Foreign funds in stocks jump nine times

Net foreign investment in the capital market soared almost nine times in the first 11 months of the year, as overseas investors continue to pour funds into Bangladesh's stockmarket seen as a frontier and emerging market by many.

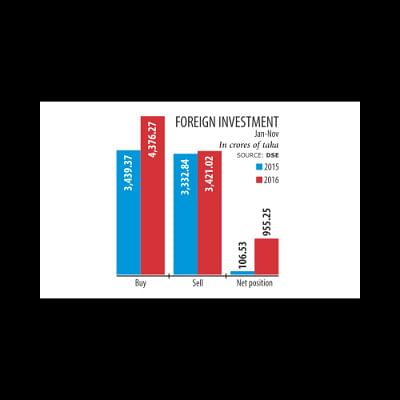

Foreign investors bought shares worth Tk 4,376.27 crore and sold shares worth Tk 3,421.02 crore to take their net investment for the January-November period to Tk 955.25 crore.

A year earlier, the net investment by foreigners stood at Tk 106.53 crore, according to data from Dhaka Stock Exchange.

Positive macroeconomic indicators, including stable exchange rate and a steady political scenario, boosted the foreign investors' confidence, analysts said.

Also, the recent trend of pulling funds out of the neighbouring stockmarkets including India created an opportunity for Bangladesh to receive more investment as a frontier and emerging market. Foreign investors have pulled out around $5 billion from the Indian capital markets in November amid concerns over the impact of demonetisation coupled with fears of rate hike by the US Federal Reserve, according to media reports.

“It's not that the foreign investors are withdrawing funds from the neighbouring markets and then investing in the Bangladesh market. They are really intensifying their focus on our market,” said Sherief MA Rahman, chief executive officer of Brac-EPL Stock Brokerage, which provides services to foreign fund managers. The foreign investors' increasing position in many listed firms also showed their growing confidence in the Bangladesh market.

Brac Bank is an example. The foreign investors now own a 41.55 percent stake in the bank, while the ratio was 35.76 percent a year ago.

Olympic Industries is another listed firm where the foreign investors' stake is 39.55 percent, up from 34.41 percent at the end of December last year. Many more examples can be cited to show the trend of rising shareholding position by foreign investors.

A stockbroker said some foreign fund managers held meetings with some listed firms in Dhaka last month to know the company fundamentals.

“If the interaction between the global fund managers and the listed firms can be increased, foreign investment would rise in the coming days,” he said, adding that listed firms sometimes hesitate to sit down with the overseas fund managers.

Also known as portfolio investment, foreign investment accounts for only 1 percent of the premier bourse's total market capitalisation, which stood at Tk 336,686 crore at the close of trade on Thursday, the last trading day.

Banks are the foreign investors' preferred sector, but non-bank financial institutions, power and energy, pharmaceuticals, multinationals, telecoms and IT also caught their attention. Foreign investors include global investment banks like Morgan Stanley, JPMorgan, Goldman Sachs and asset management firms like BlackRock.

Net foreign investment in 2015 was Tk 185.5 crore, up 93 percent year-on-year, according to DSE data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments