Taka falls against USD once again

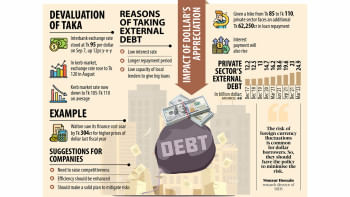

The taka yesterday depreciated against the US dollar, hitting Tk 96 on the interbank platform as the central bank moved to allow the market forces to determine the exchange rate of the national currency.

This has been the first drop for the taka since August 8. It was Tk 95 on Sunday. This means the local currency has lost its value by 12.67 per cent in the last one year.

The Bangladesh Bank sold $65 million to banks at the new rate yesterday.

A central banker, on the condition of anonymity, says the latest depreciation was a step toward adjusting the exchange rate based on the demand and supply of dollars.

On September 8, the central bank held a meeting with banks where it decided that it would let the market to fix the rate.

This prompted the Association of Bankers, Bangladesh (ABB), a platform of managing directors of banks, and the Bangladesh Foreign Exchange Dealers' Association (Bafeda), a platform of banks, to set a uniform rate of the American greenback on Sunday. The rates came into effect yesterday.

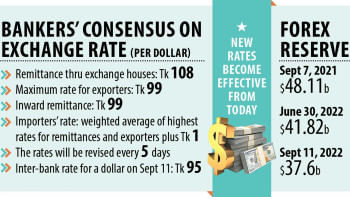

Now, banks will be able to offer a maximum of Tk 108 for a USD for the remittances coming through exchange houses.

Remitters, who send money directly to banks, as well as exporters, will get Tk 99 for each dollar.

Importers will buy the greenback to clear payments based on the weighted average rate, which will be calculated on the basis of the buying rates. Another Tk 1 will be added to the average rate as the spread.

The Bafeda yesterday set the weighted average rate at Tk 103.43 for each dollar.

The inter-bank rate, a rate at which banks buy and sell dollars with each other, will be fixed on the weighted average rate.

Yesterday, several banks bought and sold dollars on the inter-bank platform at Tk 103 to Tk 106, said a managing director of a bank.

The BB usually buys and sells dollars at the inter-bank rate.

Allowing the market forces to fix the dollar rate means the central bank is losing its grip on the exchange rate in order to make the inter-bank rate vibrant, said another BB official.

In the past, the BB used to instruct banks verbally to fix the inter-bank dollar price.

Bangladesh's forex market has been facing a volatile situation since the Russia-Ukraine war has begun as import payments rocketed.

The foreign exchange reserves slipped below $38 billion last week, versus more than $46 billion a year ago.

The central bank is pumping dollars into the market on a regular basis with a view to helping importers clear bills.

It has injected $2.82 billion so far in the current financial year, after supplying a record $7.62 billion in the last financial year, which ended in June.

"The foreign exchange market will become stable within a couple of days as all banks are now following the new rates," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

"It is a good thing that the inter-bank forex platform was activated in a full-fledged manner yesterday."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments