Cards triumph amid pandemic

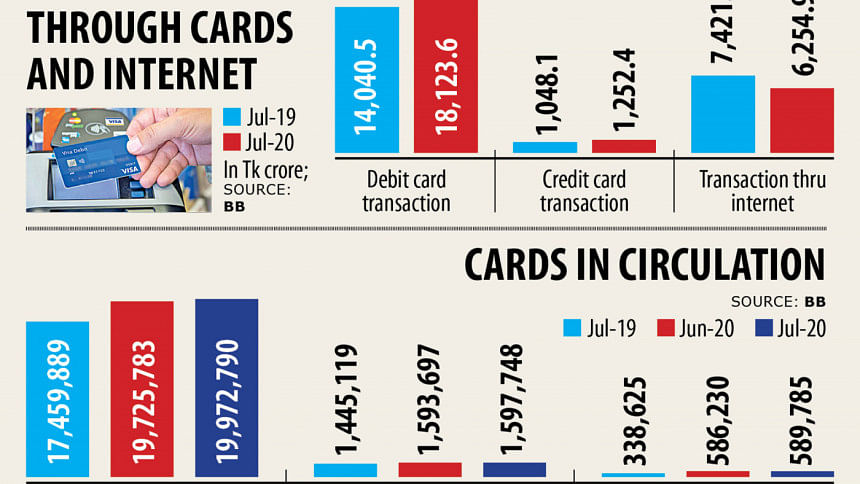

Debit card users transacted a record Tk 18,123.6 crore in July as they opted for the digital money over cash to keep the coronavirus at bay.

The transaction is the highest at least since December 2018, Bangladesh Bank data showed.

July's figure is 29.08 per cent higher than Tk 14,040.5 crore transacted in the same month a year ago and 44.66 per cent up from Tk 12,528.1 crore in June this year.

In the first month of the fiscal year, credit card-holders spent Tk 1,252.4 crore, which was the highest in six months and up 19.49 per cent year-on-year.

Their spending stood at Tk 898 crore in June this year and Tk 1,048.1 crore in July last year.

Though restrictions have been easing off since June, both debit and credit card-holders have still been relying on digital money to pay for goods and services owing to the persisting coronavirus pandemic.

"July was a good month. Eid was a factor as the religious festival was celebrated at the end of the month," said Syed Mohammad Kamal, country manager for Mastercard.

For the card business, April was the worst month. It recovered a bit in May and made a moderate comeback in June.

"In July, the card business has returned to almost the February-level. It can be said it was a turning point," Kamal said.

A significant portion of the card business is international transaction but that has been largely non-existent since April because of the pandemic.

People from Bangladesh used to travel a lot and at the same time, a lot of people used to visit Bangladesh before the deadly virus arrived on the shores of the country.

"Usually, we see a lean period after Eid, but this year August was also not a bad month if the pandemic is taken into account," said Kamal.

Restaurants are opening after remaining shut for the most of the April to May period. During the pandemic, food delivery was largely suspended as people were cautious but that too has rebounded strongly.

The reopening of the domestic airlines is helping the card business breathe a sigh of relief. Domestic hotels and resorts have reopened after Eid.

E-commerce is booming and mobile recharge through cards has gone up, while adding money to mobile financial service accounts has increased. Lifestyle shopping also went up during Eid. People started going to restaurants and groceries by maintaining social distancing and taking safety measures.

The electronics sector also performed well in the first month of the fiscal year. People tend to buy deep freeze during Eid-ul-Azha, when crores of animals are sacrificed.

Normally, the lifestyle segment does not do well during Eid-ul-Azha. But as people could not shop during Eid-ul-Fitr this year owing to the lockdown, they came out ahead of Eid-ul-Azha and spent money on clothes and other items.

"All of these helped the overall volume in the card business grow in July onwards," Kamal said.

Banks issued a total of 19,972,790 debit cards as of July, which is up 14.39 per cent from 17,459,889 in the same month a year ago and 1.25 per cent from 19,725,783 in June this year.

The number of credit cards in circulation stood at 1,597,748 in July, up 10.56 per cent compared to 1,445,119 in the same month last year. The number stood at 1,593,697 in June this year.

Thanks to an increase in online shopping, local transaction by cards rose 29.35 per cent year-on-year to Tk 19,625 crore from Tk 15,172.3 crore in the same month a year ago. It is up from Tk 13,603 crore in June this year.

Foreign currency transaction through cards, however, nosedived by 75 per cent to Tk 65.9 crore in July from Tk 264.8 crore in the same month last year, reflecting the drop in cross-border trading activities owing to the pandemic-induced shutdown at home and abroad.

July's figure, however, is the highest since April, according to data from the central bank.

In Bangladesh, credit cards were launched in 1997, debit card in 2004 and internet banking in 2006, all by Standard Chartered Bank.

The credit card segment is dominated by City Bank, Eastern Bank, Standard Chartered and Brac Bank.

Lanka-Bangla Finance dominates the domestic-only credit cards.

Dutch-Bangla Bank leads the pack of the debit card segment, followed by Islami Bank Bangladesh Ltd, Prime Bank and Brac Bank.

The number of prepaid cards rose a staggering 74.17 per cent year-on-year to 589,785 in July. It was 586,230 in June.

People who don't have the eligibility to own either debit or credit cards can still have pre-paid cards. Users have to load money onto the cards.

The prepaid card itself is an account and users don't have to open any bank account to own a pre-paid card. The cards are popular among students and freelancers.

EBL is the market leader in the prepaid card segment, followed by Bank Asia, Mutual Trust Bank and City Bank.

Transaction through internet banking fell: it was Tk 6,254.9 crore in July, down 15.72 per cent from Tk 7,421.6 crore recorded in the same month last year. It was Tk 7,421.1 crore in June this year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments