percent growth.

Ceramics, meanwhile, recorded a steep 18.97 percent decline in August. Rubber logged over 58 percent growth to reach $4.39 million.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments