Capital machinery imports keep falling

Bangladesh's import of capital machinery has continued its falling trend as banks have remained cautious in financing purchases amid the dollar crisis while entrepreneurs showed reluctance to expand owing to slowing domestic and export sales.

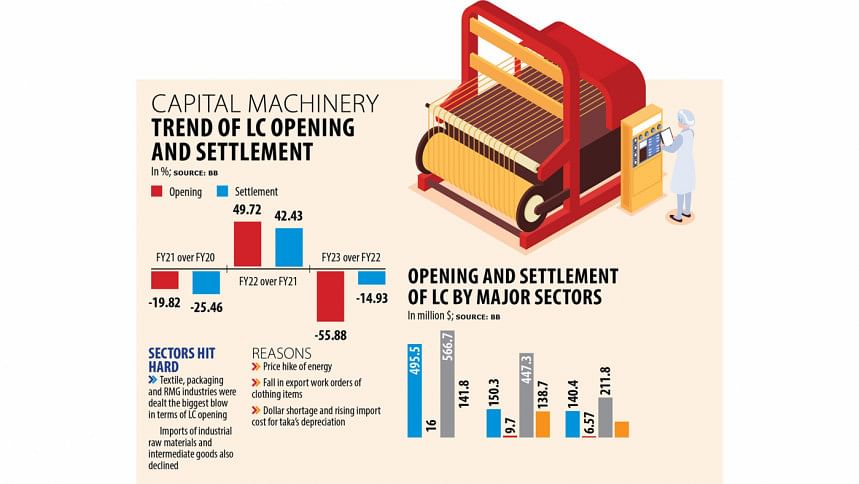

Data from the Bangladesh Bank showed that the opening of letters of credit (LCs) to import capital machinery slumped nearly 56 per cent year-on-year to $2.29 billion in the first three quarters of the ongoing financial year of 2022-23.

Settlement of LCs dropped 15 per cent to $3.13 billion in the July-March period.

Textile, packaging and garment industries took the biggest hit in terms of LCs opening, followed by jute and pharmaceutical industries, a trend, which, according to two analysts, points to the slowing investment in industries and does not bode well for the economy as more jobs need to be created and productive capacity has to be increased to accelerate growth.

Other than these major sectors that account for most of the export earnings for the country, LCs opening and settlement for other industries plunged 53 per cent and 23 per cent, respectively, in the first nine months of FY23.

The imports of industrial raw materials and intermediate goods also suffered a fall.

"The trend of LC opening and settlement declined mainly because of an abnormal price hike of energy, the fall in export orders of clothing items, the abnormal rise of the exchange rate of the US dollar due to the volatility in the economy," said Mohammad Ali Khokon, president of the Bangladesh Textile Mills Association.

He said many entrepreneurs had planned to set up new textile and garment factories considering the rebound of exports in the global textile and apparel supply chain from the lows of the coronavirus pandemic, but the sudden outbreak of the Russia-Ukraine war has started affecting the global supply chain again.

As a result, many entrepreneurs had to cancel LCs, he said, adding that the future of the business is depending on the direction of the war.

Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association, said exporters showed courage and invested to expand and upgrade their factories during the Covid-19 pandemic in order to reduce dependence on China.

That courage paid off.

"Now, persisting higher inflation amid worries of recession in the western markets has affected the buying power of consumers in the West. There are still inventories in some western markets. As a result, order flow has shrunk and it is likely to decline for a couple of months," Hassan said.

"This is why investors are not showing enthusiasm to go for fresh investments."

At the same time, banks are not feeling encouraged to finance the imports of capital machinery and have become tight because of the scarcity of the US dollar, according to the chief of the BGMEA.

"This will have a negative effect on employment."

He, however, said exporters are not facing any problem in opening LCs to import the raw materials against export orders.

Aameir Alihussain, managing director of BSRM, one of the leading steel makers in Bangladesh, says a lot of investment has already been made in the steel sector.

"But entrepreneurs are facing troubles in opening LCs. There is also some sort of uncertainty."

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, blames the dollar shortage for the declining trend of capital machinery imports.

"There is also uncertainty in both exports and domestic markets. Generally, sales are down," he said.

"The implication of this is that the productive capacity of the economy will not increase and job creation will be low."

The latest Labour Force Survey data produced by the Bangladesh Bureau of Statistics showed that the number of jobs in the industrial sector dropped nearly 3 per cent to 1.20 crore in 2022. It was 1.24 crore in 2016-17.

The share of industrial jobs in the overall employment slipped to 17.02 per cent last year from 20.4 per cent five years ago.

Mansur said the data shows that the economy is softening and the overall economic growth will slow down.

"The most of the effect is likely to be on the economy in the next fiscal year."

Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, said the dip in the import of capital machinery is the result of the conservative steps that the Bangladesh Bank has taken to protect the reserves from further declining.

"But it carries an economic cost and that is being evidenced from the data. This will put an adverse effect on employment, investment and economic growth. And we will have to accept this cost."

The forex reserves stood at $31.17 billion on April 12, down nearly 30 per cent from $44.27 billion on the same day last year, data from the BB showed.

Rahman suggested the government prioritise the implementation of the projects that will encourage private investments, take measures to reduce the cost of doing business and take fiscal measures in the coming financial year to stimulate exports and investments.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments