Govt to drop wilful defaulter tag

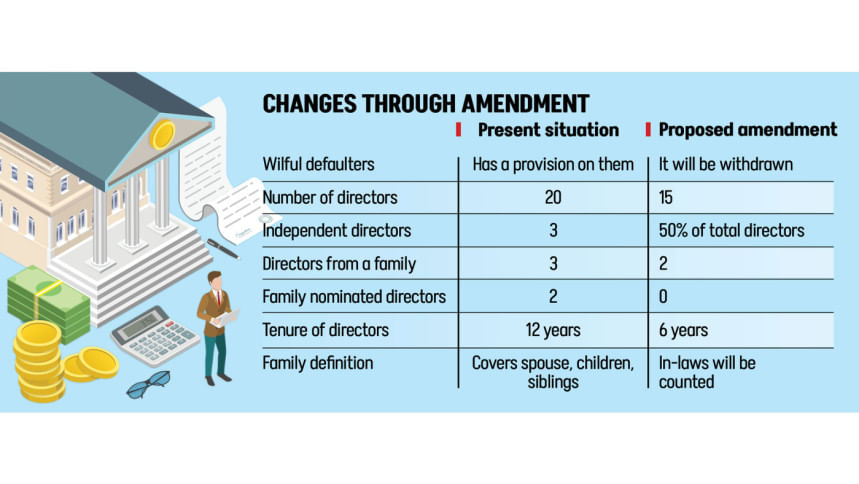

The government has moved to amend several sections of the Bank Company Act, including the removal of the provision on "wilful defaulters" that was introduced for the first time in 2023, and reducing the size of bank boards.

Under the current law, banks are required to prepare separate lists of loan defaulters deemed unwilling to repay, categorised as "wilful defaulters".

There will only be the defaulter list, and bad borrowers will face penalties according to related laws.

Bangladesh Bank officials said the rule of wilful defaulter not only creates additional workload but also leaves room for corruption due to subjective interpretation.

The proposed changes to the act are part of a wider reform of the financial sector. The central bank has already drafted the amendments, and its board has approved them recently.

A finance ministry official said the draft is now under review, with preparations to place it before the advisory council by September. An ordinance could be issued by December.

A finance ministry official said the draft is now under review, with preparations to place it before the advisory council by September. An ordinance could be issued by December

The draft recommends reducing the number of directors to 15 from 20. Currently, banks have three independent directors, but the draft sets this at half of the board.

Officials said this would mean seven or eight independent directors, adding that such a move was aimed at ensuring good governance through the inclusion of banking experts.

Independent directors would be chosen from a vetted pool of candidates shortlisted by an expert panel.

The officials said that bank boards in many countries are dominated by professionals rather than profit-seeking shareholders.

The draft also seeks to restrict the number of directors from one family. The existing law allows three family members, with two more nominated by relatives.

According to the draft, only two from a family would be permitted. Also, the definition of family would also be broadened to include in-laws.

There are allegations that board directors have often been appointed from among in-laws, which the existing law cannot prevent. The expanded definition of family is intended to curb such practices, according to the draft.

Another proposed change is the reduction of a director's tenure from 12 years to six.

Under the current law, if a company within a business conglomerate defaults on a loan, its sister firms can still get bank loans.

The amendments would end this, meaning a default by one firm would bar other companies in the group from borrowing.

Md Nazrul Huda, a former deputy governor of the Bangladesh Bank, welcomed the proposal, saying the wilful defaulter provision could have encouraged corruption among bankers and central bank officials.

"There are no criteria which can define the defaulters either wilful or not," he said.

On board size, he said smaller boards are more effective. "More board members mean a burden, extra agendas and irregularities… the number should be between 9 and 11," he said.

He added that appointing qualified professionals such as bankers and chartered accountants mattered more than the number of directors.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments