Banking thru voice

Banking services are set to come even closer to clients in Bangladesh as Bank Asia plans to roll out voice banking, allowing its clients to carry out transactions through conversation.

What is more, customers will not require any internet connection or even an app to transfer funds and pay bills.

As such, even people who live in the most remote parts of the country will not need to visit brick-and-mortar branches, which are usually located far from their homes, as an artificial intelligence-based method will help them settle transactions.

Even a person without digital literacy can settle transactions by using a feature phone.

Bank Asia will introduce the voice banking service -- the first of its kind in Bangladesh -- on December 16 as a part of its efforts to bring unbanked people under the formal financial sector.

The lender unveiled the new window yesterday at a press conference organised to mark its 22nd anniversary at the InterContinental hotel in Dhaka.

"The service is more secure than other existing services used in performing financial transactions," said Md Arfan Ali, managing director of Bank Asia.

He hopes that the service would change the country's banking system to a large extent as people from all walks of life will be able to settle transactions in an easier manner than before.

Bank Asia signed an agreement with Hishab, a Dhaka-based IT company with a global presence, on November 22 to run the new banking method. It started piloting the service on March 26.

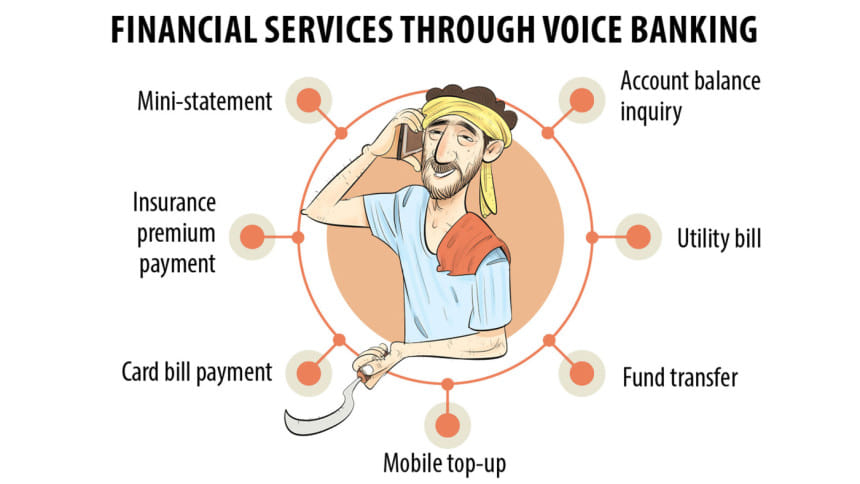

Initially, the account-holders of the private bank will enjoy four types of services using voice banking: balance inquiry, mini statement, product information, and setting the PIN of debit and credit cards.

Within two to three months after the formal launch, clients will be able to transfer funds from one bank to another, make utility bill payments, top up mobile phones, and so on.

In order to secure financial services through voice banking, clients will have to dial the bank's short code from a basic or smartphone and speak in their native Bangla dialects.

The conversational engine will fulfil the clients' need on a real-time basis. It will store and save the clients' voice so that it can recognise it later while accomplishing transactions.

It is like a thumb or face recognition, eliminating the scope for an unwanted person copying the voice of the actual accountholders to embezzle funds.

"We will pursue mobile phone operators to bring down the call rates so that people feel comfortable to use the new service," Ali said.

Reducing the call charge will be a win-win situation for both parties as it will attract a good number of people to use voice banking using the mobile network.

Bank Asia also plans to provide subsidy for the phone calls to motivate clients.

Fayadan Hossain, co-founder and chief operating officer of Hishab, said the conversational engine would work in different phases.

It will automatically recognise the dialects of clients and process the language, he said, adding that voice banking might surpass internet banking as it will serve all kinds of customers.

The voice banking service will be particularly helpful for the clients of agent banking who live in the hinterland.

Bank Asia, the pioneer in the field of agent banking, has 60 lakh accounts, of which 75 per cent were opened through agents.

"We strongly believe that the number of accounts will rise riding on the new method," Ali said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments