Govt move to use surplus funds of state-run firms to spook stock investors: analysts

The government's decision to use the surplus funds of state-run companies, including listed ones, is eroding investor confidence as the move will reduce profits of the companies, according to market analysts.

"We received a lot of selling orders from foreign investors after the government had passed the bill," said a top official of a leading brokerage house that handles a huge amount of foreign investment in the stock market.

In January, the government passed a bill aimed at bringing a total of Tk 218,839 crore held by state-owned enterprises as surplus funds to the national exchequer for use in various development projects.

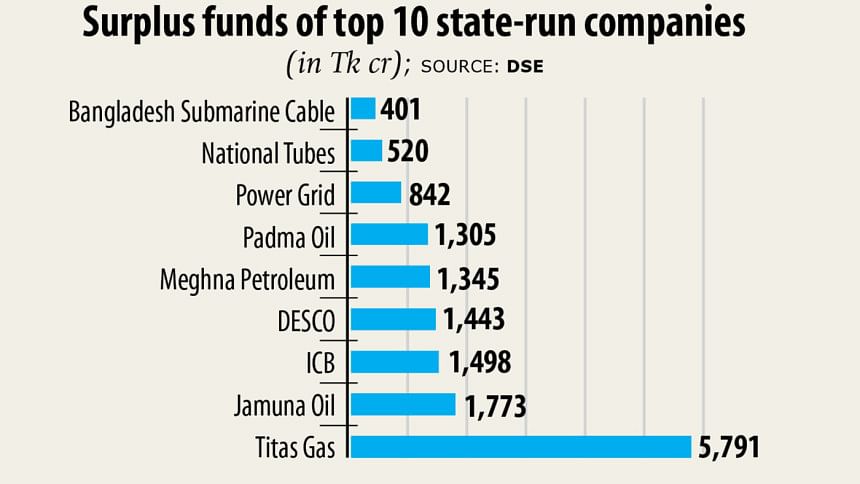

Among the state-run companies, the 18 that are listed have a combined Tk 16,236 crore surplus fund, most of which is kept at banks as fixed deposit receipts (FDRs).

However, foreign clients who invested in state-run firms are irked by the sudden development with many having decided to reclaim their stakes in the companies, the official said.

In fiscal 2019-20, foreign investors pulled out Tk 1,399 crore in financing from the stock market, making it the largest withdrawal of funding in any given year, according to data from the Dhaka Stock Exchange.

The government's decision, among others, to utilise surplus funds also affects local investors, he said.

The official also gave the example of the recent tussle between Grameenphone and the Bangladesh Telecommunication Regulatory Commission (BTRC), saying this kind of development puts a negative impact on the market.

The BTRC claimed Tk 12,580 crore from the country's leading mobile network provider as dues.

Grameenphone, the sole listed mobile operator, was legally compelled to pay a portion of the amount so far.

The telecom regulator also declared the company as significant market power which narrowed its scope for business, the official said.

"If the government takes away the surplus funds of listed state-run companies, then profits for those companies will take a dive as their interest income will decrease," said a top official of a merchant bank preferring anonymity.

Therefore, it would impact the share price of those companies and subsequently, the overall stock market. Besides, it has been observed that listed state-run companies are already under pressure to sell more shares, he added.

"This is not the first time that sudden policy intervention from the government has hit the earnings of both listed companies and the market," he said, using Titas Gas Transmission and Distribution Company as an example.

In 2015, the energy regulator slashed the distribution charges of Titas Gas, a listed company that had a substantial amount of foreign investment at the time.

As a result, the state-run gas utility company lost more than Tk 3,000 crore in market value in the five-month lead up to February 2016.

"We were so disappointed as we had to incur losses. After that, we didn't keep any state-run companies in our portfolio, not even on our watch list," he said.

Sudden policy changes are not beneficial for the stock market; moreover, the government has now passed a bill to take money from listed state-run companies that will seriously dampen the investor confidence, the merchant banker added.

The decision to reallocate those funds will have a negative impact on the stock market since investors finance companies after seeing if said company's FDR breeds huge profits, said Ali Xahangir, chief executive officer of Amarstock.com, a stock market analysis based online portal.

"This is not legal also because investors have a right to the money," Xahangir added.

Meanwhile, a top official of the Bangladesh Securities and Exchange Commission preferring anonymity said no government agency has informed the organisation of the decision to utilise surplus funds of listed state-run companies.

However, since the government did indeed pass the bill, they may access the funds, which could be taken in the form of an advance, he said.

"There is no way to use the listed companies' funds without paying them interest," he added.

The listed state-run companies are: Titas Gas, Usmania Glass, Atlas, Eastern Cables, National Tubes, Renwick Jasneswar, DESCO, Eastern Lubricants, Jamuna Oil, Meghna Petroleum, Padma Oil, Power Grid, Bangladesh Shipping Corporation, Bangladesh Submarine Cable, Shyampur Sugar, Zeal Bangla, Rupali Bank and Investment Corporation of Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments