3 reasons behind stock slide: BSEC chief

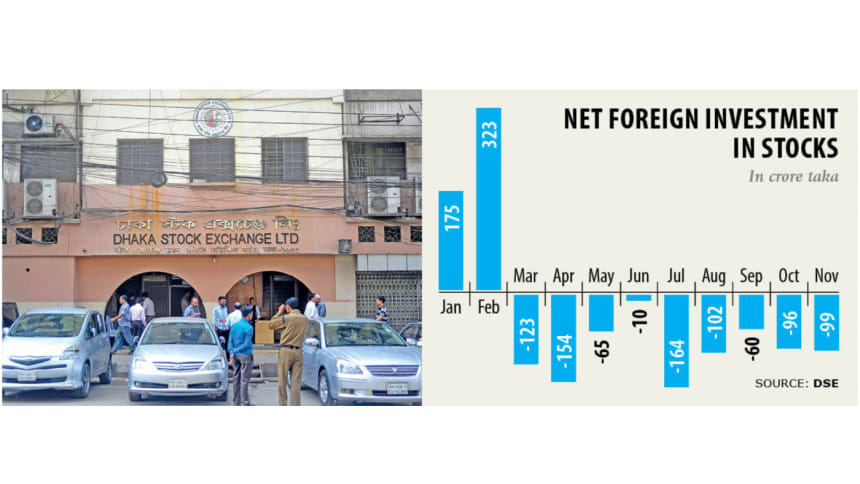

The chief of Bangladesh Securities and Exchange Commission has blamed the recent plunge in stocks on the ongoing tussle between Grameenphone and the telecom regulator as well as a huge selloff by foreign investors.

A piece of news in April that the revenue administration is making tax identification number (TIN) mandatory for opening beneficiary owners’ accounts also played a part, BSEC Chairman M Khairul Hossain said.

Besides, apprehension is doing the rounds in the market that the local currency may devalue, prompting foreign investors to go for massive selloffs, he added.

But Finance Minister AHM Mustafa Kamal has ruled out the possibility of any currency devaluation, he said.

Hossain spoke while inaugurating the new office of the Capital Market Journalists’ Forum (CMJF) in Motijheel on Thursday.

In the first week of April, a news item was published, quoting the chairman of the National Board of Revenue (NBR), that stock investors would need TINs to open beneficiary owners’ accounts.

Hossain said the market started to fall after the comment. Later, the tax authority clarified that it did not make opening TINs mandatory for stock investors, allaying the fears of general investors.

The benchmark index of the Dhaka Stock Exchange fell 261 points, or 4.73 percent, within six days, starting from the day when the report was published.

The dispute between Grameenphone, the largest listed company in terms of capitalisation, and the telecom regulator began to impact the “structure of the market” because foreign investors pour funds largely looking at the fundamentals of companies, the BSEC chief said.

The Bangladesh Telecommunication Regulatory Commission (BTRC) ran a long auditing process, and in 2016 it claimed that the mobile phone operator owed it Tk 12,579.95 crore in revenue share, taxes, and late fees accumulated until December 2014.

Grameenphone maintains that the amount is disputed and filed a writ with the High Court, challenging the BTRC’s claim. The High Court has issued an injunction on the BTRC move. In the meantime, the Supreme Court has ordered the operator to pay Tk 2,000 crore to the BTRC.

Grameenphone’s parent company Telenor has recently sent a legal notice to the president of Bangladesh calling for arbitration to resolve the disputed audit claim.

Foreign investors sold off the shares of Grameenphone along with Olympic Industries, United Power Generation, British American Tobacco Bangladesh (BATB), and Square Pharmaceuticals, Hossain said.

The fall of the five companies accounted for 80 percent of the market slide, he said, pointing out that the DSEX shed around 174 points in the last two months only because of the mobile operator and BATB.

“When foreign investors sell, local investors follow suit, leading to a massive slide,” Hossain said.

BSEC commissioners Helal Uddin Nizami, Swapan Kumar Bala, and Khondoker Kamaluzzaman and CMJF President Hasan Imam Rubel were present at the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments