BB to crack down on habitual defaulters

The central bank has moved to reform the existing acts to clamp down on habitual defaulters, whose tendency to go to courts to stall paying back loans has sent the sector's non-performing loans to an alarming level.

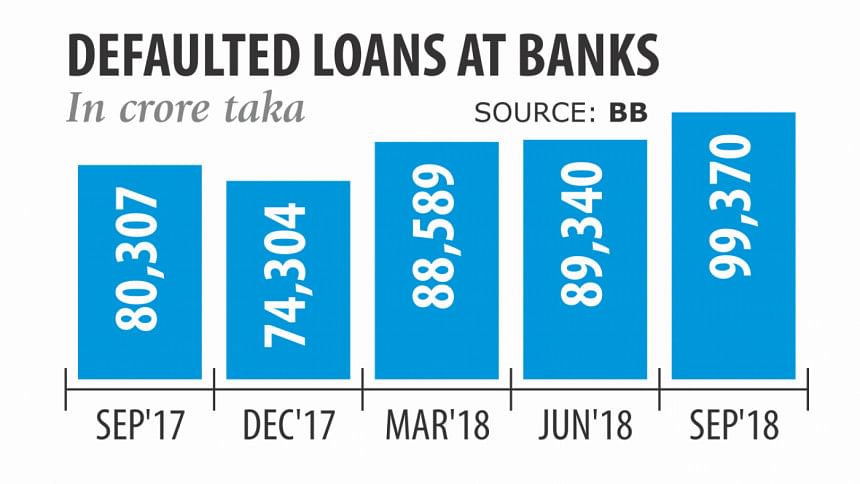

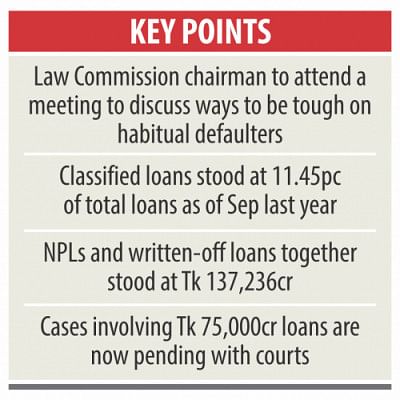

As of September last year, the ratio of NPLs stood at 11.45 percent of the total outstanding loans. In terms of amount, it is Tk 99,370 crore.

The Bangladesh Bank is set to hold a meeting on February 6 with banks' managing directors. Law Commission Chairman ABM Khairul Haque and Bangladesh International Arbitration Centre CEO Muhammad A (Rumee) Ali will explore all legal routes with a view to handing out exemplary punishment to habitual defaulters.

When banks step in to realise the defaulted loans the habitual defaulters go to courts, thwarting the move, said a BB paper. The trick used by the habitual defaulters has created an impediment to recovering the default loans.

More than Tk 75,000 crore of default loans is pending with the money loan courts because of the drawn-out process to settle the cases. Even then, the money loan court can give a maximum six-month civil imprisonment to a defaulter in line with the Artha Rin Adalat Ain 2003, said Imran Ahmed Bhuiyan, a deputy attorney general.

“There is an urgent requirement to reform the money loan court act to reduce NPLs,” he added.

Subsequently, the BB has asked the banks' MDs to place their opinions on how to speed up recovery of default loans and ensure exemplary punishment for habitual defaulters at the meeting on February 6.

“We will give probable solutions upon hearing the proposals placed by banks,” Haque told The Daily Star.

As per the act, the courts issue decrees in favour of banks to float tenders to sell the mortgaged assets when defaulters fail to make payment in line with verdicts, according to Bhuiyan. In most of the cases, the banks fail to find buyers for the mortgaged assets, fearing it may invite trouble for them in future, he said. “And then the banks apply to the courts to get the ownership of the mortgaged properties. In my long experience I have seen that the ownership of the majority of the mortgaged assets remains disputed,” said Bhuiyan, also a financial lawsuit expert.

As a result, the lenders fail to enjoy the ownership status, and the cases remain stuck with the court.

So, there should be a provision in the law that will resolve the question of ownership of the mortgaged assets before floating the auction, which will help settle the cases at the earliest, he added.

Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh (ABB), a platform of banks' MDs, welcomed the central bank's initiative. “This is long overdue.”

Lenders have been demanding for long to reform the acts in order to recover the default loans.

“It takes a long time to resolve the cases at the money loan courts because of the lengthy process of the Artha Rin Adalat Ain,” said Rahman, also the MD of Dhaka Bank.

The authority concerned should set up a dedicated bench with the High Court to settle the cases pertaining to default loans, he said.

In a joint meeting held on January 12, the Bangladesh Association of Banks, a platform of sponsors of private banks, asked the ABB chairman to prepare a working paper on how to recover default loans.

The two organisations have taken the decision as part of the instructions given by Finance Minister AHM Mustafa Kamal on January 8 to stem further rise in default loans.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments