Mobile banking made stricter

The central bank yesterday lowered the ceiling for mobile banking transactions, citing that the facility is being abused by “some vested quarters”.

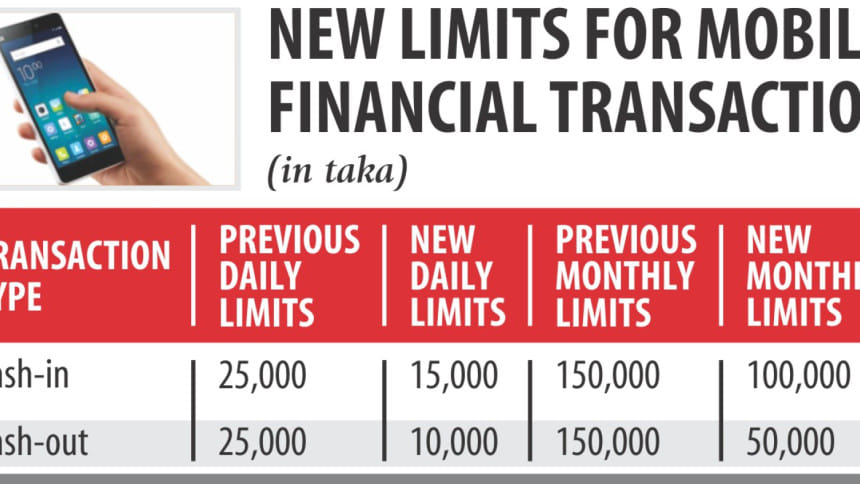

From now, a maximum of Tk 15,000 can be deposited into a mobile banking account each day and Tk 10,000 can be taken out, Bangladesh Bank said in a notice.

The previous daily ceiling was Tk 25,000 both for cash-in and cash-out.

The BB also directed the mobile financial service providers not to open more than one account with a single national identity card.

If they find more than one account associated with the same NID card they will have to shut all of them, except for one.

An account holder can make deposits twice and withdraw three times in a day. Previously, the limit for cash-in was five and for cash-out three.

Each month, a mobile money customer can deposit a maximum of Tk 1 lakh, down from Tk 1.50 lakh earlier. The maximum monthly withdrawal limit is Tk 50,000 through 10 transactions at most.

Previously, the cash-out limit through each agent was Tk 25,000 per transaction; three transactions were allowed at most. The overall cash-out limit used to be Tk 1.50 lakh in 10 transactions a month.

The move has elicited mixed reactions from experts: while it can weed out the unnecessary transactions and curb terror financing, it will slow mobile money growth.

The BB said the decision was taken to safeguard the MFS sector from misuse and superfluous transactions and bring discipline.

“Over-the-counter transactions might come down but that is our target,” said Subhankar Saha, executive director and spokesman for the BB.

At present, Tk 700 crore is transacted a day through the MFS on average, with the majority of transactions via OTC.

Earlier, various law enforcement agencies said MFS transactions were being used for terrorist financing.

The recipient cannot withdraw more than Tk 5,000 in the first 24 hours.

To withdraw cash of Tk 5,000 and over, the recipient must show proper verification -- national identity card or its photocopy -- to the mobile banking agent beforehand.

The agents also need to maintain a register for every cash-in and cash-out transaction, according to the directive.

The BB also directed the MFS providers to monitor the agents' activities. If negligence is detected in this regard, their licence will be cancelled immediately.

Saha said they tried to make it easier for the genuine customers and place hurdles for those who abuse the service.

Dutch-Bangla Bank, one of the major MFS providers in Bangladesh, welcomed the new directive, which is unlikely to impact genuine transactions.

However, due to such strict measures some good customers might sometimes face challenges.

Md Abul Kashem Shirin, managing director of Dutch-Bangla Bank, said foreign remittance may increase as a result of the measures and the burden of the OTC transactions will come down.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments