Who owns Nagad?

In March 2019, Nagad started out as the mobile financial service (MFS) of the Bangladesh Post Office (BPO), and it has since been operated by Third Wave Technologies Ltd.

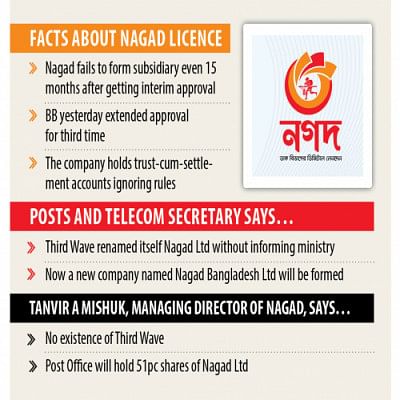

Third Wave Technologies was renamed Nagad Ltd in February this year allegedly without informing the BPO. Now, the government has set out to form a new subsidiary to help it secure a full-fledged licence from the central bank.

Although the debate about the ownership of the fast-growing MFS provider is deepening, the most important issue about the service has been hanging in the air: Nagad has been operating without any full-fledged licence from the central bank since its beginning, and its 5.20 crore customers are transacting Tk 700 crore daily.

The BB yesterday extended the interim approval for another three months to September after the existing permission expires today. This is the third extension.

In March last year, the central bank asked banks not to provide any service to unauthorised payment or MFS providers and operators in the interest of depositors.

This forced the BPO to take an interim approval from the central bank on March 15 last year for six months as all banks had suspended transactions with Nagad.

While availing the interim approval, the BPO committed to completing official procedures to manage the full-fledged licence. But it has failed to do so in the last 15 months.

While granting the initial permission to BPO in March last year, the central bank asked the BPO to form the subsidiary holding 51 per cent shares. The BPO could not form the subsidiary yet.

It prepared the drafts of the memorandum of association, articles of association and vendor's agreement, according to the minutes of a meeting at the Posts and Telecommunications Division on June 7. Telecom Secretary Md Afzal Hossain chaired the meeting.

"A new company named Nagad Bangladesh Ltd will be formed to run the operation of the MFS," Hossain told The Daily Star.

The meeting decided that the Post Office Act, 1898 and the Post Office (Amendment) Act 2010 would require an amendment to set up the subsidiary.

At the meeting, it was also decided that an inter-ministerial meeting among high officials of the ministries of public administration, law and commerce, the Directorate of Post Office, the BB, the finance division, and the financial institutions division will take place to scrutinise the drafts regarding the formation of the subsidiary.

The participants also discussed the issue of operating the trust-cum-settlement accounts (TCSAs) under the name of the BPO as per the directive of the BB to protect the interest of depositors.

The BB attached the condition as some of the TCSAs are being operated by Third Wave Technologies Ltd, which is the master agent and technological and logistic support provider to the BPO to operate the MFS.

At the meeting, it was decided that either the TCSAs would be operated under the name of the BPO, or the BPO would initiate a move to send letters to banks to allow Third Wave Technologies Ltd to operate the TCSAs.

Many MFS clients usually do not spend all of their money immediately after funds are deposited in the accounts. The unused funds are collectively significant, which are deposited at TCSAs.

TCSAs act as custody accounts where the legal tender is stored against the issuance of e-money by the MFS and e-money service providers.

In its latest interim approval, the central bank once again asked the BPO to operate all TCSAs on its own.

Tanvir A Mishuk, managing director of Nagad Ltd, said that his company had not operated any TCSAs breaching central bank rules.

But, the meeting minutes of the posts and telecommunications division said that Third Wave Technologies was still operating some of the TCSAs.

A central bank official said it was highly risky if an agent operated TCSAs where public money is kept.

Mishuk said Third Wave Technologies was renamed Nagad Ltd in February this year, so Third Wave Technologies did not exist.

But Md Siraz Uddin, director-general of the Directorate of Posts, said: "We are running Nagad as per our agreement with Third Wave Technologies."

The website of Nagad also says Third Wave Technologies Ltd operates the Nagad brand.

The name was changed after completing the procedures of the office of the Registrar of Joint Stock Companies and Firms, Mishuk said.

He claimed that the BPO would eventually hold a 51 per cent stake in Nagad Ltd.

Although Nagad is the brand name of the MFS of the BPO, Third Wave Technologies did not take any permission from the government agency to change the name, Telecom Secretary Afzal Hossain said.

"Third Wave Technologies has made a mistake by forming a company as it is a brand of the BPO."

The company is still maintaining TCSAs, he said. Third Wave Technologies will hold 49 per cent shares in the upcoming entity.

Mishuk said it had informed the telecom ministry before renaming the company.

The private firm provides service to the BPO under a revenue-sharing model. The government agency gets 51 per cent of the revenue and the private firm the rest.

In Bangladesh, the MFS service is run under a bank-led model. There are 15 bank-led MFS operators providing mobile wallet service, according to the BB.

They are bKash of Brac Bank, Rocket of Dutch-Bangla Bank, MYCash of Mercantile Bank, Islami Bank mCash, t-cash of Trust Bank, First Pay SureCash of First Security Islami Bank, Upay of United Commercial Bank, OK Banking of One Bank, Rupali Bank SureCash, TeleCash of Southeast Bank, BCB SureCash of Bangladesh Commerce Bank, Jamuna Bank SureCash, Islamic Wallet of Al-Arafah Islami Bank, Spot Cash of Standard Bank, and Meghna Bank Tap n Pay.

The number of MFS account-holders was 9.64 crore in April, and the average daily transaction through the MFS industry was Tk 2,115 crore in April.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments